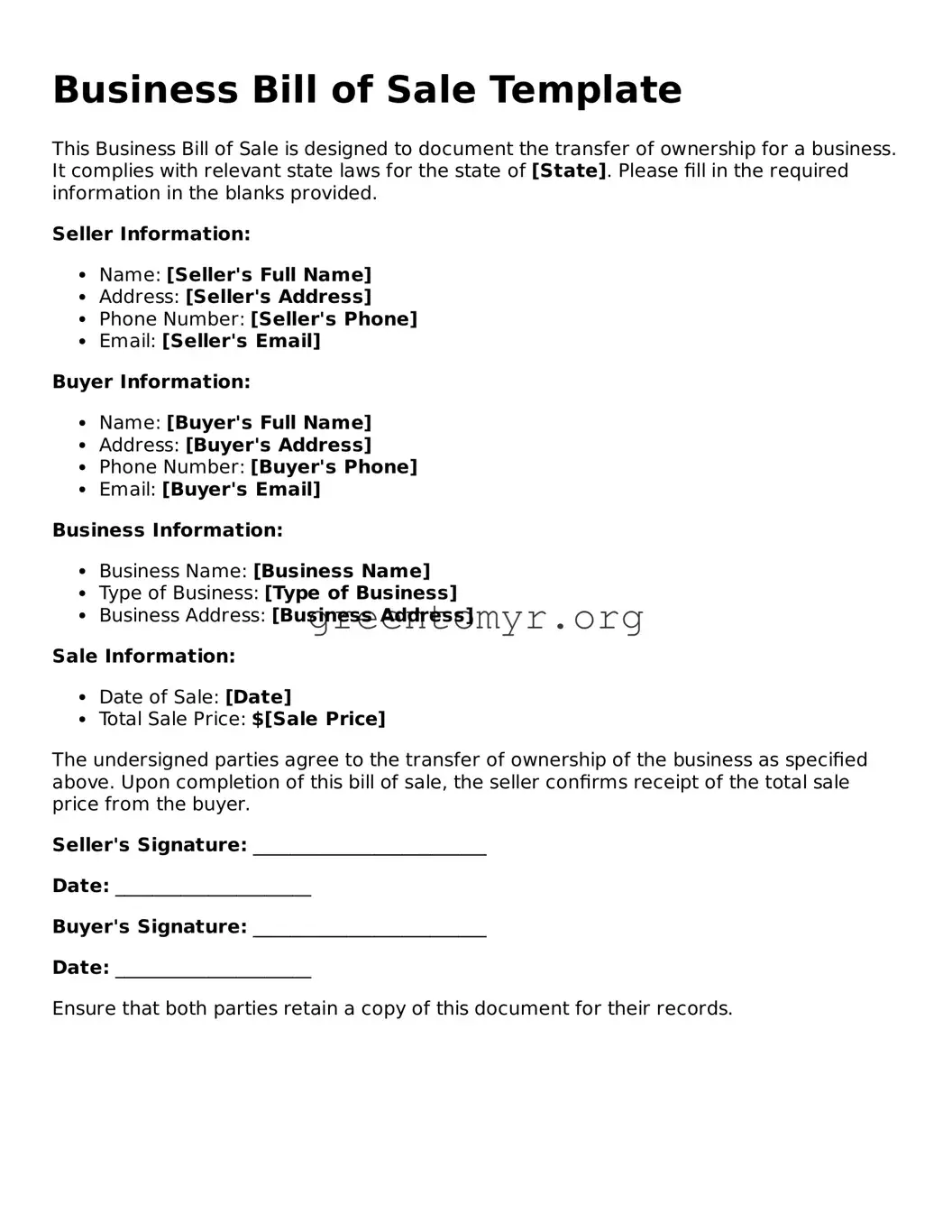

Business Bill of Sale Template

This Business Bill of Sale is designed to document the transfer of ownership for a business. It complies with relevant state laws for the state of [State]. Please fill in the required information in the blanks provided.

Seller Information:

- Name: [Seller's Full Name]

- Address: [Seller's Address]

- Phone Number: [Seller's Phone]

- Email: [Seller's Email]

Buyer Information:

- Name: [Buyer's Full Name]

- Address: [Buyer's Address]

- Phone Number: [Buyer's Phone]

- Email: [Buyer's Email]

Business Information:

- Business Name: [Business Name]

- Type of Business: [Type of Business]

- Business Address: [Business Address]

Sale Information:

- Date of Sale: [Date]

- Total Sale Price: $[Sale Price]

The undersigned parties agree to the transfer of ownership of the business as specified above. Upon completion of this bill of sale, the seller confirms receipt of the total sale price from the buyer.

Seller's Signature: _________________________

Date: _____________________

Buyer's Signature: _________________________

Date: _____________________

Ensure that both parties retain a copy of this document for their records.