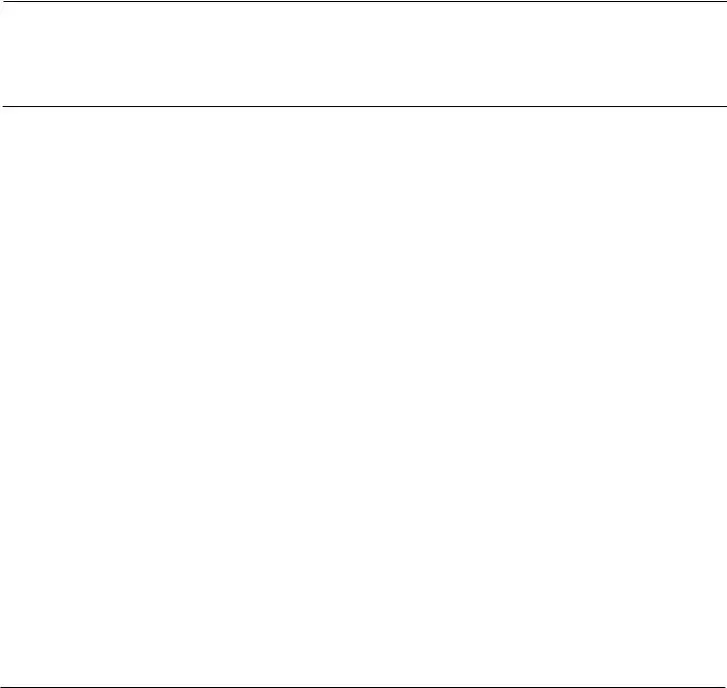

U.S. Department of Labor

Office of Workers' Compensation Programs

Employee Statement - Please carefully read instructions on reverse before filling out this form.

1. Name of Employee: (Last, First, Middle) |

|

2. SSN |

|

3. OWCP File Number |

|

|

|

|

|

|

4. Period Covered by This Form:

5. Total Hours Claimed

for LWOP:  for Leave BuyBack

for Leave BuyBack

6.In ''Type of Leave Used'' column, use codes "S" = Sick, "A" = Annual, "O" = Other. If Compensation is claimed for date, indicate "Yes'' in ''Compensation Claimed'' column.

Number of Hours

LWOP Worked Hol Leave

Reason for Leave Use/Remarks (e.g., doctor visit, therapy, etc.)

Totals

Signature of Claimant |

Date Signed |

7. Agency Statement/Certification: I certify the above is accurate, except as follows:

Signature of Agency Official |

Date Signed |

Instructions for Completing Form CA-7A

Time Analysis

General: This form is used when claiming FECA compensation, including repurchase of paid leave. It must be used when claiming compensation for more than one consecutive period of leave.

Instructions for Employee:

Blocks 1, 2, and 3: Self-explanatory.

Block 4: Indicate beginning and ending dates covered by this form. These must be the same as on Forms CA-7 and CA-7b.

Block 5: If claiming compensation for any dates detailed in block 4, state total number of hours claimed for leave without pay and total number of hours of leave. This should be at least 10 hours unless this is your final claim.

Block 6:

1st Column: |

Show full date. |

2nd Column: |

For each date noted in column 1, state "Y" if you are claiming compensation |

|

for that date and "N'' if you are not. |

3rd, 4th, |

Show the number of hours of LWOP, number of hours worked, paid |

5th and 6th |

Columns: |

holiday hours, and number of hours of paid leave. |

7th Column: |

Using the legend provided, indicate the type of leave used. |

8th Column: |

State the reason you were off work. For each date for which compensation |

|

is claimed, there must be medical evidence supporting entitlement. |

Sign and Date Form and Submit to the Appropriate Agency Official.

Instructions for Employing Agency:

Block 7: Verify accuracy of hours and status for each date listed. If challenging entitlement for any date, attempt to resolve discrepancies prior to submitting claim to OWCP. If discrepancy cannot be resolved, indicate the specific basis for the challenge in the space provided.

for Leave BuyBack

for Leave BuyBack