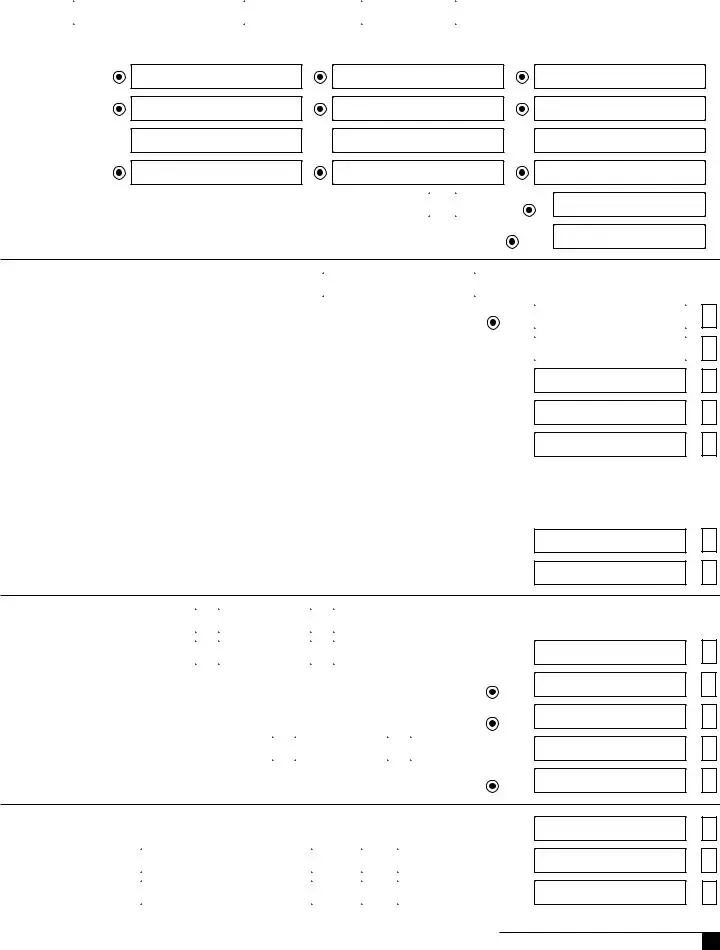

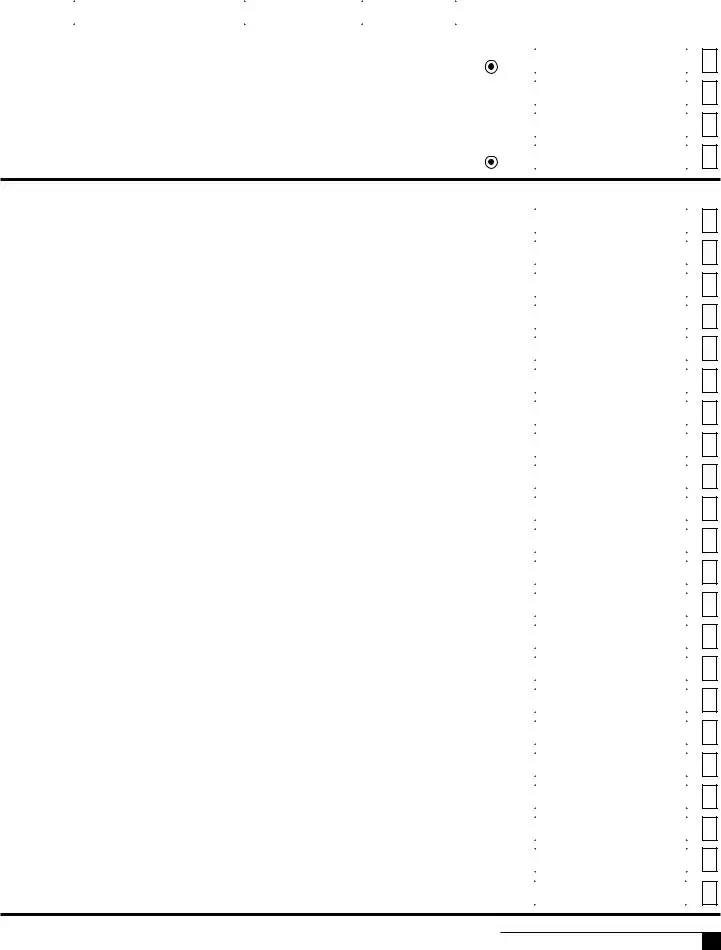

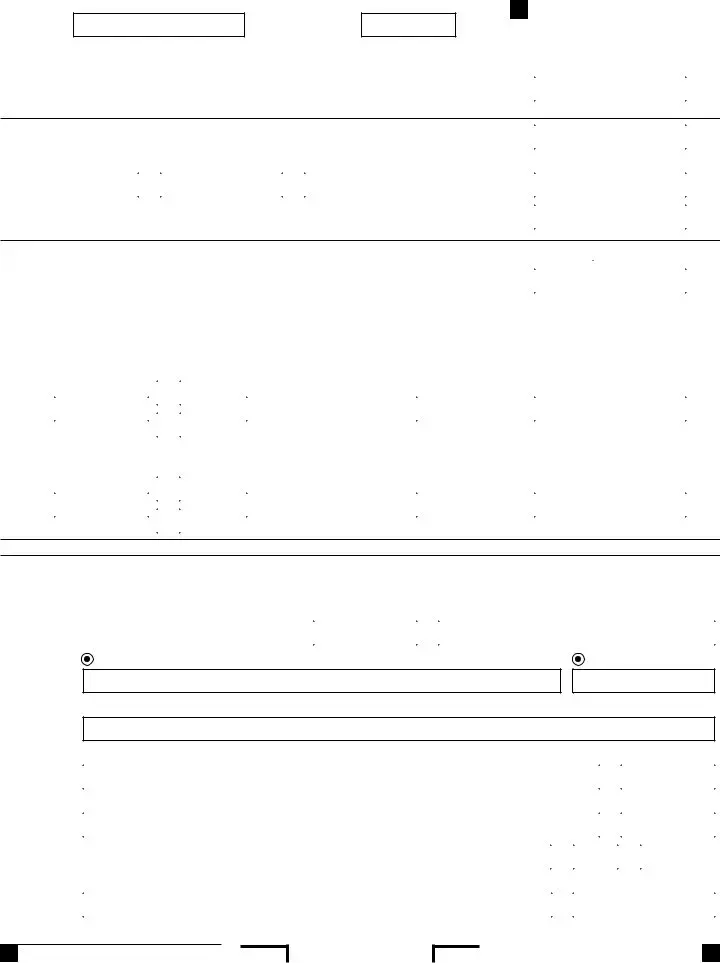

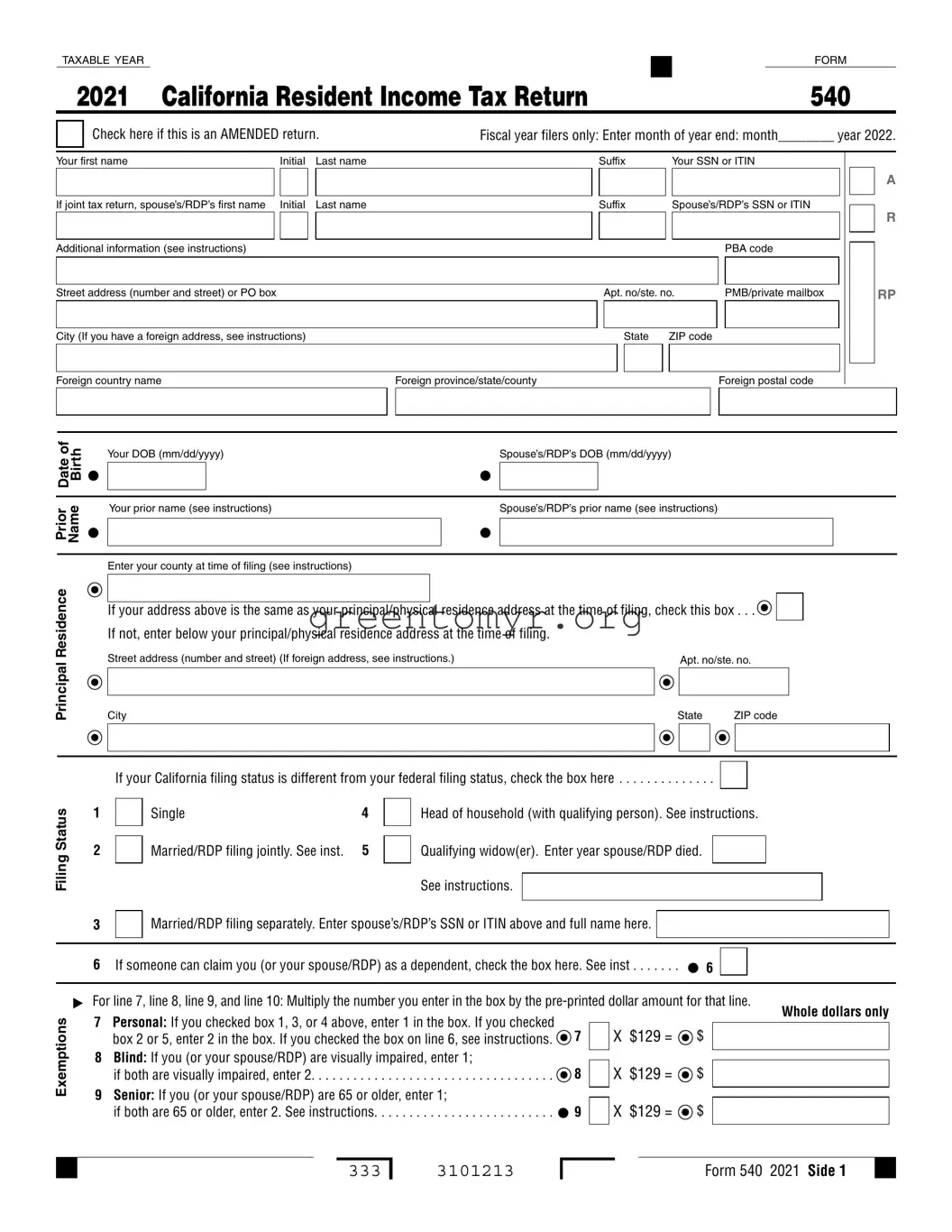

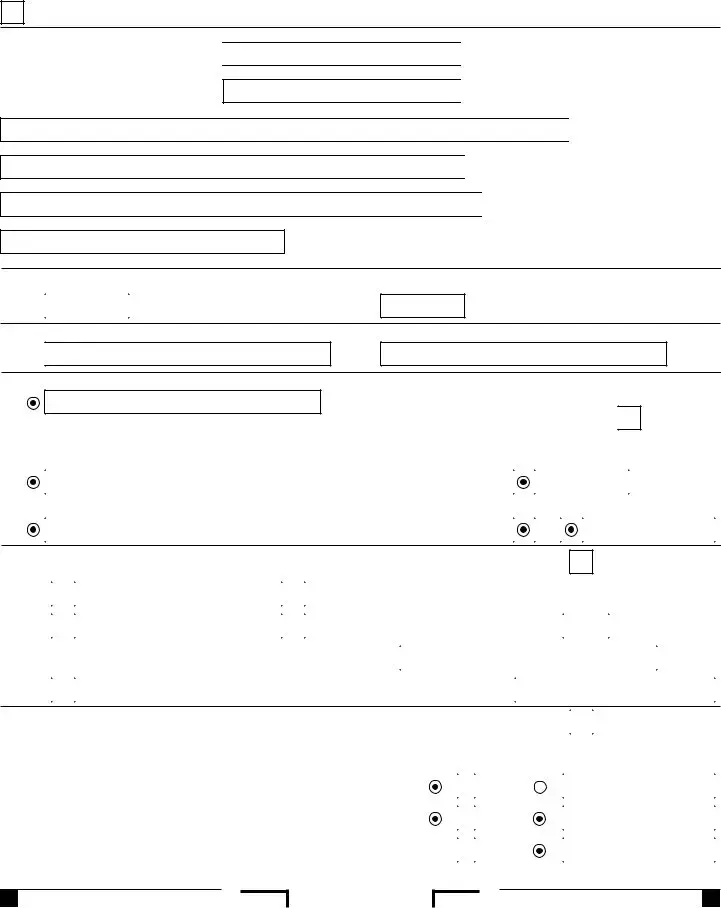

The California Form 540 is a critical document for residents filing their income taxes in the Golden State. Designed for California residents, this form collects key information about your income, filing status, exemptions, and credits for the tax year. If you’re filing jointly with a spouse or registered domestic partner, the form accommodates both individuals, requiring personal details like names, Social Security numbers, and dates of birth. Various filing statuses—such as single, married, or head of household—directly influence your tax calculations. One important aspect to consider is exemptions; the form allows taxpayers to declare personal and dependent exemptions, potentially reducing taxable income. Moreover, it assists in reporting income, including wages and adjustments for California-specific tax considerations. With additional sections for tax credits, deductions, and potential payments owed or refunds due, Form 540 serves as a comprehensive tool for managing your tax obligations in California. Understanding this form’s various sections is essential for ensuring accurate and compliant tax filing, helping you maximize your potential tax benefits and minimize miscalculations.

If not, enter below your principal/physical residence address at the time of filing.

If not, enter below your principal/physical residence address at the time of filing.