|

|

|

|

|

|

|

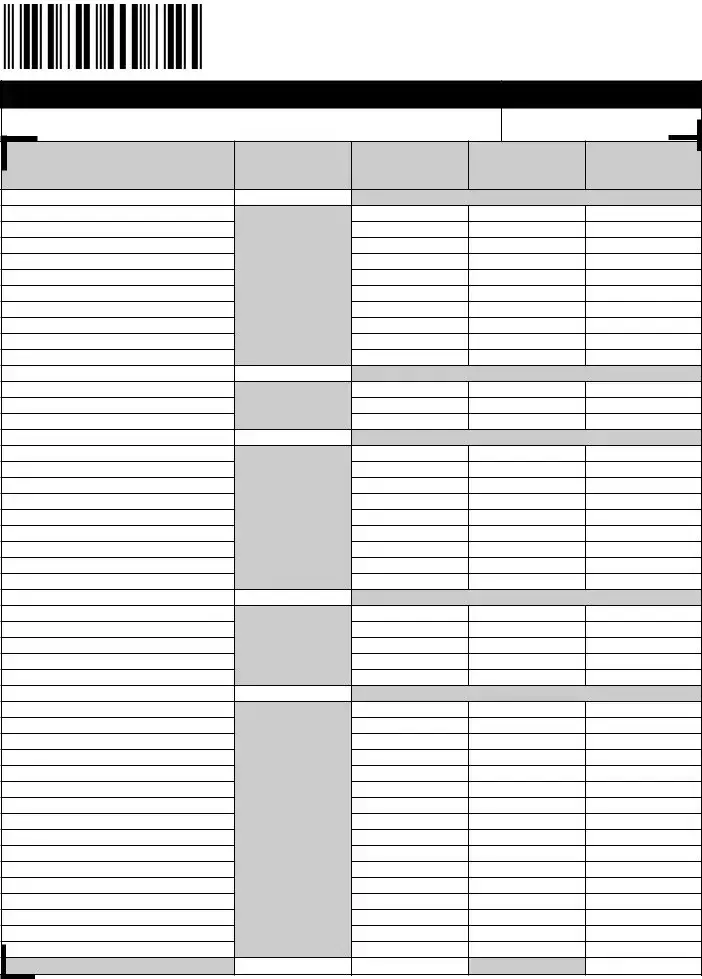

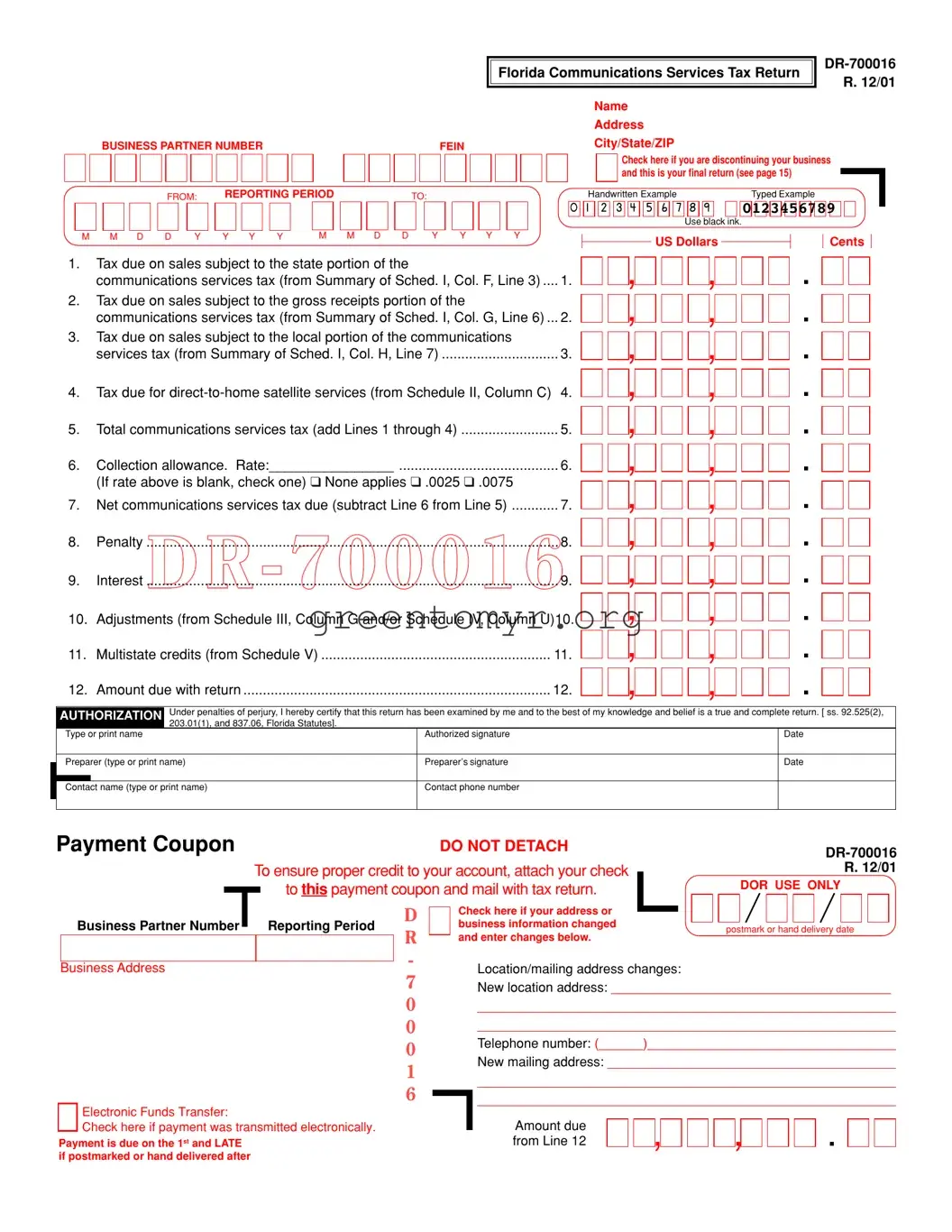

Florida Communications Services Tax Return |

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

Address |

BUSINESS PARTNER NUMBER |

FEIN |

City/State/ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you are discontinuing your business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and this is your final return (see page 15) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

