|

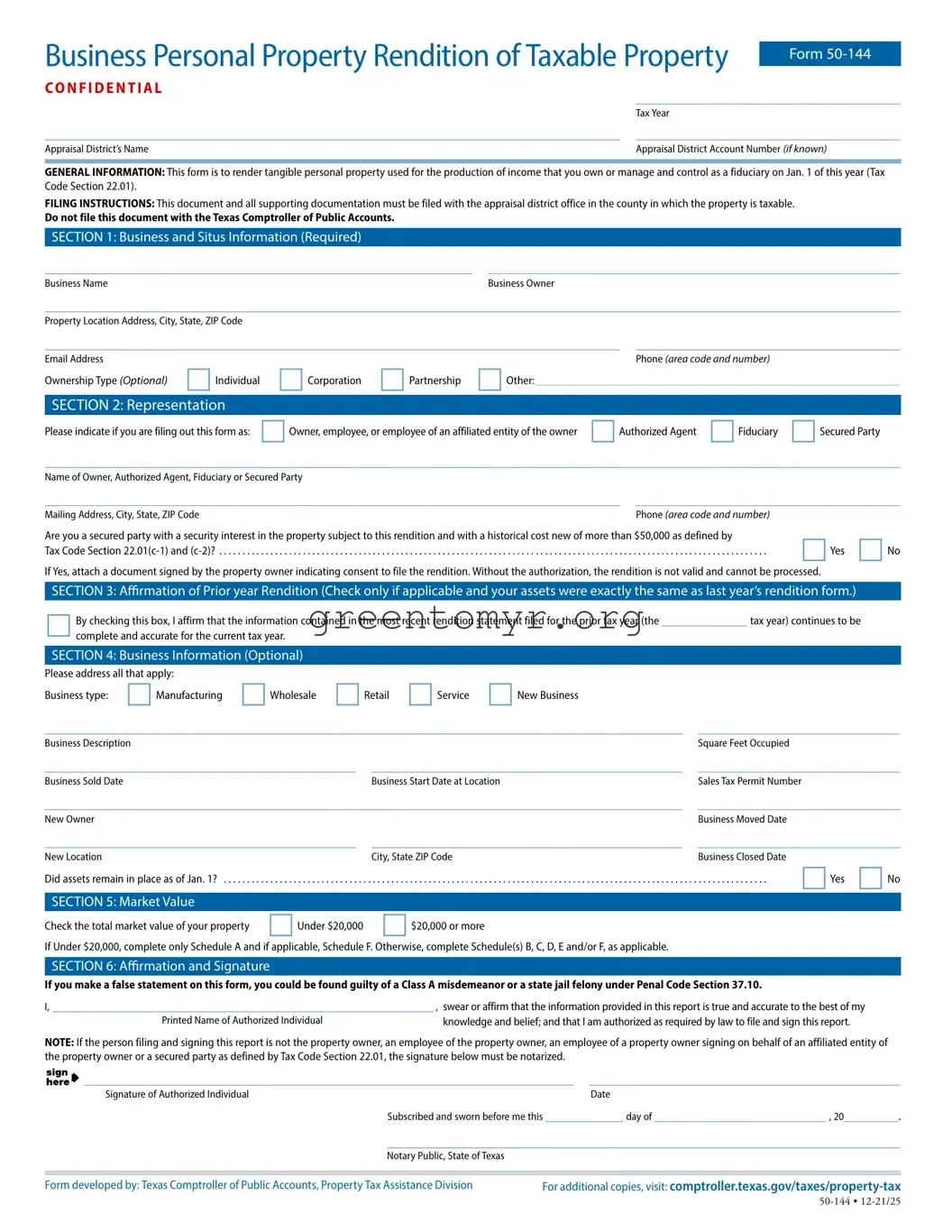

Business Personal Property Rendition of Taxable Property |

|

|

Form 50-144 |

|

|

|

|

C O N F I D E N T I A L |

__________________________________ |

|

|

|

|

Tax Year |

|

|

__________________________________________________________________________ |

__________________________________ |

|

Appraisal District’s Name |

Appraisal District Account Number (if known) |

GENERAL INFORMATION: This form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year (Tax Code Section 22.01).

