Obtaining a SC Title without a Previous Title

In order to receive approval to title a vehicle, trailer or mobile home where no previous title is available, the current owner of the vehicle, trailer or mobile home must submit the following:

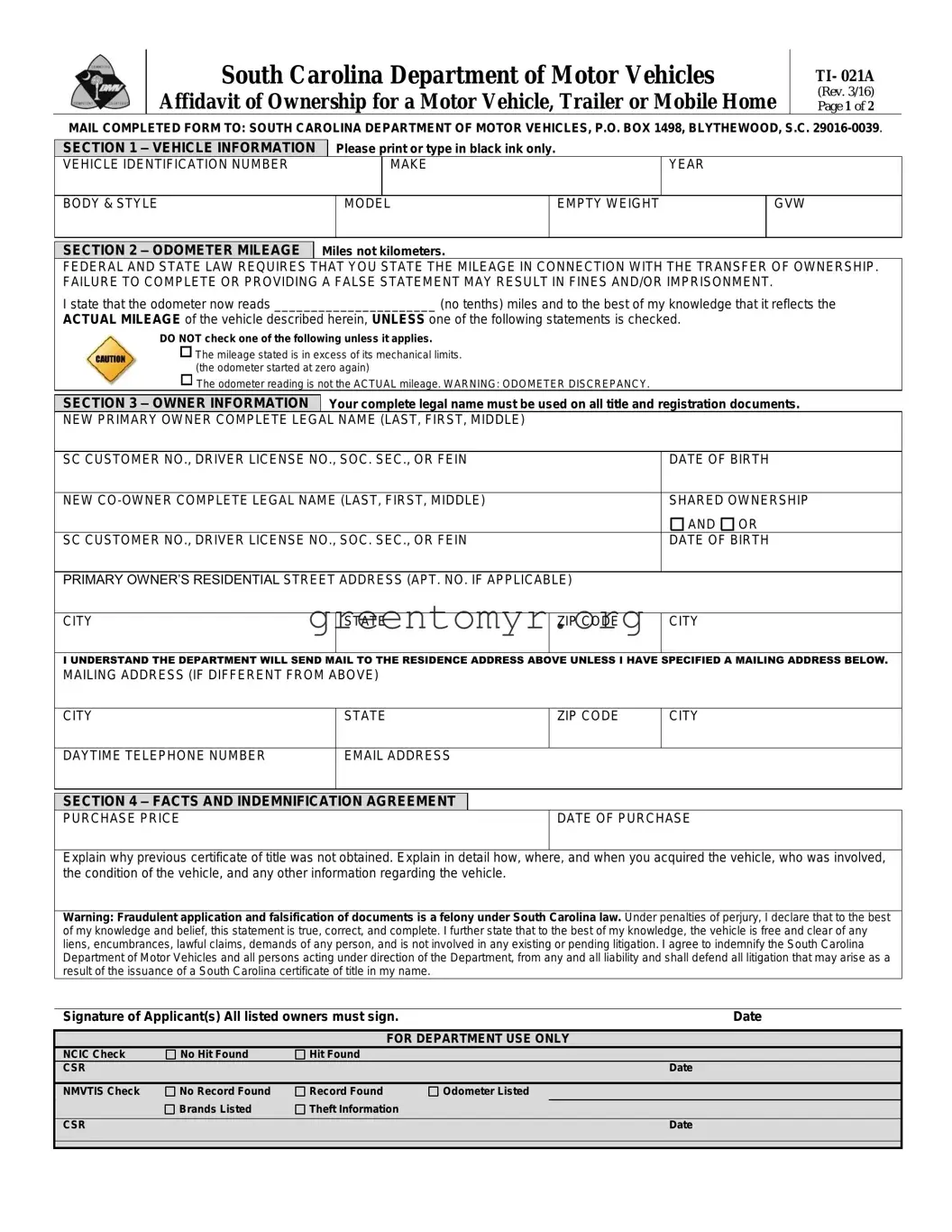

Affidavit of Ownership, Form TI-021A, to include the vehicle and current owner information, and a statement indicating how the vehicle was acquired to include in detail how, where and when the owner acquired the vehicle, who were the seller(s) and/or lien holder(s), the condition of the vehicle and any other information regarding the vehicle.

Photographs of the vehicle from all angles (photos will not be returned).

Vehicle Identification Verification for Title without Previous Title, Form TI-021B from a SCDMV official. The vehicle must be taken to a local DMV branch by the customer or the customer can contact Law Enforcement for an inspection if the customer wishes to obtain a South Carolina title.

If the Vehicle Identification Verification for Title without Previous Title indicates that the vehicle is not operable, the vehicle will be branded “Not for Road Use”.

In order to remove the ‘Not for Road Use” brand, the vehicle will need to be brought to a local DMV branch office to be re-inspected with an indication to remove the “Not for Road Use” brand.

If a unique identifying number is not affixed to the vehicle, before proceeding with this request, the customer will be required to apply for an assigned serial number from the Department by completing Form 401-A.

Copy of the owner’s South Carolina credential; or copy of the owner’s out of state credential, passport, employment authorization document or permanent residency card along with a completed Form TI-006.

Additional Requirements for Mobile Homes

A letter or receipt from the county treasurer’s office indicating property taxes are current for the mobile home.

Seven (7) years of property tax statements in the current owner’s name; or,

Insurance company records indicating the home has been insured in the owner’s name for the previous 7 years or more.

The insurance documents or property tax statements may also be used to indicate ownership rights of prior owners or the person(s) selling the vehicle, as well as former deeds or installment sales contracts or bills of sale identifying the mobile home by make, model year and VIN.

Please print or type in black ink only.

Please print or type in black ink only. SECTION 2 – ODOMETER MILEAGE

SECTION 2 – ODOMETER MILEAGE

The mileage stated is in excess of its mechanical limits. (the odometer started at zero again)

The mileage stated is in excess of its mechanical limits. (the odometer started at zero again)

The odometer reading is not the ACTUAL mileage. WARNING: ODOMETER DISCREPANCY.

The odometer reading is not the ACTUAL mileage. WARNING: ODOMETER DISCREPANCY.

Your complete legal name must be used on all title and registration documents.

Your complete legal name must be used on all title and registration documents. SECTION 4 – FACTS AND INDEMNIFICATION AGREEMENT

SECTION 4 – FACTS AND INDEMNIFICATION AGREEMENT