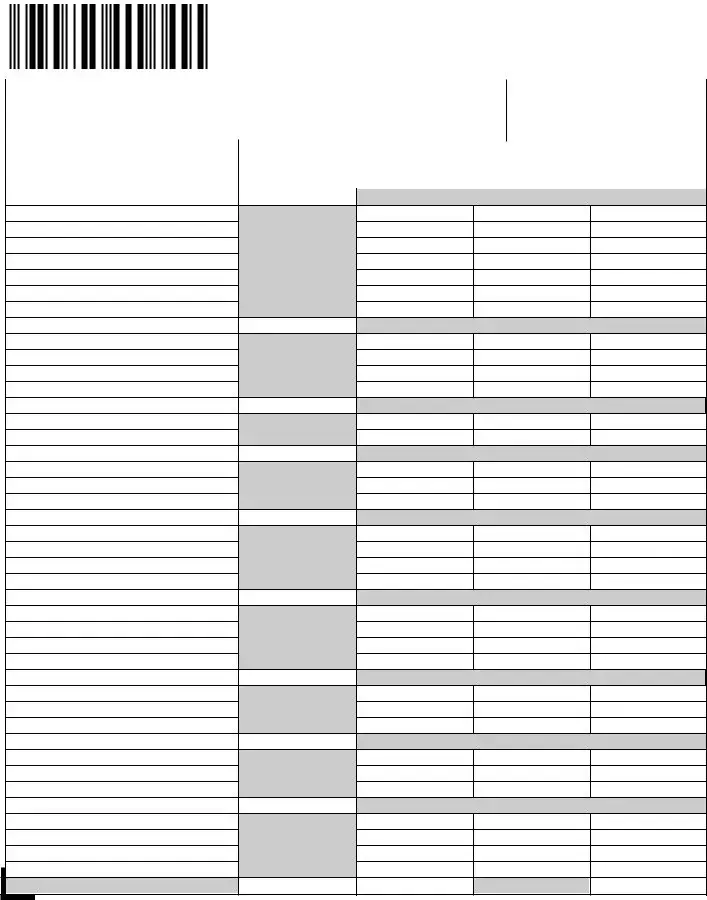

FROM: |

|

REPORTING PERIOD |

TO: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Handwritten Example |

|

|

|

Typed Example |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|

0123456789 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use black ink. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M M D D |

Y |

|

Y Y |

|

Y |

|

M M D D |

|

|

|

Y |

|

|

Y Y |

|

|

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Dollars |

|

|

|

Cents |

|

|

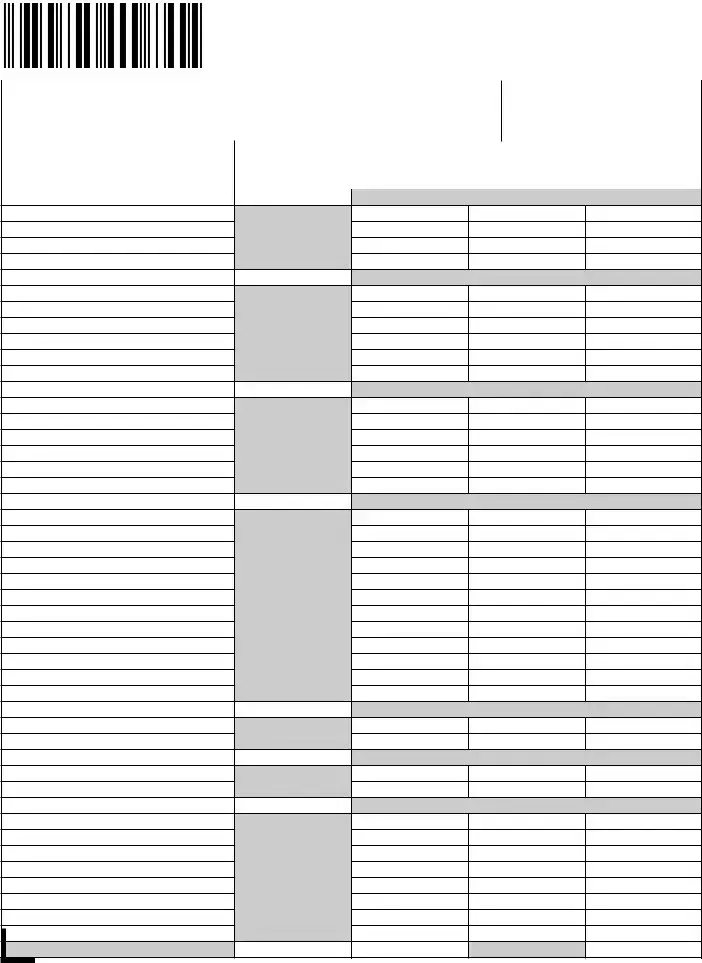

1.Tax due on sales subject to the state portion of the

communications services tax (from Summary of Sched. I, Col. F, Line 3) .... 1.

2.Tax due on sales subject to the gross receipts portion of the

communications services tax (from Summary of Sched. I, Col. G, Line 6) ... 2.

3.Tax due on sales subject to the local portion of the communications

services tax (from Summary of Sched. I, Col. H, Line 7) |

3. |

4.Tax due for direct-to-home satellite services (from Schedule II, Column C) 4.

5. |

Total communications services tax (add Lines 1 through 4) |

5. |

6. |

Collection allowance. Rate:________________ |

6. |

|

(If rate above is blank, check one) ❑ None applies ❑ .0025 ❑ .0075 |

|

7. |

Net communications services tax due (subtract Line 6 from Line 5) |

7. |

8.Penalty D..........................................................................................................R - 7 0 0 0 1 68.

