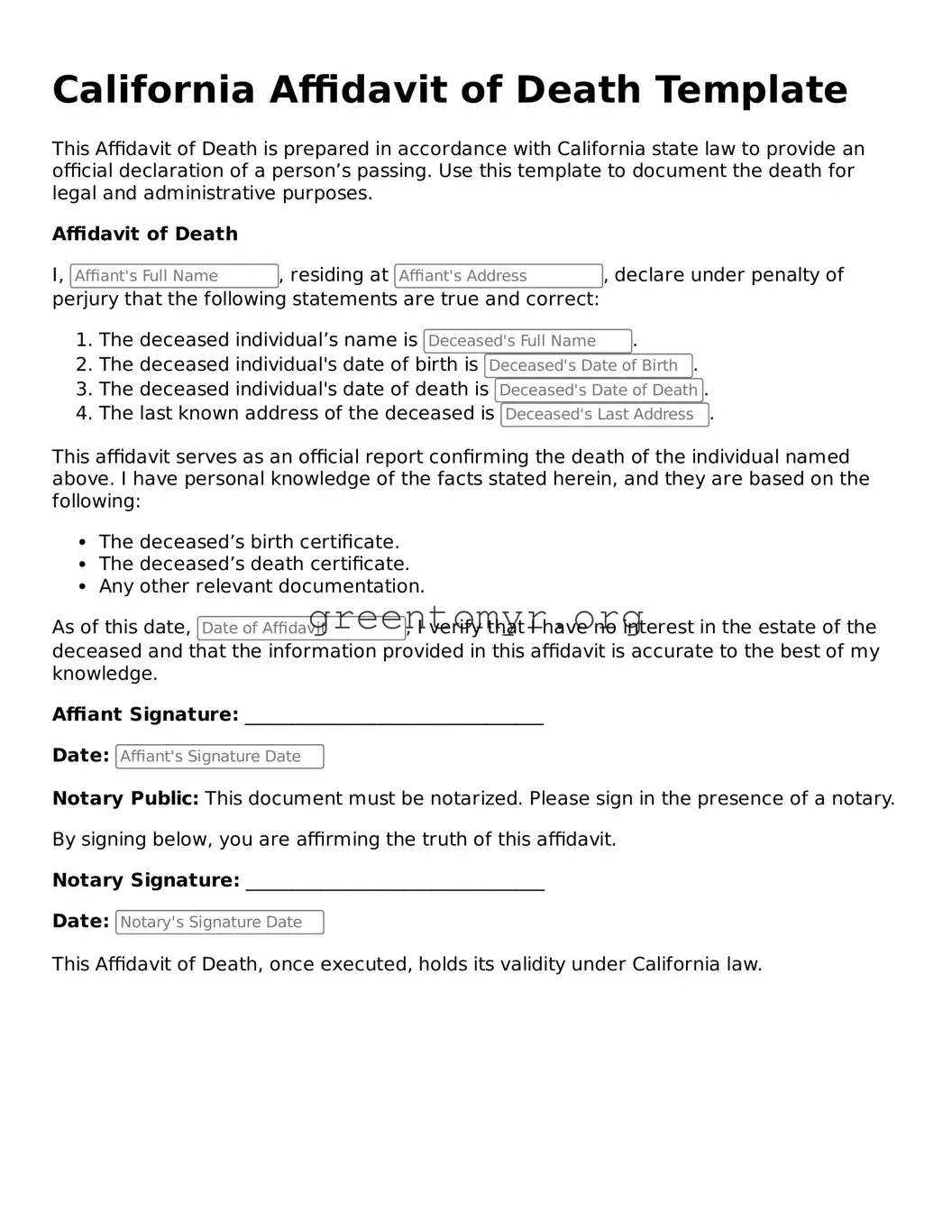

Affidavit of Death Form for the State of California

The California Affidavit of Death form is a legal document used to officially declare the passing of an individual. This form serves as an important tool for settling a deceased person's affairs, particularly when it comes to transferring property and settling debts. Understanding how to complete this form accurately can facilitate a smoother transition during a challenging time, so take the first step by filling out your affidavit today by clicking the button below.