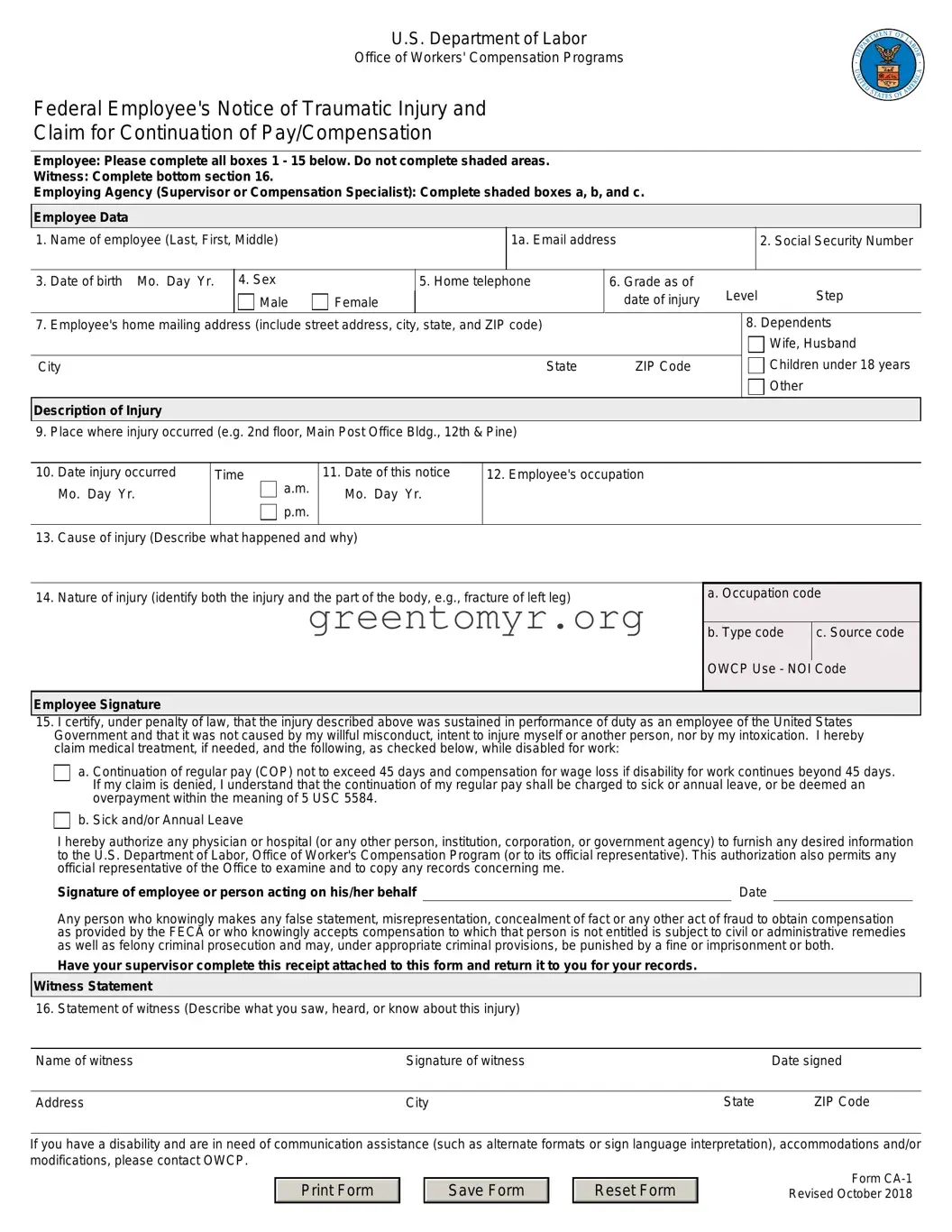

|

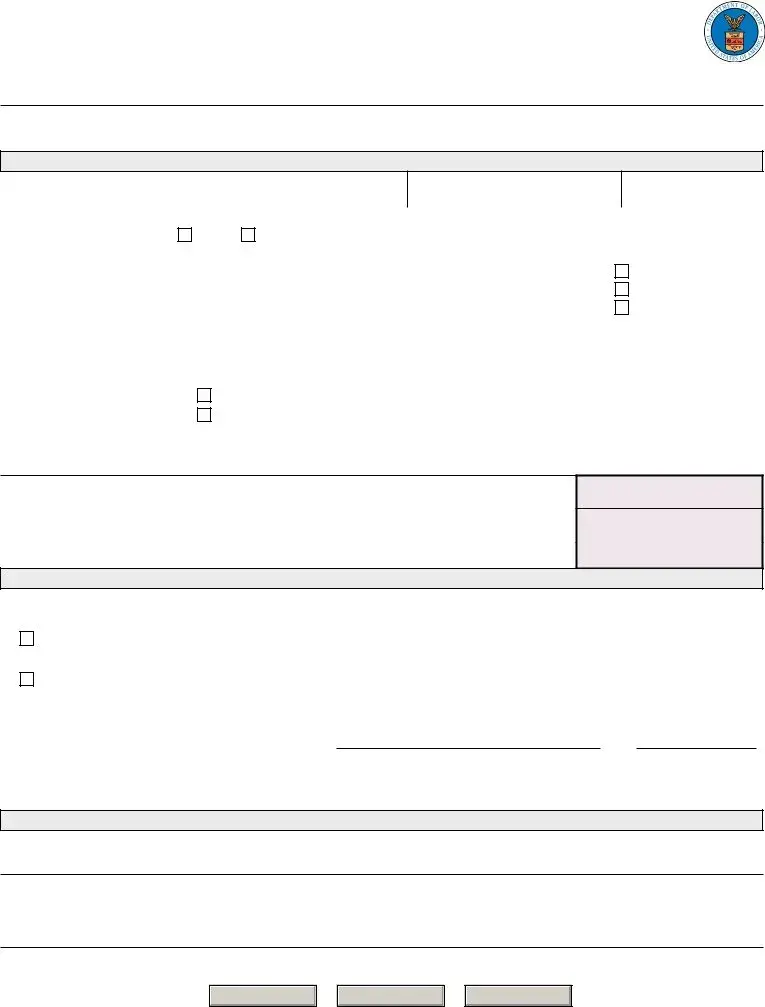

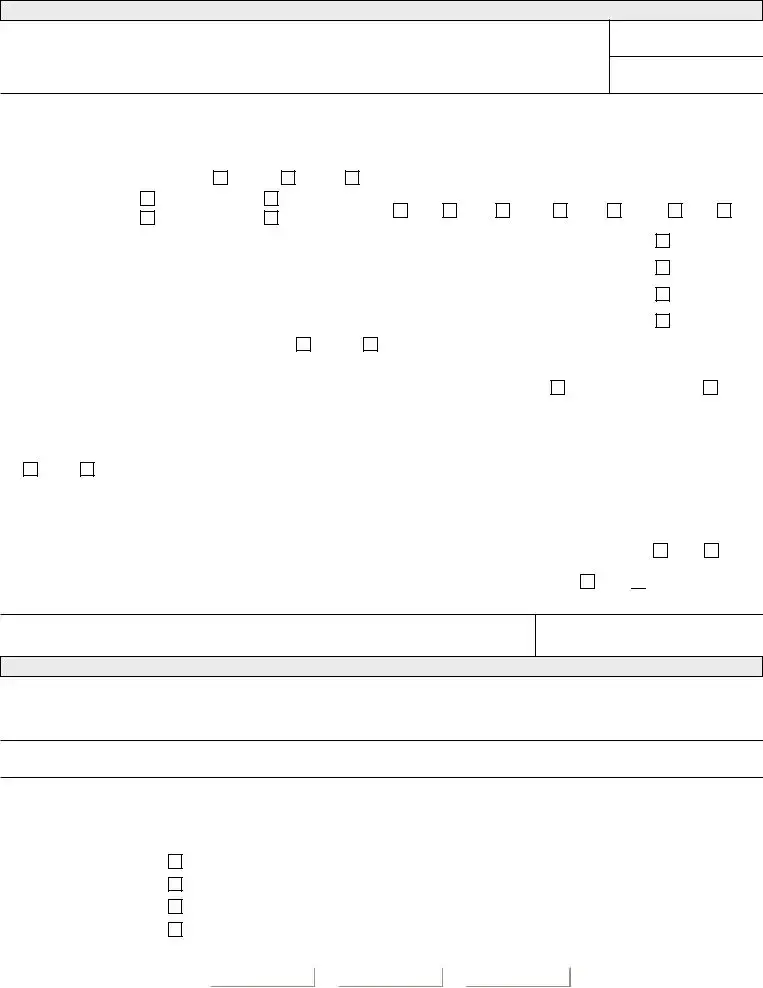

As the time the form is received, complete the receipt of notice of |

33) First date medical care received |

|

injury and give it to the employee. In addition to completing |

The date of the first visit to the physician listed in Item 31. |

|

Items 17 through 39, the supervisor is responsible for obtaining |

|

the witness statement in Item 16 and for filling in the proper codes |

36) If the employing agency controverts continuation of |

|

in shaded boxes a, b, and c on the front of the form. If medical |

|

expense or lost time is incurred or expected, the completed form |

pay, state the reason in detail. |

|

should be sent to OWCP within 10 working days after is received. |

COP may be controverted (disputed) for any reason; however, |

|

The supervisor should also submit any other information or |

|

the employing agency may refuse to pay COP only if the |

|

evidence pertinent to the merits of this claim. |

controversion is based upon one of the nine reasons given |

|

If the employing agency controverts COP, the employee should |

below: |

|

be notified and the reason for controversion explained to him or |

