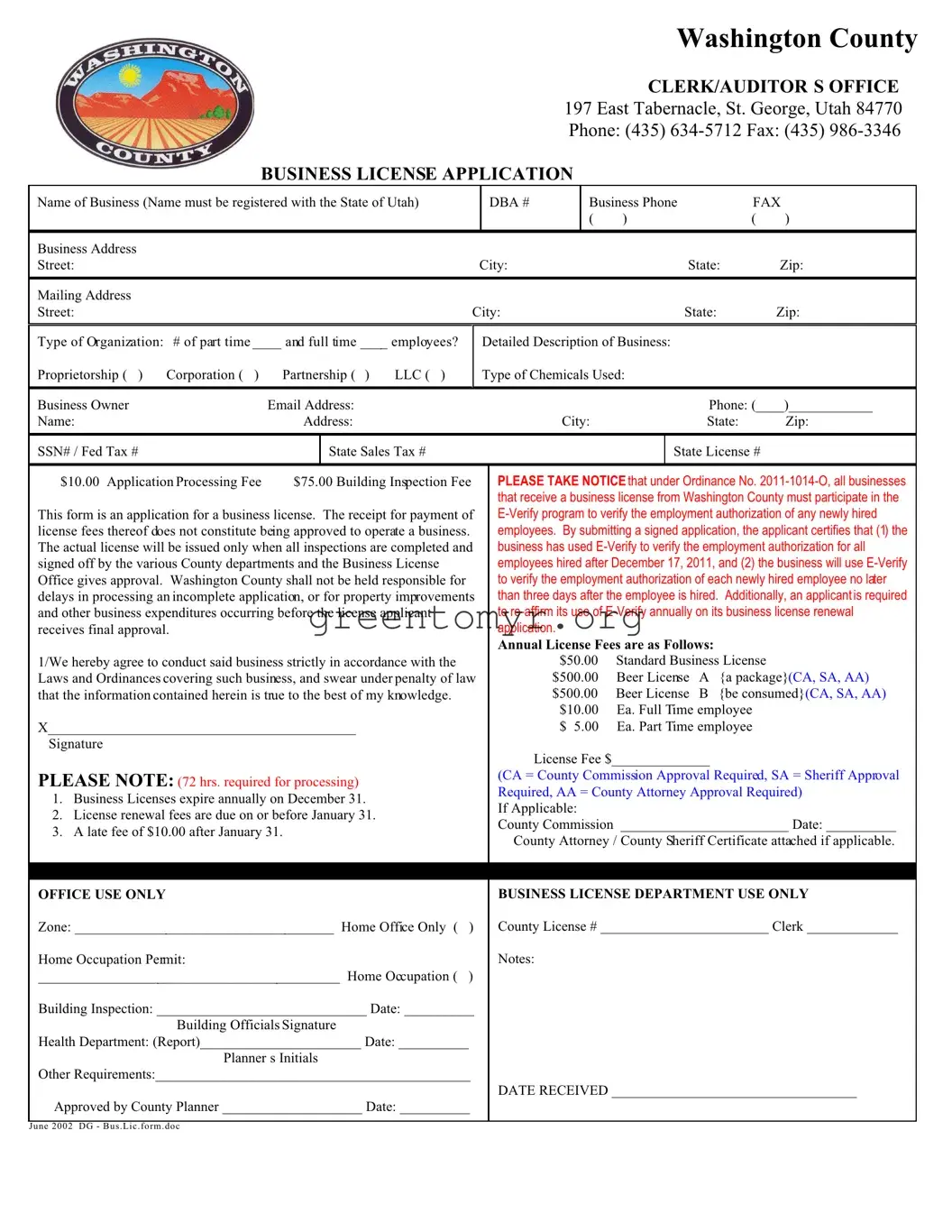

197 East Tabernacle, St. George, Utah 84770

Name of Business (Name must be registered with the State of Utah) |

|

|

|

DBA # |

|

Business Phone |

|

FAX |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street: |

|

|

|

|

|

|

City: |

|

|

|

State: |

|

Zip: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street: |

|

|

|

|

City: |

|

|

|

State: |

|

Zip: |

|

|

|

|

|

|

|

|

|

|

|

|

Type of Organization: |

# of part time ____ and full time ____ employees? |

|

|

Detailed Description of Business: |

|

|

|

Proprietorship ( ) |

Corporation ( ) |

Partnership ( ) |

LLC ( ) |

|

|

Type of Chemicals Used: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Owner |

