What is a Broker Price Opinion (BPO)?

A Broker Price Opinion is a professional assessment of a property's value, typically conducted by a licensed real estate broker or agent. It helps lenders, investors, or homeowners understand the current market value of a property, especially in situations involving foreclosure or short sales. The BPO takes into account various factors such as comparable sales, current market conditions, and the property’s unique characteristics.

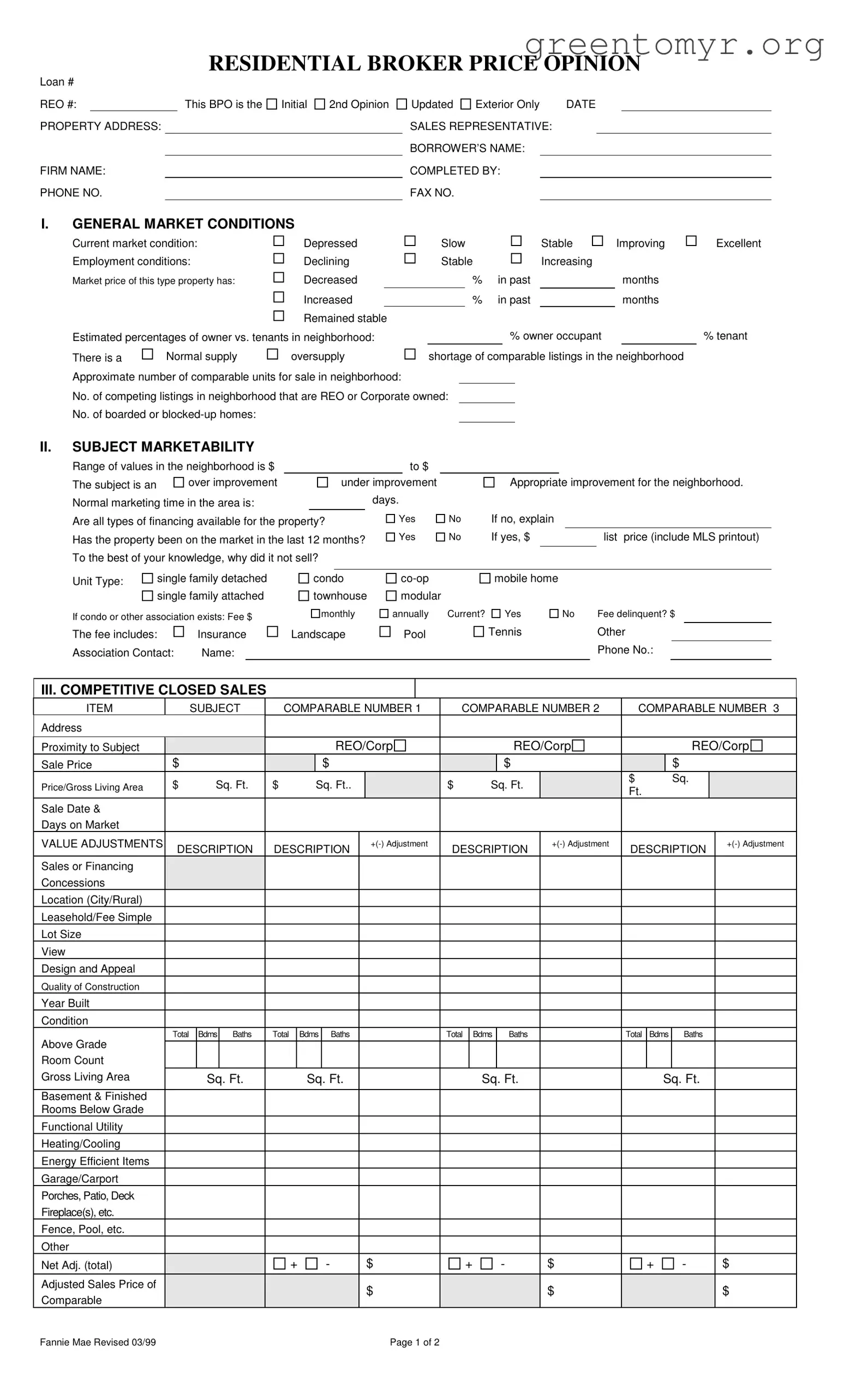

A standard Broker Price Opinion form includes several key sections, such as:

-

General market conditions, like employment status and property price trends.

-

Subject property details, including its condition and marketability.

-

Comparable sales data and adjustments made to assess value accurately.

-

Marketing strategy and estimated repair costs, if necessary.

This comprehensive approach helps establish a more accurate value for the subject property.

How does a BPO differ from an appraisal?

A BPO is generally less formal and less expensive than a full property appraisal. While an appraisal requires a licensed appraiser to conduct a detailed inspection and analysis, a BPO is primarily based on accessible data and may not include a physical inspection of the property. BPOs are meant to provide a quick estimate, whereas appraisals offer a deeply researched valuation for lending or legal purposes.

Who typically requests a Broker Price Opinion?

Various parties may request a BPO, including:

-

Mortgage lenders who need to understand the current market value of collateral properties.

-

Investors looking to purchase properties or evaluate their portfolios.

-

Real estate agents seeking insights on property pricing for marketing efforts.

-

Homeowners wanting to know their property’s value before selling.

The flexibility of BPOs makes them useful in a range of real estate scenarios.

What is the turnaround time for completing a BPO?

The turnaround time for a Broker Price Opinion can vary depending on the complexity of the property and local market conditions. Generally, it can take anywhere from 24 to 72 hours to receive a completed BPO. It’s important to provide accurate information and any necessary documents upfront to avoid delays in the assessment process.

What should I do if I disagree with the BPO value?

If you disagree with the value determined in a Broker Price Opinion, you have a few options. Gather relevant data that supports your position, such as updates to the property or recent sales of similar properties. It may be beneficial to discuss your concerns with the broker who prepared the BPO. In some cases, you might request an updated BPO or a formal appraisal for a more thorough evaluation.

Unknown

Unknown

Investor

Investor