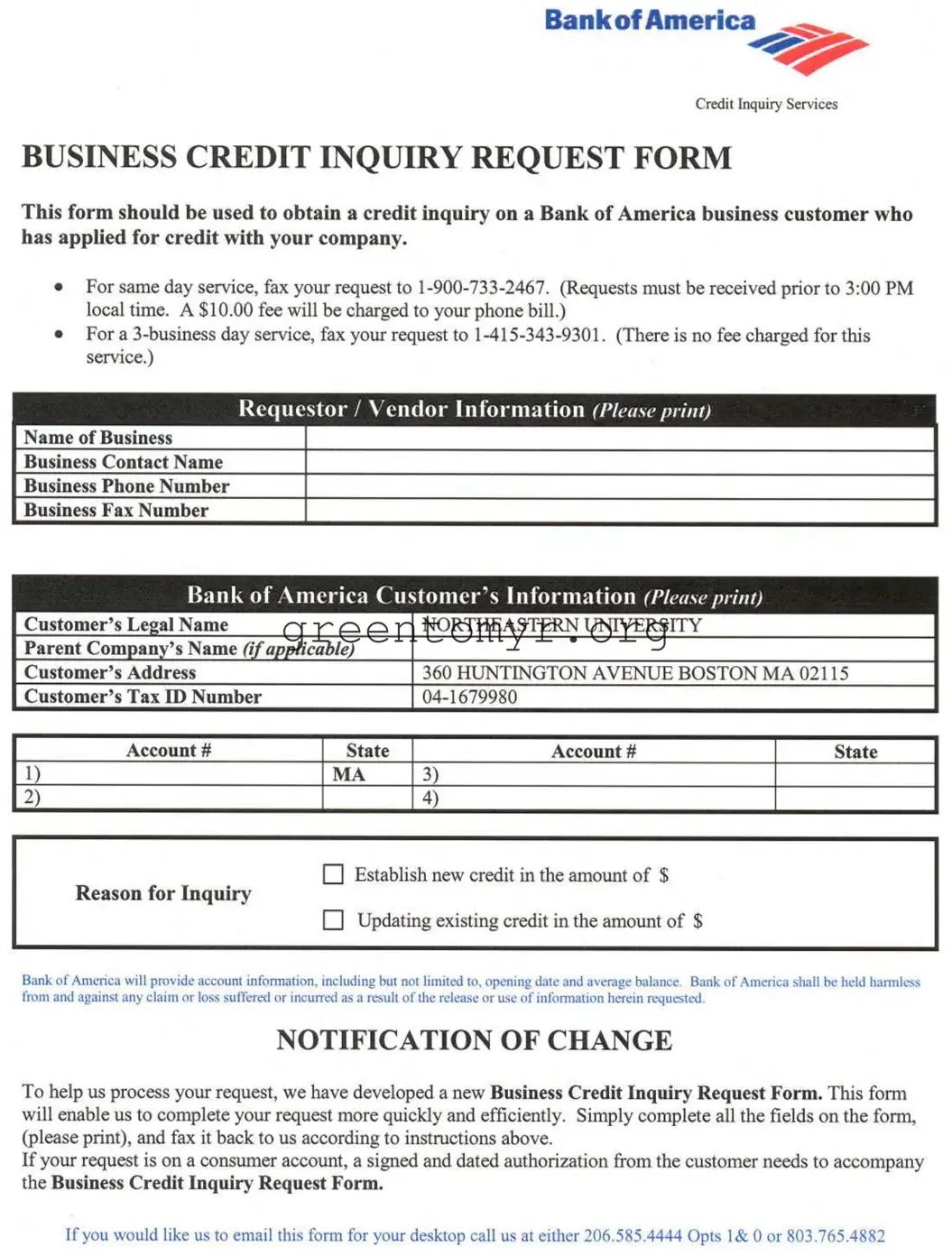

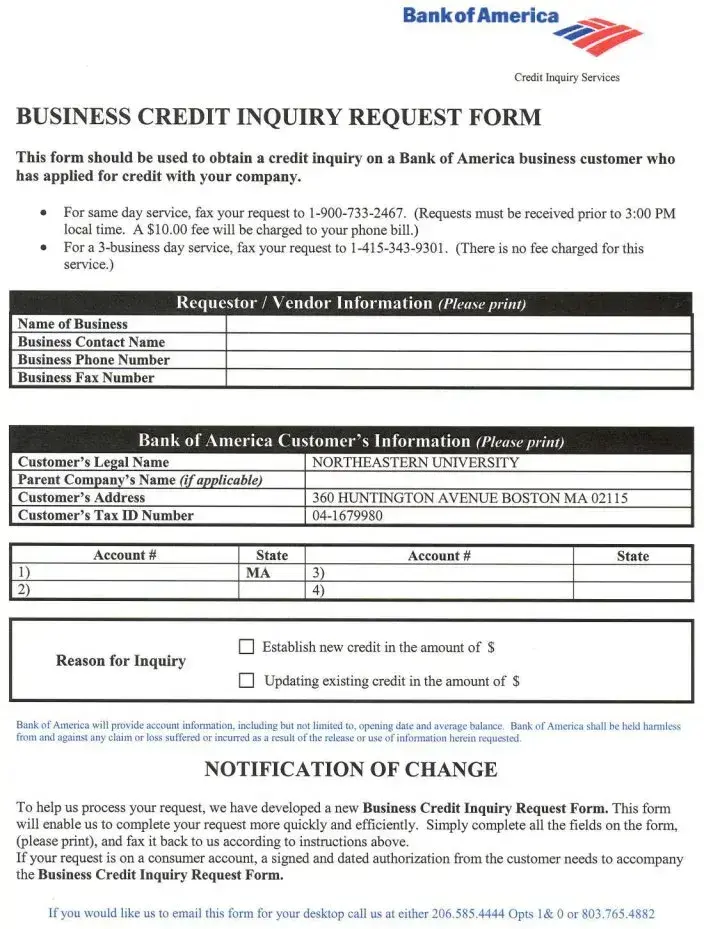

When seeking to establish or update credit for a business customer, the Business Credit Inquiry Request form is an essential tool for vendors and requestors alike. This form is specifically designed for use with Bank of America business customers who have applied for credit within your company. Completing the form correctly ensures streamlined processing of requests for credit inquiries. It includes fields for both the requestor's and the Bank of America's customer’s information, requiring details such as the legal name of the customer, the tax ID number, and the account number. Depending on the urgency of your needs, you can choose between same-day or standard three-business day service options. Be mindful of the service requirements: same-day requests must be submitted before 3:00 PM local time and carry a fee of $10, while the standard option allows for no fee and a slightly longer response time. To ensure efficient processing, completing all fields clearly is crucial. Additionally, if the inquiry concerns a consumer account, a signed and dated authorization from the customer is necessary. This form not only aids in obtaining vital credit information but also helps clarify the rationale behind the inquiry, whether for new or existing credit. By using this updated Business Credit Inquiry Request Form, individuals can expect a more efficient response, promoting smoother financial interactions and fostering better business relationships.