9.Interest .......................................................................................................... 9.

10. |

Adjustments (from Schedule III, Column G and/or Schedule IV, Column U)10. |

11. |

Multistate credits (from Schedule V) |

11. |

12. |

Amount due with return |

12. |

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

|

AUTHORIZATION |

Under penalties of perjury, I hereby certify that this return has been examined by me and to the best of my knowledge and belief is a true and complete return. [ ss. 92.525(2), |

|

|

|

203.01(1), and 837.06, Florida Statutes]. |

|

|

|

Type or print name |

Authorized signature |

Date |

|

|

|

|

|

|

Preparer (type or print name) |

Preparer’s signature |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact name (type or print name) |

Contact phone number |

|

|

|

|

|

|

|

|

|

|

|

|

|

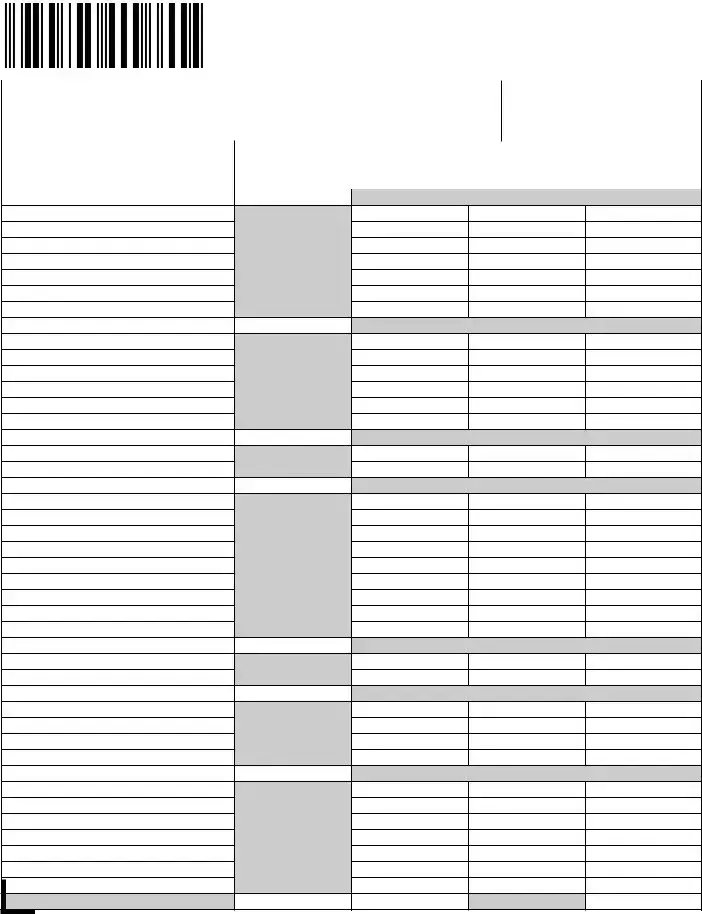

Payment Coupon |

|

|

|

|

DO NOT DETACH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DR-700016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To ensure proper credit to your account, attach your check |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. 12/01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to this payment coupon and mail with tax return. |

|

|

|

|

|

|

|

|

|

|

|

|

DOR USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

Check here if your address or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Partner Number |

|

|

Reporting Period |

|

|

business information changed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

postmark or hand delivery date |

|

|

|

|

|

|

|

R |

|

|

and enter changes below. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Address |

|

|

|

|

|

|

Location/mailing address changes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New location address: ______________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

_________________________________________________________ |

|

|

|

|

|

0 |

_________________________________________________________ |

|

|

|

|

|

0 |

|

|

|

|

Telephone number: (______)__________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

New mailing address: ________________________________________ |

|

|

|

|

|

_________________________________________________________ |

|

|

|

|

|

6 |

|

|

Electronic Funds Transfer: |

|

|

|

|

_________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if payment was transmitted electronically. |

|

|

|

|

Amount due |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment is due on the 1st and LATE |

|

|

|

|

|

|

|

from Line 12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if postmarked or hand delivered after

Where to send payments and returns

Make check payable to and send with return to:

FLORIDA DEPARTMENT OF REVENUE PO BOX 6520

TALLAHASSEE FL 32314-6520 or

File online via our Internet site at www.myflorida.com/dor

File electronically . . .

it’s easy!

