|

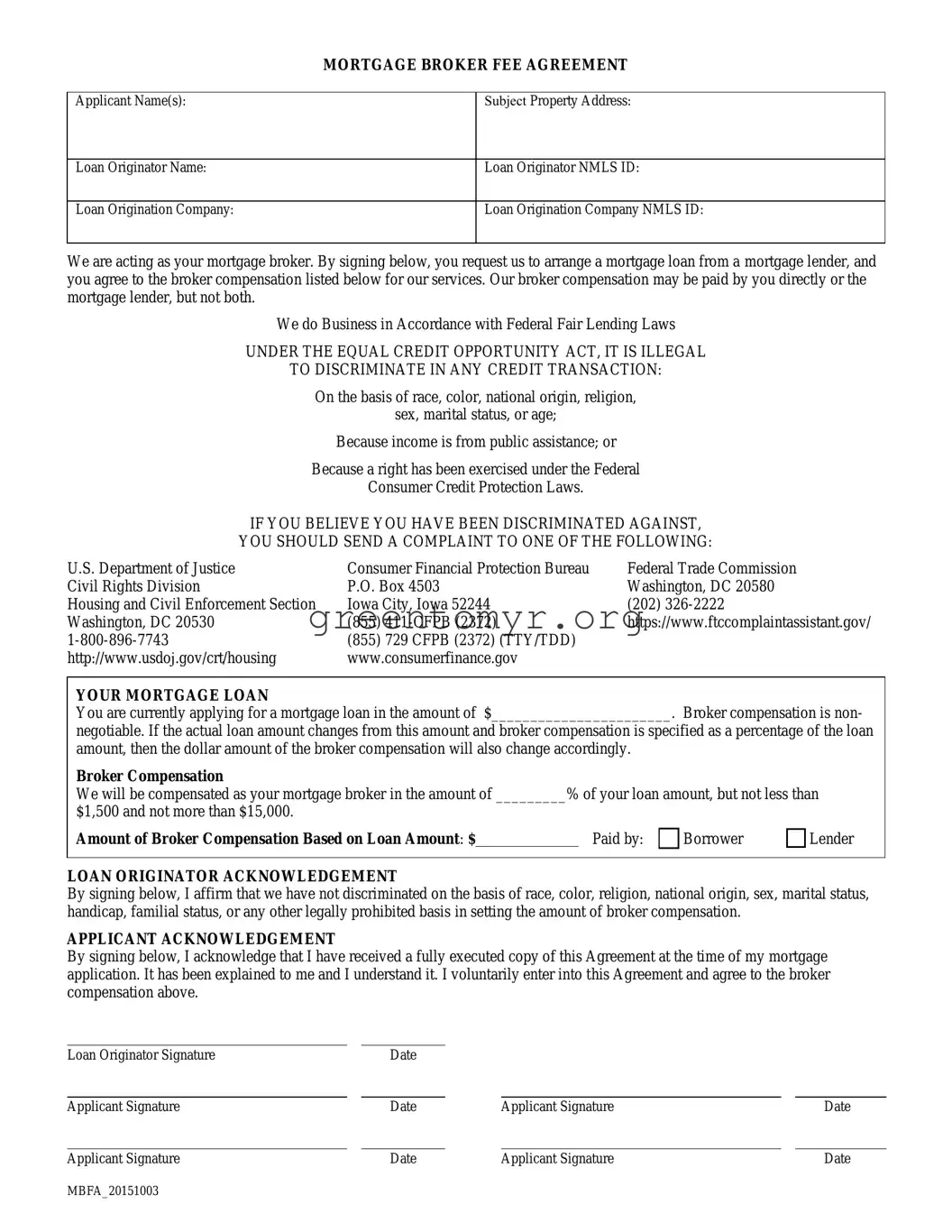

MORTGAGE BROKER FEE AGREEMENT |

|

|

|

Applicant Name(s): |

|

Subject Property Address: |

|

|

|

Loan Originator Name: |

|

Loan Originator NMLS ID: |

|

|

|

Loan Origination Company: |

|

Loan Origination Company NMLS ID: |

|

|

|

We are acting as your mortgage broker. By signing below, you request us to arrange a mortgage loan from a mortgage lender, and you agree to the broker compensation listed below for our services. Our broker compensation may be paid by you directly or the mortgage lender, but not both.

We do Business in Accordance with Federal Fair Lending Laws

UNDER THE EQUAL CREDIT OPPORTUNITY ACT, IT IS ILLEGAL

TO DISCRIMINATE IN ANY CREDIT TRANSACTION:

On the basis of race, color, national origin, religion,

sex, marital status, or age;

Because income is from public assistance; or

Because a right has been exercised under the Federal

Consumer Credit Protection Laws.

IF YOU BELIEVE YOU HAVE BEEN DISCRIMINATED AGAINST,

YOU SHOULD SEND A COMPLAINT TO ONE OF THE FOLLOWING:

U.S. Department of Justice |

Consumer Financial Protection Bureau |

Federal Trade Commission |

Civil Rights Division |

P.O. Box 4503 |

Washington, DC 20580 |

Housing and Civil Enforcement Section |

Iowa City, Iowa 52244 |

(202) 326-2222 |

Washington, DC 20530 |

(855) |

411-CFPB (2372) |

https://www.ftccomplaintassistant.gov/ |

1-800-896-7743 |

(855) |

729 CFPB (2372) (TTY/TDD) |

|

http://www.usdoj.gov/crt/housing |

www.consumerfinance.gov |

|

YOUR MORTGAGE LOAN

You are currently applying for a mortgage loan in the amount of $_______________________. Broker compensation is non-

negotiable. If the actual loan amount changes from this amount and broker compensation is specified as a percentage of the loan amount, then the dollar amount of the broker compensation will also change accordingly.

Broker Compensation

We will be compensated as your mortgage broker in the amount of _________% of your loan amount, but not less than

$1,500 and not more than $15,000.

Amount of Broker Compensation Based on Loan Amount: $ |

|

Paid by: |

Borrower |

Lender |

LOAN ORIGINATOR ACKNOWLEDGEMENT

By signing below, I affirm that we have not discriminated on the basis of race, color, religion, national origin, sex, marital status, handicap, familial status, or any other legally prohibited basis in setting the amount of broker compensation.

APPLICANT ACKNOWLEDGEMENT

By signing below, I acknowledge that I have received a fully executed copy of this Agreement at the time of my mortgage application. It has been explained to me and I understand it. I voluntarily enter into this Agreement and agree to the broker compensation above.

Loan Originator Signature |

|

Date |

|

|

|

|

|

|

|

|

|

|

|

Applicant Signature |

|

Date |

|

Applicant Signature |

|

Date |

|

|

|

|

|

|

|

Applicant Signature |

|

Date |

|

Applicant Signature |

|

Date |