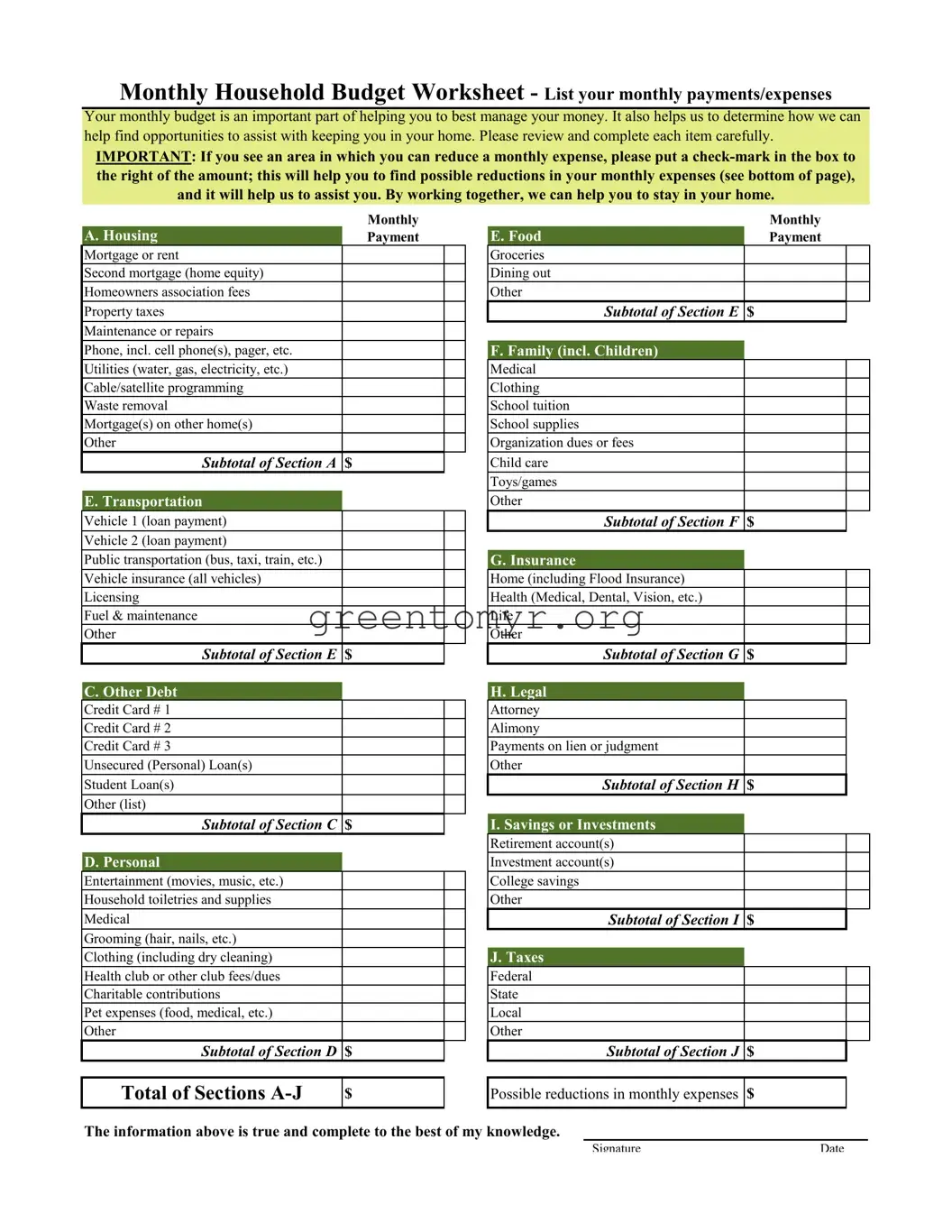

What is the purpose of the Monthly Household Budget Worksheet?

The Monthly Household Budget Worksheet is designed to help individuals and families manage their finances effectively. By listing and organizing all monthly expenses, it not only provides a clear picture of your financial situation but also identifies areas where savings can be made. This is particularly useful for those seeking assistance to maintain their housing situation. The information collected through the budget form can guide financial counseling and support services that may be available to you.

In the housing section, you will need to detail all housing-related expenses. This includes not only your mortgage or rent but also other costs associated with your home such as property taxes, homeowners association fees, and maintenance or repair expenses. Take your time to check each expense item name, and where applicable, provide specific amounts. If you find any expenses that can be reduced, be sure to mark them with a check, as this will aid in identifying potential savings.

What kinds of expenses should I include in the transportation section?

When completing the transportation section, list all expenses related to vehicle ownership and public transport. This should cover items such as loan payments for your vehicles, insurance, fuel, maintenance, and any public transportation fare you regularly incur. If you own multiple vehicles, ensure that you include the costs for each one. Keeping these details accurate will help provide a more comprehensive overview of your finances.

Why is it important to assess personal entertainment and miscellaneous expenses?

Personal entertainment and miscellaneous expenses can sometimes be overlooked, yet they play an important role in your overall budget. By including expenses like grooming, medical costs, and entertainment, you can determine whether these costs are manageable within your budget. Identifying unnecessary expenditures in this category may reveal opportunities for savings, helping you allocate funds more effectively toward essential needs or savings.

What should I do if I notice areas where I can reduce expenses?

If you identify areas where you can cut back on spending, it's essential to mark those on the budget worksheet. Placing a check-mark next to these amounts can highlight potential reductions and facilitate discussions with advisors or counselors. This proactive approach can be beneficial in creating a financial strategy that prioritizes necessary living expenses and ultimately helps maintain housing stability.

How do I interpret the “Total of Sections A-J” and the “Possible reductions in monthly expenses”?

The “Total of Sections A-J” represents the overall amount of your monthly expenses across various categories, providing you with a consolidated view of your financial commitments. Meanwhile, the “Possible reductions in monthly expenses” reflects the sum of any identified savings opportunities from marked items. Analyzing these numbers can help you understand your financial health more clearly and create a plan that supports your goals for stability and growth.