FILING INSTRUCTIONS: This document and all supporting documentation must be filed with the appraisal district office in the county in which the property is taxable.

Do not file this document with the Texas Comptroller of Public Accounts.

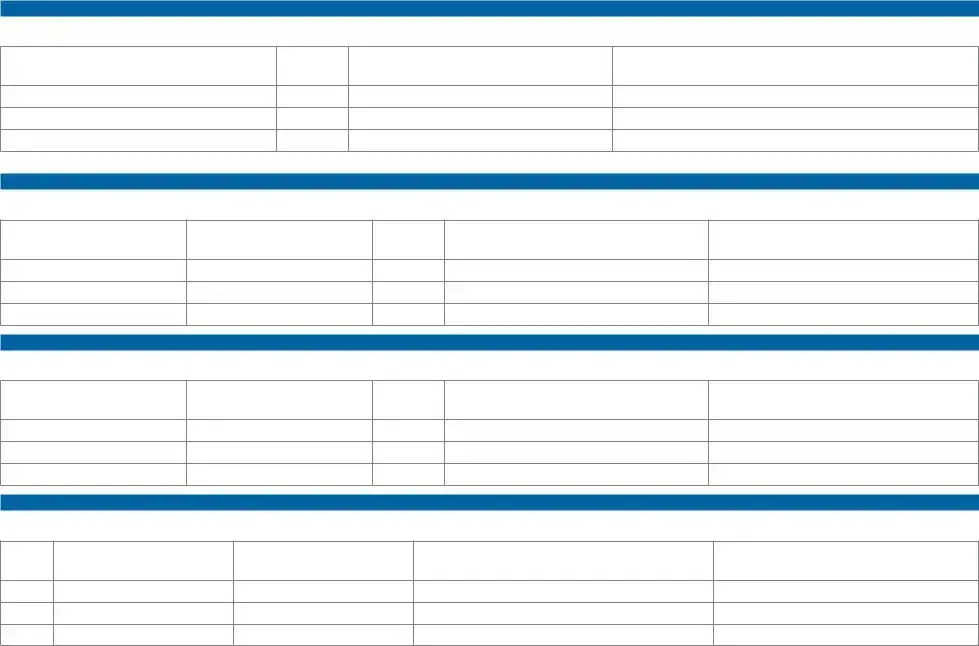

SECTION 1: Business and Situs Information (Required)

_______________________________________________________ |

_____________________________________________________ |

Business Name |

Business Owner |

______________________________________________________________________________________________________________

Property Location Address, City, State, ZIP Code

__________________________________________________________________________ __________________________________

Email Address |

Phone (area code and number) |

Ownership Type (Optional) Individual |

Corporation Partnership Other:___________________________________________________________________ |

SECTION 2: Representation |

|

Please indicate if you are filing out this form as: Owner, employee, or employee of an affiliated entity of the owner Authorized Agent Fiduciary Secured Party

______________________________________________________________________________________________________________

Name of Owner, Authorized Agent, Fiduciary or Secured Party

__________________________________________________________________________ |

__________________________________ |

Mailing Address, City, State, ZIP Code |

Phone (area code and number) |

|

|

Are you a secured party with a security interest in the property subject to this rendition and with a historical cost new of more than $50,000 as defined by |

Yes |

No |

Tax Code Section 22.01(c-1) and (c-2)? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

If Yes, attach a document signed by the property owner indicating consent to file the rendition. Without the authorization, the rendition is not valid and cannot be processed.

SECTION 3: Affirmation of Prior year Rendition (Check only if applicable and your assets were exactly the same as last year’s rendition form.)

By checking this box, I affirm that the information contained in the most recent rendition statement filed for the prior tax year (the ___________ tax year) continues to be complete and accurate for the current tax year.