All dealers are encouraged to file using an electronic method. Filing communications services tax returns electronically ensures quick, efficient, and accurate processing. E-Services are easier, faster, and more cost effective than shuffling old-fashioned paper. The Department has taken steps to ensure that the data you report electronically is just as secure as the data you report on paper. The Internet site is protected by a secure socket layer (SSL) as well as encryption and user ID (password).

Internet filing: The DOR Internet site will guide dealers easily through the filing process. Dealers should visit www.myflorida.com/dor or call the Department’s e-Services Unit at 1-800-352-3671 (in Florida only) or at 850-487-7972.

Hearing or speech impaired persons may call the TDD line at 1-800-367-8331 or 850-922-1115.

EFT and EDI filing: Some dealers are required to file using this method. If, in the previous state fiscal year (July 1 through June 30), a dealer paid $50,000 or more in gross receipts tax, sales tax, or communications services tax, that dealer must file the return using electronic data interchange (EDI) and remit funds using electronic funds transfer (EFT), or may both file and remit using the Internet.

DR-700016S

N. 10/01

Page 3

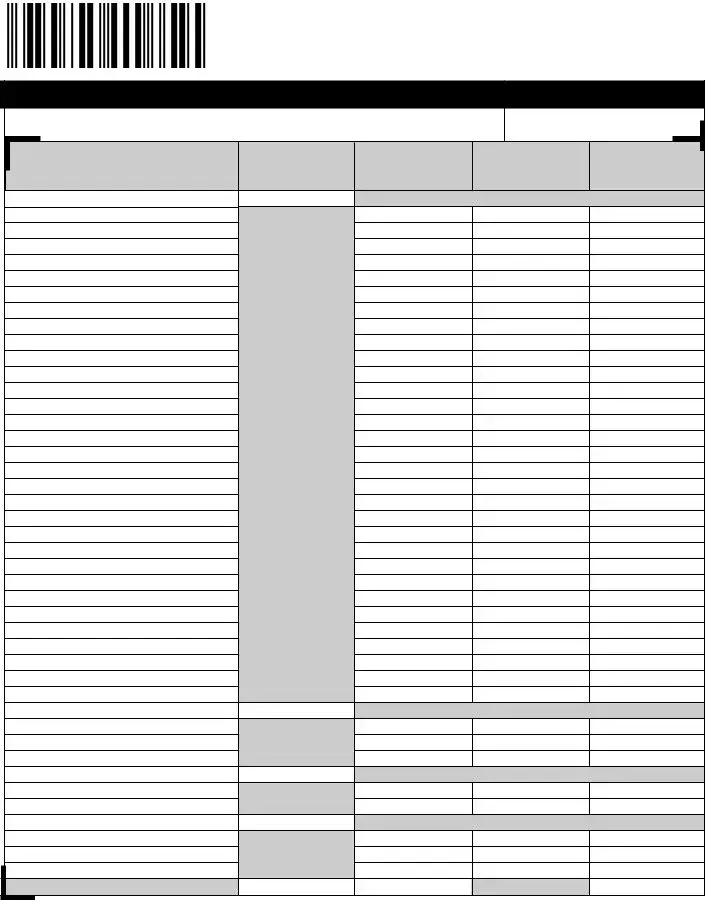

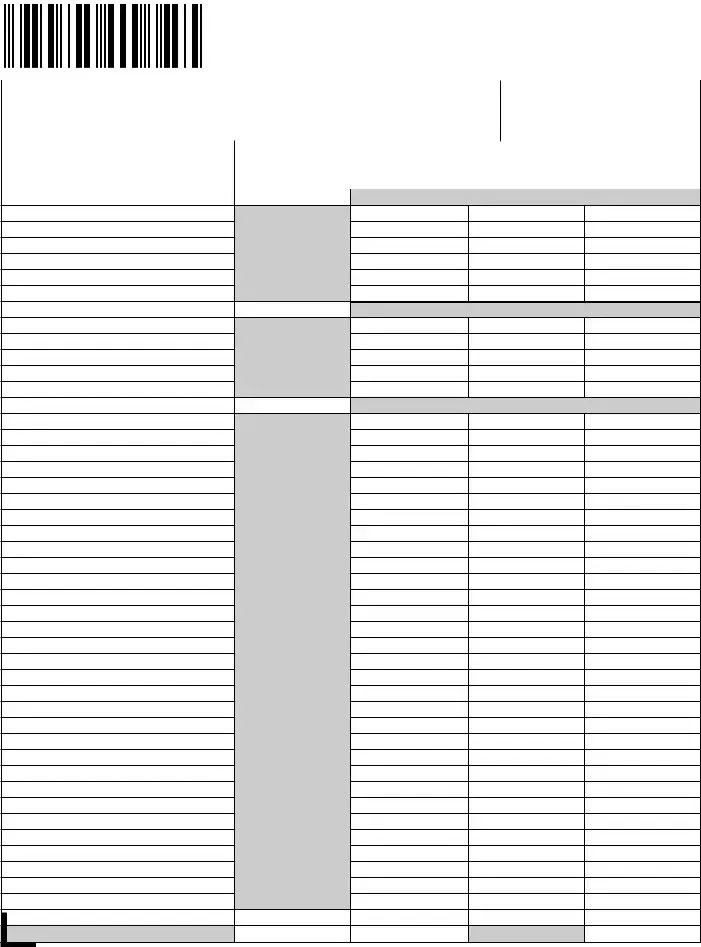

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name |

Business partner number |

A. |

B. |

C. |

D. |

E. |

Local jurisdiction |

Taxable sales |

Taxable sales subject |

Local tax rates |

Local tax due |

|

subject to state tax |

to local taxes |

|

|

ALACHUA |

|

|

|

|

Unincorporated area |

|

|

0.0552 |

|

Alachua |

|

|

0.0410 |

|

Archer |

|

|

0.0542 |

|

Gainesville |

|

|

0.0542 |

|

Hawthorne |

|

|

0.0212 |

|

High Springs |

|

|

0.0542 |

|

La Crosse |

|

|

0.0372 |

|

Micanopy |

|

|

0.0282 |

|

Newberry |

|

|

0.0460 |

|

Waldo |

|

|

0.0152 |

|

BAKER |

|

|

|

|

Unincorporated area |

|

|

0.0124 |

|

Glen St. Mary |

|

|

0.0620 |

|

Macclenny |

|

|

0.0702 |

|

BAY |

|

|

|

|

Unincorporated area |

|

|

0.0234 |

|

Callaway |

|

|

0.0600 |

|

Cedar Grove |

|

|

0.0582 |

|

Lynn Haven |

|

|

0.0612 |

|

Mexico Beach |

|

|

0.0358 |

|

Panama City |

|

|

0.0612 |

|

Panama City Beach |

|

|

0.0602 |

|

Parker |

|

|

0.0602 |

|

Springfield |

|

|

0.0612 |

|

BRADFORD |

|

|

|

|

Unincorporated area |

|

|

0.0134 |

|

Brooker |

|

|

0.0380 |

|

Hampton |

|

|

0.0300 |

|

Lawtey |

|

|

0.0180 |

