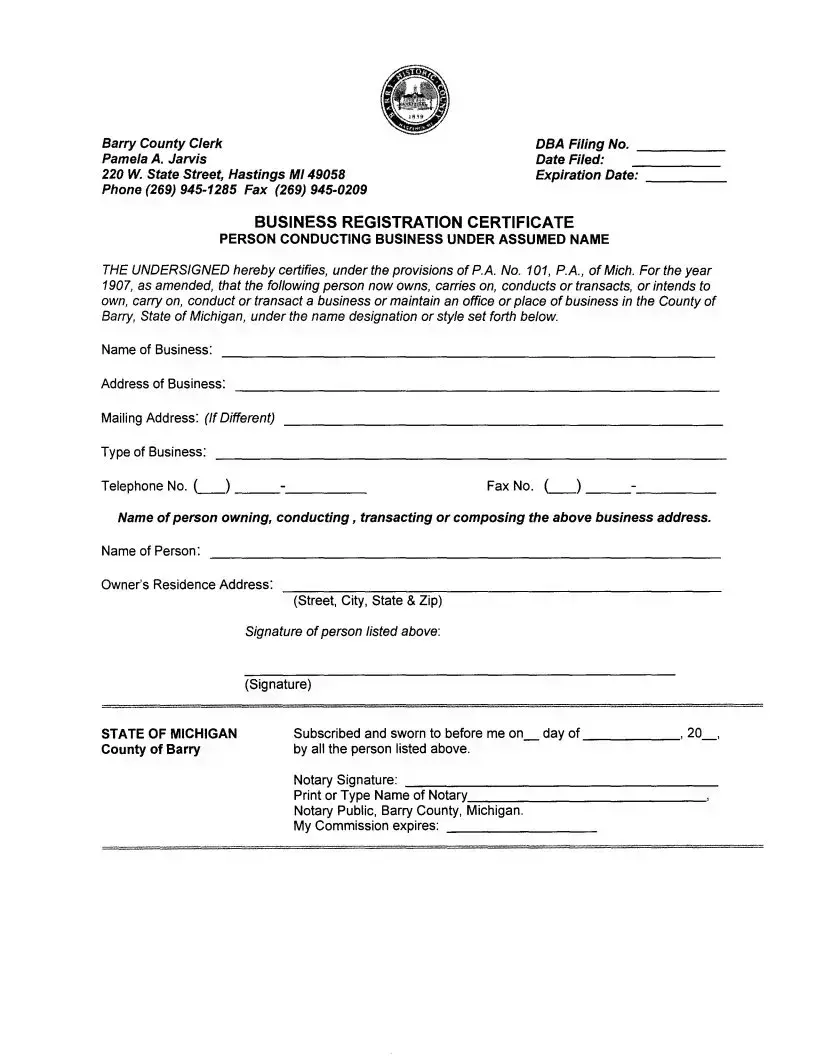

Barry County Clerk |

DBA Filing No. _____ |

Pamela A. Jarvis |

Date Filed: |

220 W. State Street, Hastings MI49058 |

Expiration Date: _____ |

Phone (269) 945-1285 Fax (269) 945-0209 |

|

BUSINESS REGISTRATION CERTIFICATE

PERSON CONDUCTING BUSINESS UNDER ASSUMED NAME

THE UNDERSIGNED hereby celtifies, under the provisions of P.A. No. 101, P.A., of Mich. For the year 1907, as amended, that the fol/owing person now owns, carries on, conducts or transacts, or intends to own, carry on, conduct or transact a business or maintain an office or place of business in the County of Barry, State of Michigan, under the name designation or style set folth below.

Name of Business:

Address of Business:

Mailing Address: (If Different)

Type of Business:

Telephone No. セI@ |

_ |

Fax No. セI@ |

_ |

Name of person owning, conducting, transacting or composing the above business address.

Name of Person:

Owner's Residence Address:

(Street, City, State & Zip)

STATE OF MICHIGAN County of Barry

Signature of person listed above:

(Signature)

Subscribed and sworn to before me on_ day of ______, 20_,

by all the person listed above.

Notary Signature: ⦅セ@ |

_ |

Print or Type Name of nッエ。イケZMZMZMセ@ |

_ |

Notary Public, Barry County, Michigan. |

|

My Commission expires: |

|