a) The disability was not caused by a traumatic injury. |

|

her. |

|

|

|

17) Agency name and address of reporting office |

b) The employee is a volunteer working without pay or for |

|

nominal pay, or a member of the office staff of a former |

|

|

|

The name and address of the office to which correspondence |

President; |

|

from OWCP should be sent (if applicable, the address of the |

c) The employee is not a citizen or a resident of the United |

|

personnel or compensation office). |

|

18) Duty station street address and zip code |

States or Canada; |

|

d) The injury occurred off the employing agency's premises and |

|

|

|

The address and zip code of the establishment where the |

the employee was not involved in official "off premise" duties; |

|

employee actually works. |

e) The injury was proximately caused by the employee's willful |

|

|

|

19) Employers Retirement Coverage. |

misconduct, intent to bring about injury or death to self or |

|

another person, or intoxication; |

|

Indicate which retirement system the employee is covered under. |

f) The injury was not reported on Form CA-1 within 30 days |

|

|

|

30) Was injury caused by third party? |

following the injury; |

|

|

|

A third party is an individual or organization (other than the |

g) Work stoppage first occurred 45 days or more following |

|

the injury; |

|

injured employee or the Federal government) who is liable for |

|

the injury. For instance, the driver of a vehicle causing an |

h) The employee initially reported the injury after his or her |

|

accident in which an employee is injured, the owner of a |

|

employment was terminated; or |

|

building where unsafe conditions cause an employee to fall, and |

|

a manufacturer whose defective product causes an employee's |

i) The employee is enrolled in the Civil Air Patrol, Peace Corps, |

|

injury, could all be considered third parties to the injury. |

|

Youth Conservation Corps, Work Study Programs, or other |

|

|

|

32) Name and address of physician first providing medical |

similar groups. |

|

|

|

care |

|

|

The name and address of the physician who first provided |

|

|

medical care for this injury. If initial care was given by a nurse |

|

|

or other health professional (not a physician) in the employing |

|

|

agency's health unit or clinic, indicate this on a separate sheet |

|

|

of paper. |

|

No (If "No," explain)

No (If "No," explain)