|

Starke |

|

|

0.0452 |

|

BREVARD |

|

|

|

|

Unincorporated area |

|

|

0.0166 |

|

Cape Canaveral |

|

|

0.0562 |

|

Cocoa |

|

|

0.0430 |

|

Cocoa Beach |

|

|

0.0562 |

|

Indialantic |

|

|

0.0670 |

|

Indian Harbour Beach |

|

|

0.0534 |

|

Malabar |

|

|

0.0562 |

|

Melbourne |

|

|

0.0572 |

|

Melbourne Beach |

|

|

0.0562 |

|

Melbourne Village |

|

|

0.0562 |

|

Palm Bay |

|

|

0.0562 |

|

Palm Shores |

|

|

0.0520 |

|

Rockledge |

|

|

0.0552 |

|

Satellite Beach |

|

|

0.0532 |

|

Titusville |

|

|

0.0582 |

|

West Melbourne |

|

|

0.0592 |

|

PAGE TOTAL |

|

|

|

|

DR-700016S

N. 10/01

Page 4

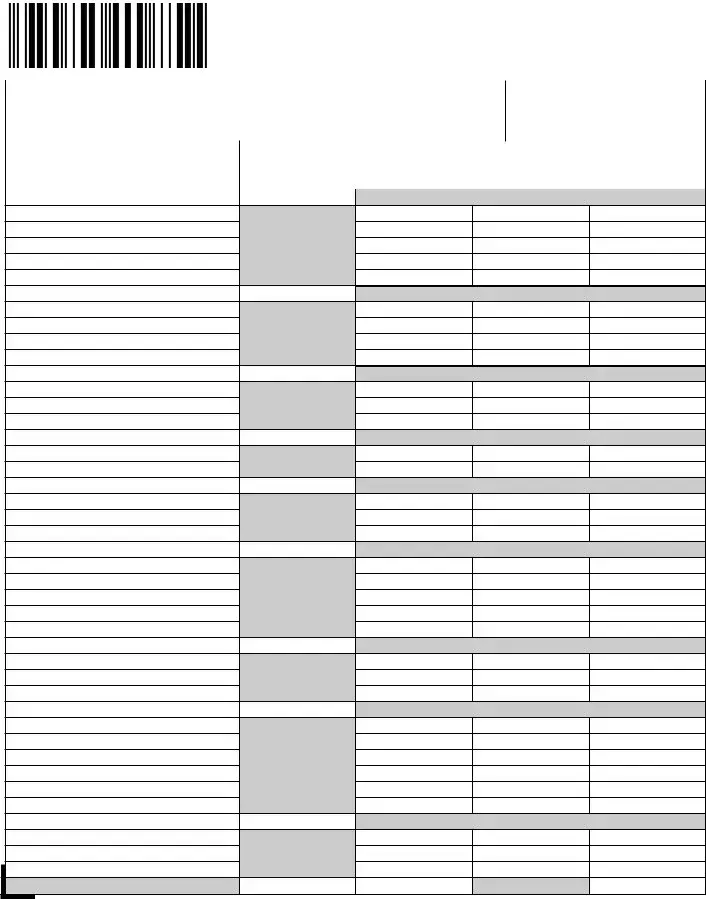

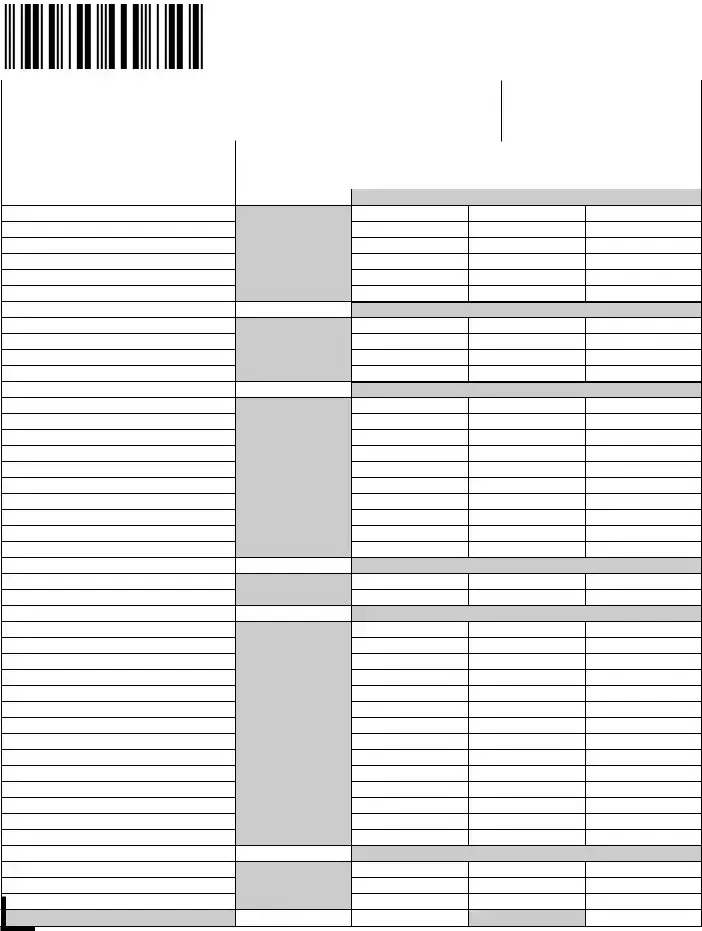

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name |

Business partner number |

A. |

B. |

C. |

D. |

E. |

Local jurisdiction |

Taxable sales |

Taxable sales subject |

Local tax rates |

Local tax due |

|

subject to state tax |

to local taxes |

|

|

BROWARD |

|

|

|

|

Unincorporated area |

|

|

0.0522 |

|

Coconut Creek |

|

|

0.0562 |

|

Cooper City |

|

|

0.0532 |

|

Coral Springs |

|

|

0.0562 |

|

Dania |

|

|

0.0572 |

|

Davie |

|

|

0.0560 |

|

Deerfield Beach |

|

|

0.0162 |