|

Email Address: |

|

|

|

|

|

|

|

|

|

Phone: (____)____________ |

Name: |

|

Address: |

|

|

|

|

|

City: |

|

|

State: |

|

Zip: |

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN# / Fed Tax # |

|

|

State Sales Tax # |

|

|

|

|

|

|

|

State License # |

|

|

|

|

|

|

|

' Q $10.00 Application Processing Fee |

' Q$75.00 Building Inspection Fee |

|

PLEASE TAKE NOTICE that under Ordinance No. 2011-1014-O, all businesses |

|

|

|

|

|

|

|

|

that receive a business license from Washington County must participate in the |

This form is an application for a business license. The receipt for payment of |

|

E-Verify program to verify the employment authorization of any newly hired |

license fees thereof does not constitute being approved to operate a business. |

|

employees. By submitting a signed application, the applicant certifies that (1) the |

The actual license will be issued only when all inspections are completed and |

|

business has used E-Verify to verify the employment authorization for all |

signed off by the various County departments and the Business License |

|

|

|

employees hired after December 17, 2011, and (2) the business will use E-Verify |

Office gives approval. Washington County shall not be held responsible for |

|

|

|

to verify the employment authorization of each newly hired employee no later |

delays in processing an incomplete application, or for property improvements |

|

than three days after the employee is hired. Additionally, an applicant is required |

and other business expenditures occurring before the license applicant |

|

|

|

to re-affirm its use of E-Verify annually on its business license renewal |

receives final approval. |

|

|

|

|

|

|

application. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual License Fees are as Follows: |

|

|

1/We hereby agree to conduct said business strictly in accordance with the |

|

|

|

|

' Q $50.00 |

Standard Business License |

|

Laws and Ordinances covering such business, and swear under penalty of law |

|

|

' Q$500.00 |

Beer License |

A {a package}(CA, SA, AA) |

that the information contained herein is true to the best of my knowledge. |

|

|

|

|

' Q$500.00 |

Beer License |

B {be consumed}(CA, SA, AA) |

|

|

|

|

|

|

|

|

|

' Q $10.00 |

Ea. Full Time employee |

|

X____________________________________________ |

|

|

|

|

|

' Q $ 5.00 |

Ea. Part Time employee |

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License Fee $______________ |

|

|

PLEASE NOTE: (72 hrs. required for processing) |

|

|

|

|

(CA = County Commission Approval Required, SA = Sheriff Approval |

|

|

|

|

Required, AA = County Attorney Approval Required) |

1. Business Licenses expire annually on December 31. |

|

|

|

|

|

|

|

|

If Applicable: |

|

|

|

|

|

2. License renewal fees are due on or before January 31. |

|

|

|

|

|

|

|

|

|

|

|

|

|

County Commission ________________________ Date: __________ |

3. A late fee of $10.00 after January 31. |

|

|

|

|

|

|

|

|

' QCounty Attorney / County Sheriff Certificate attached if applicable. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OFFICE USE ONLY |

|

|

|

|

|

|

|

BUSINESS LICENSE DEPARTMENT USE ONLY |

Zone: _____________________________________ Home Office Only ( |

) |

|

|

County License # ________________________ Clerk _____________ |

Home Occupation Permit: |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

___________________________________________ Home Occupation ( |

) |

|

|

|

|

|

|

|

|

|

|

Building Inspection: ______________________________ Date: __________ |

|

|

|

|

|

|

|

|

|

|

Building Officials Signature |

|

|

|

|

|

|

|

|

|

|

|

|

Health Department: (Report)_______________________ Date: __________ |

|

|

|

|

|

|

|

|

|

|

Planner s Initials |

|

|

|

|

|

|

|

|

|

|

|

|

Other Requirements:_____________________________________________ |

|

|

|

|

|

|

|

|

|

' QApproved by County Planner ____________________ Date: __________ |

|

DATE RECEIVED ___________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|