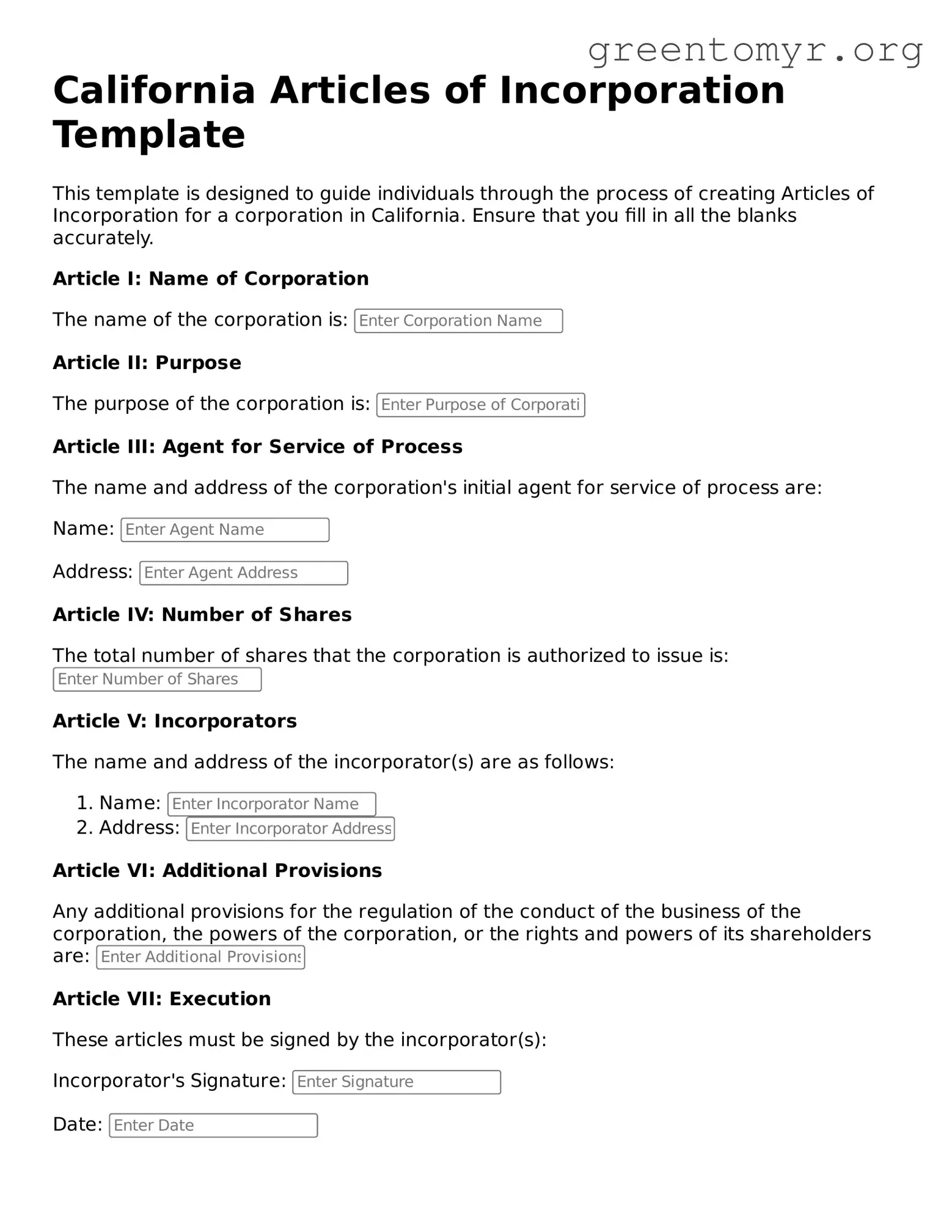

Articles of Incorporation Form for the State of California

The California Articles of Incorporation form is a legal document that establishes a corporation in the state of California. This form outlines the corporation's basic information, such as its name, purpose, and management structure. Completing this form is the first crucial step in starting a business, so don't hesitate—fill it out by clicking the button below.