|

Fort Lauderdale |

|

|

0.0562 |

|

Hallandale Beach |

|

|

0.0562 |

|

Hillsboro Beach |

|

|

0.0130 |

|

Hollywood |

|

|

0.0562 |

|

Lauderdale Lakes |

|

|

0.0572 |

|

Lauderdale-by-the-Sea |

|

|

0.0562 |

|

Lauderhill |

|

|

0.0562 |

|

Lazy Lakes |

|

|

0.0060 |

|

Lighthouse Point |

|

|

0.0672 |

|

Margate |

|

|

0.0572 |

|

Miramar |

|

|

0.0562 |

|

North Lauderdale |

|

|

0.0552 |

|

Oakland Park |

|

|

0.0582 |

|

Parkland |

|

|

0.0532 |

|

Pembroke Park |

|

|

0.0562 |

|

Pembroke Pines |

|

|

0.0582 |

|

Plantation |

|

|

0.0562 |

|

Pompano Beach |

|

|

0.0562 |

|

Sea Ranch Lakes |

|

|

0.0532 |

|

Southwest Ranches |

|

|

0.0490 |

|

Sunrise |

|

|

0.0562 |

|

Tamarac |

|

|

0.0542 |

|

Weston |

|

|

0.0572 |

|

Wilton Manors |

|

|

0.0602 |

|

CALHOUN |

|

|

|

|

Unincorporated area |

|

|

0.0050 |

|

Altha |

|

|

0.0602 |

|

Blountstown |

|

|

0.0582 |

|

CHARLOTTE |

|

|

|

|

Unincorporated area |

|

|

0.0602 |

|

Punta Gorda |

|

|

0.0622 |

|

CITRUS |

|

|

|

|

Unincorporated area |

|

|

0.0234 |

|

Crystal River |

|

|

0.0572 |

|

Inverness |

|

|

0.0572 |

|

PAGE TOTAL |

|

|

|

|

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,