SECTION 4: Business Information (Optional)

Please address all that apply: |

|

|

|

|

Business type: |

Manufacturing |

Wholesale |

Retail |

Service |

New Business |

__________________________________________________________________________________ |

__________________________ |

Business Description |

|

Square Feet Occupied |

________________________________________ |

________________________________________ |

__________________________ |

Business Sold Date |

Business Start Date at Location |

Sales Tax Permit Number |

__________________________________________________________________________________ |

__________________________ |

New Owner |

|

Business Moved Date |

________________________________________ |

________________________________________ |

__________________________ |

New Location |

City, State ZIP Code |

Business Closed Date |

Did assets remain in place as of Jan. 1? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . Yes No |

SECTION 5: Market Value |

|

|

Check the total market value of your property Under $20,000 |

$20,000 or more |

|

If Under $20,000, complete only Schedule A and if applicable, Schedule F. Otherwise, complete Schedule(s) B, C, D, E and/or F, as applicable.

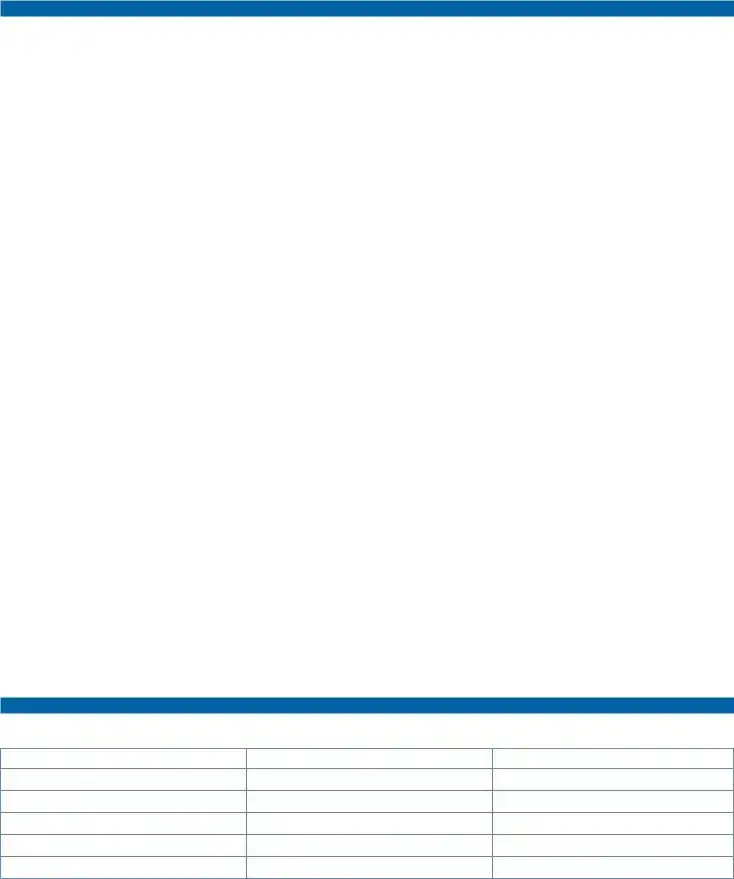

SECTION 6: Affirmation and Signature

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Penal Code Section 37.10.

I, _________________________________________________ , swear or affirm that the information provided in this report is true and accurate to the best of my

Printed Name of Authorized Individual |

knowledge and belief; and that I am authorized as required by law to file and sign this report. |

NOTE: If the person filing and signing this report is not the property owner, an employee of the property owner, an employee of a property owner signing on behalf of an affiliated entity of the property owner or a secured party as defined by Tax Code Section 22.01, the signature below must be notarized.

_______________________________________________________________ ________________________________________

_______________________________________________________________ ________________________________________

Signature of Authorized Individual |

Date |

Subscribed and sworn before me this __________ day of ______________________ , 20_______. |

__________________________________________________________________ |

Notary Public, State of Texas |

|

|

|

|

|

Form developed by: Texas Comptroller of Public Accounts, Property Tax Assistance Division |

For additional copies, visit: comptroller.texas.gov/taxes/property-tax |

_______________________________________________________________ ________________________________________

_______________________________________________________________ ________________________________________