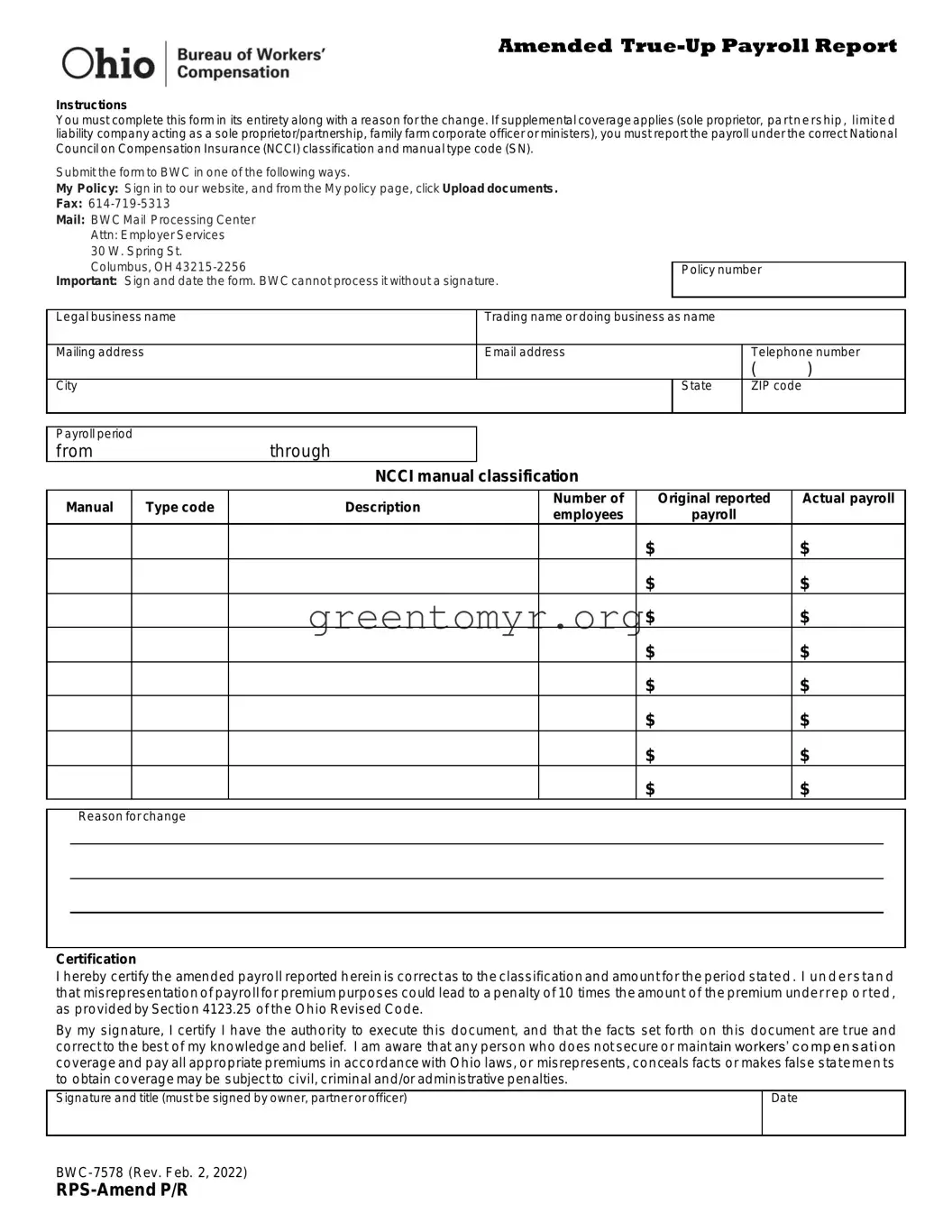

Filling out the BWC 7578 form can seem straightforward, but there are several common mistakes that can lead to delays or issues. One major error is failing to complete the form in its entirety. Incomplete forms lack the necessary information for processing, and BWC will send them back, which prolongs resolution time.

Another frequent mistake is neglecting to provide a reason for changes made. Your explanation matters, especially when adjustments appear. Omitting this crucial detail can lead to confusion and further inquiry from BWC, creating unnecessary back-and-forth communication.

People often confuse the payroll reporting details. This can happen if individuals do not categorize payroll under the correct National Council on Compensation Insurance (NCCI) classification. If the classification is incorrect, it affects premium calculations, causing more problems down the line.

Submitting the form improperly is also a common misstep. Many people overlook the submission guidelines. Remember that BWC accepts forms via their website, fax, or traditional mail. Ensuring you use one of these methods will help in getting your form to the right place without additional hassles.

A significant error can arise from not signing and dating the form. The BWC cannot process a form lacking an authorized signature. Without a date, they may question the validity of the submission, which could lead to delays.

Incorrectly listing the policy number, legal business name, or any contact information can cause your form to be misfiled. Errors in this section can hinder BWC’s ability to locate your account, further complicating the processing of your report.

Lastly, individuals often underestimate the importance of proper certification of the payroll reported. Misrepresentation of payroll can have serious consequences. Understanding the potential penalties should motivate careful review and accuracy when filling out the form.