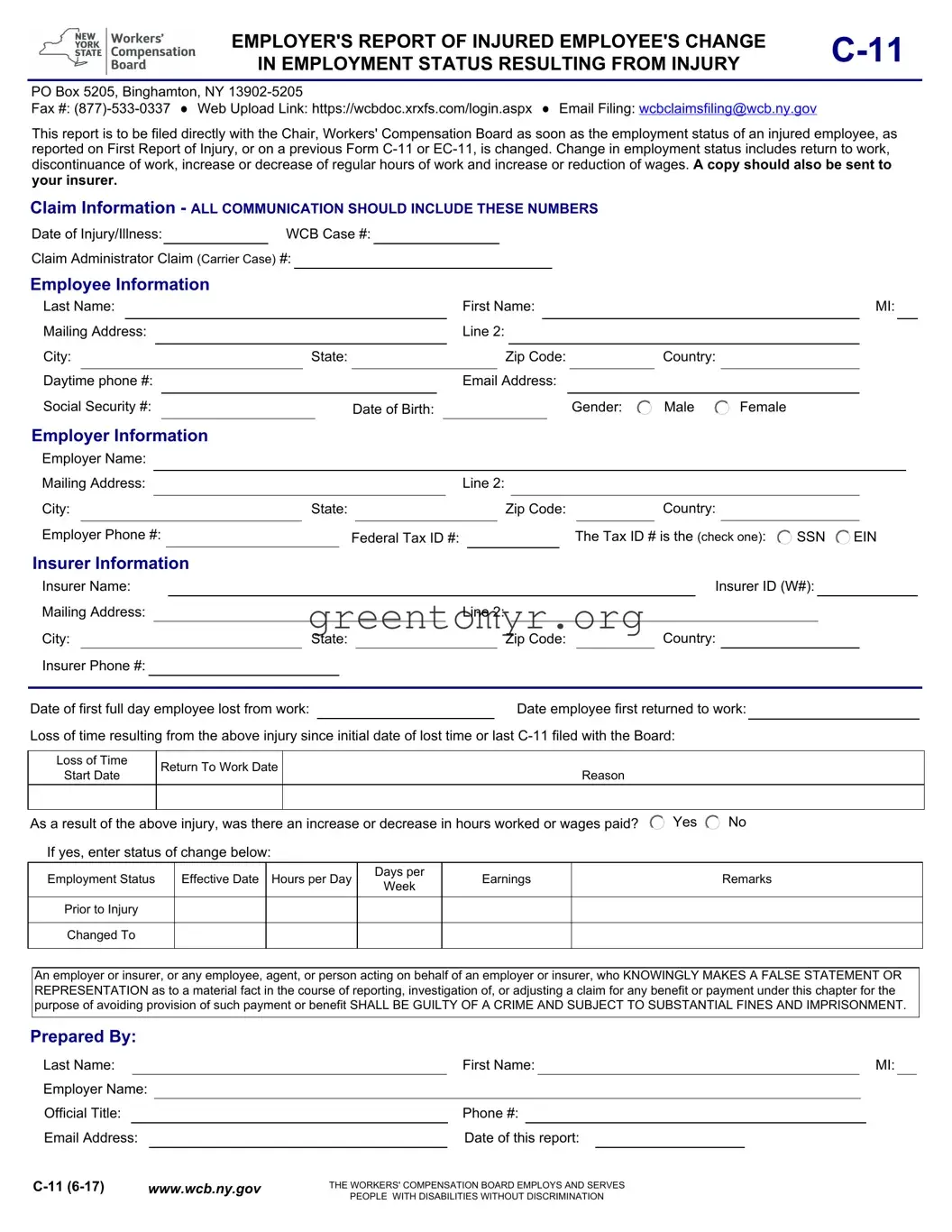

The C-11 form serves as an employer's report indicating changes in an injured employee's employment status due to their injury. This includes details about whether the employee has returned to work, stopped working, adjusted their hours, or experienced a change in wages.

The form should be filed as soon as there is a change in the employment status of an injured employee. This includes changes reported in the First Report of Injury or updates made in prior C-11 or EC-11 forms.

The completed C-11 form must be sent directly to the Chair of the Workers' Compensation Board. Additionally, a copy should be forwarded to your insurer to keep them informed of the changes.

The form requires detailed information, including:

-

Employee's personal details (name, address, phone, social security number)

-

Employer information (name, address, tax ID)

-

Insurer details (name, ID)

-

Information regarding the date of injury, dates of lost time, and return to work

-

Details on any changes in hours and wages

How does an employer determine if an increase or decrease in hours or wages has occurred?

As an employer, you should compare the employee's initial work hours and wages prior to injury with their current status after the injury. If there has been any notable change, such as a shift in the number of hours worked per day or a change in pay rate, this should be recorded on the form.

Providing false statements or misrepresentations on the C-11 form can lead to serious legal repercussions. It is considered a crime, with potential consequences including substantial fines and imprisonment.

Yes, the C-11 form can be submitted electronically through the Web Upload Link provided on the Workers' Compensation Board website. You may also choose to file it via email at the specified claims filing email address.

What if the employee experiences multiple changes in employment status?

If there are multiple changes in the employee's status, it is essential to file a separate report for each change, as each must be documented accurately to maintain compliance with reporting requirements.

The employer or their designated agent must complete and submit the C-11 form. Ensure that the information recorded is accurate and that the form is submitted in a timely manner to avoid delays in processing claims.

For more information and resources, you can visit the Workers' Compensation Board's official website. They offer guidance and FAQs that can help clarify the process of completing the C-11 form and other related inquiries.

Yes

Yes  No If yes, enter status of change below:

No If yes, enter status of change below: