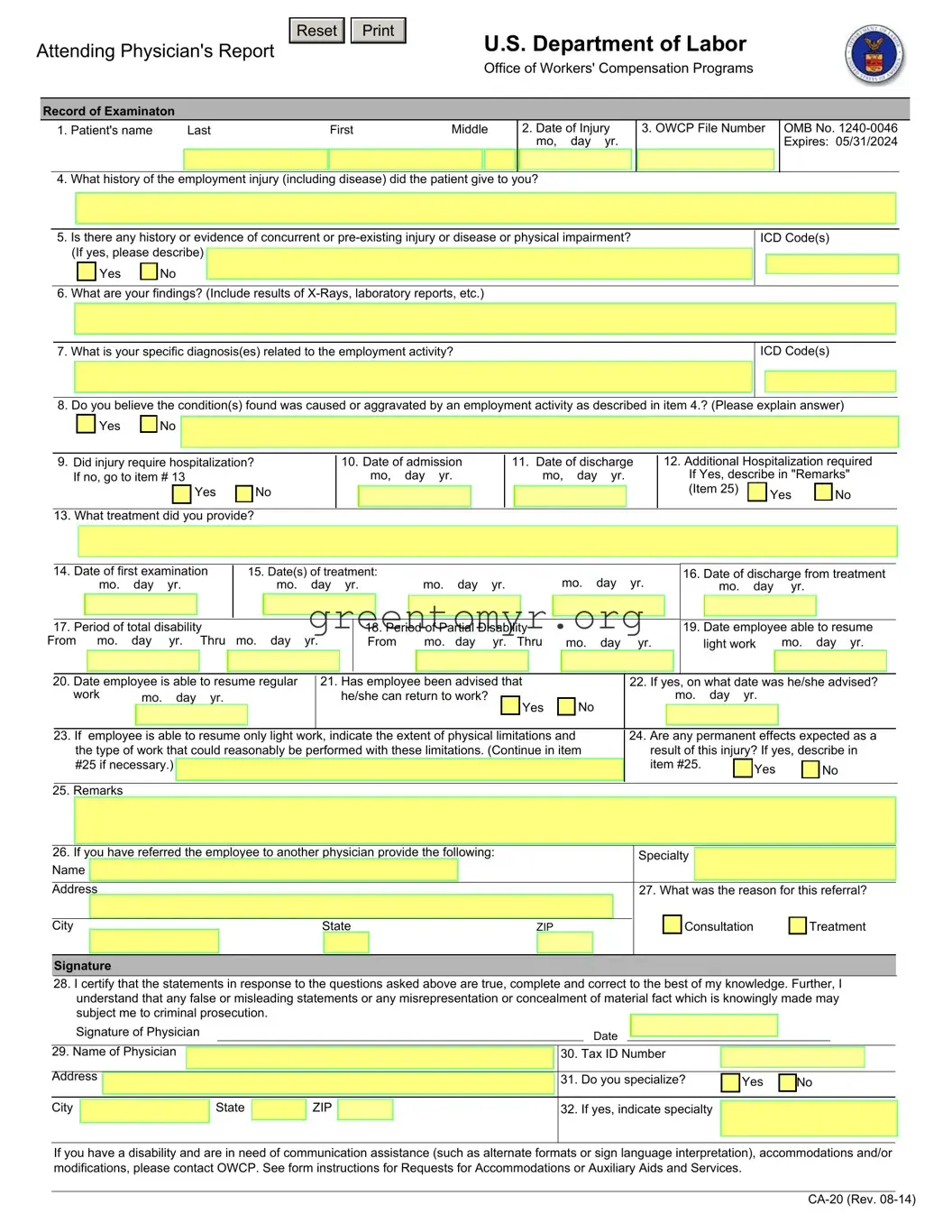

INSTRUCTIONS TO PHYSICIAN FOR COMPLETING ATTENDING PHYSICIAN'S REPORT

1.COMPLETE THE ENTRIES 1-32 ON THE FORM; AND

2.IF DISABILITY HAS NOT TERMINATED, INDICATE IN ITEM 17; AND

3.SEND THE FORM AND YOUR BILL TO:

Office of Workers’ Compensation Programs

Division of Federal Employees’, Longshore and Harbor Workers’ Compensation

Federal Employees’ Compensation Act

(OWCP/DFELHWC-FECA)

PO Box 8311

London, KY 40742-8311

IMPORTANT: A medical report is required by the Office of Workers' Compensation Programs before payment of compensation for loss of wages or permanent disability can be made to the employee.

This information is required to obtain or retain a benefit (5 U.S.C. 8101, et seq.). If you have submitted a narrative medical report or a form CA-16 to OWCP within the past 10 days, you need not submit this form CA-20.

OWCP requires that medical bills, other than hospital bills, be submitted on the American Medical Association health insurance claim form, HCFA 1500/OWCP-1500.

INSTRUCTIONS FOR THE INJURED WORKER/ EMPLOYING AGENCY

Compensation for wage loss cannot be paid unless medical evidence has been submitted supporting disability for work during the period claimed. For claims based on traumatic injury and reported on Form CA-1, the employee should detach Form CA-20 and complete items 1-3 on the front. The form should be promptly referred to the attending physician for early completion. If the claim is for occupational disease, filed on Form CA-2, a medical report as described in the instructions accompanying that form is required in most cases. The employee should bring these requirements to the physician's attention. It may be necessary for the physician to provide a narrative medical report in place of or in addition to Form CA-20 to adequately explain and support the relationship of the disability to the employment.

For payment of a schedule award the claimant must have a permanent loss or loss of function of one of the members of the body or organs enumerated in the regulations (20 C.F.R. 10.404). The attending physician must affirm that maximum medical improvement of the condition has been reached and should describe the functional loss and the resulting impairment in accordance with the American Association Guides to the Evaluation of Permanent Impairment.

Notice

Requests for Accommodations or Auxiliary Aids and Services

If you have a disability, federal law gives you the right to receive help from the OWCP in the form of communication assistance, accommodation(s) and/or modification(s) to aid you in the claims process. For example, we will provide you with copies of documents in alternate formats, communication services such as sign language interpretation, or other kinds of adjustments or changes to accommodate your disability. Please contact our office or your OWCP claims examiner to ask about this assistance.