What is a California Bill of Sale?

A California Bill of Sale is a legal document that records the transfer of ownership of personal property. This document is essential for transactions involving items like vehicles, boats, or other significant assets. It provides proof of the sale and protects both the buyer and the seller by documenting important details about the transaction.

When do I need a Bill of Sale?

A Bill of Sale is typically needed in several situations, including:

-

Purchasing or selling a vehicle or boat.

-

Transferring ownership of valuable personal property, such as art or jewelry.

-

As part of a larger transaction where an asset is being sold.

While not always required by law, having a Bill of Sale is often necessary for record-keeping and may be demanded by the DMV or other authorities.

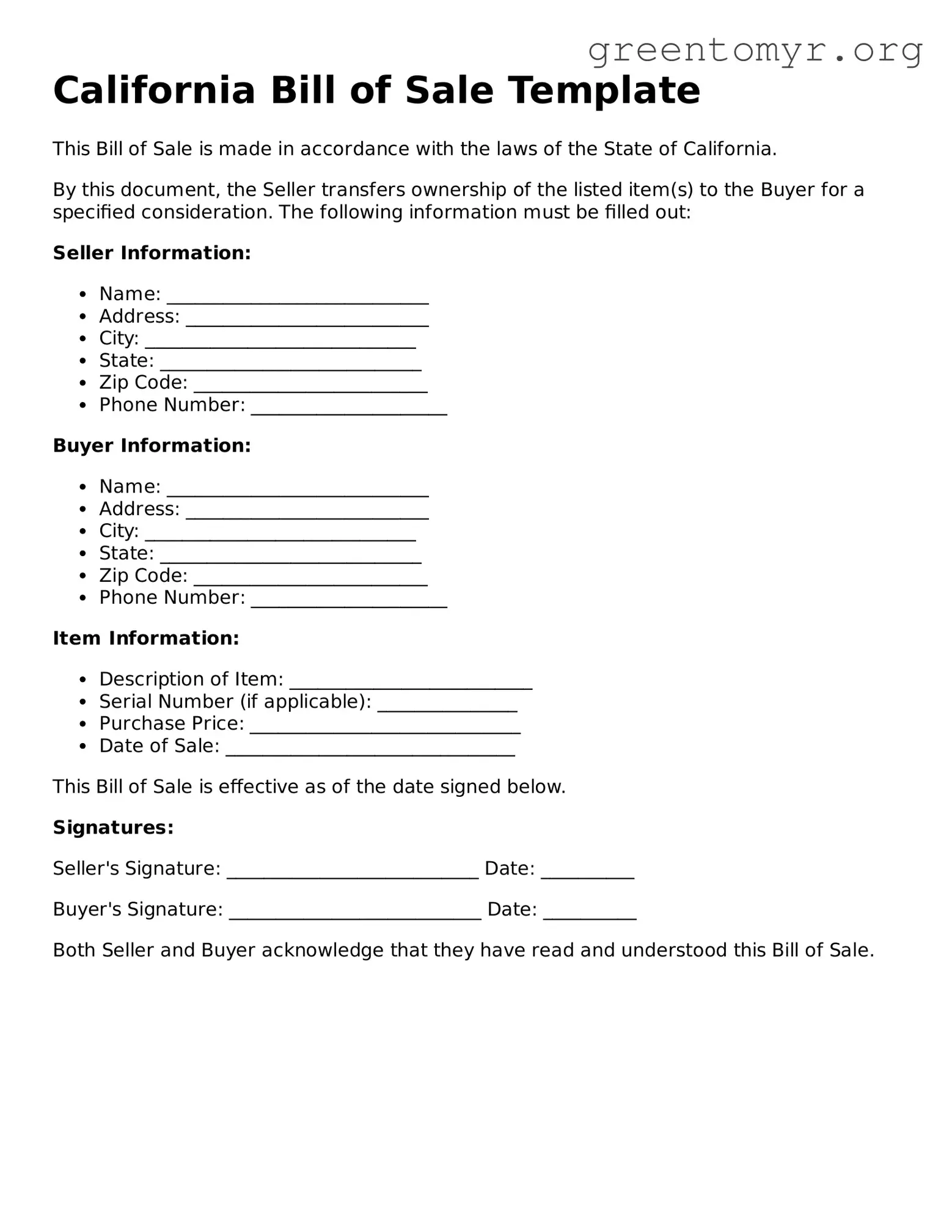

A comprehensive Bill of Sale should include the following details:

-

The names and addresses of both the seller and buyer.

-

A description of the property being sold, including make, model, and VIN for vehicles.

-

The purchase price.

-

The date of the transaction.

-

Signatures of both the seller and the buyer.

This information helps clarify the transaction and serves as a record for both parties.

Is a Bill of Sale required for selling a car in California?

Yes, in California, a Bill of Sale is highly recommended when selling a vehicle. While the state does not legally mandate a Bill of Sale for all vehicle transactions, it serves as crucial evidence of the sale. Furthermore, it's often necessary for completing the title transfer at the Department of Motor Vehicles (DMV).

Can I write a Bill of Sale myself?

Absolutely! You can create your own Bill of Sale using a template or by drafting it from scratch. Ensure that it contains all the necessary information outlined above. For added peace of mind, you may consider having it reviewed by a legal professional.

Do I need a witness or notarization for a Bill of Sale in California?

A Bill of Sale does not generally require a witness or notarization to be legally valid in California. However, having the document notarized can offer additional protection and assurance, especially in more significant transactions. Notarization can help verify the identities of both parties.

What should I do with the Bill of Sale after completing a transaction?

Keep both the buyer's and seller's copies of the Bill of Sale in a safe place. The buyer may need it for registering the property, while the seller should retain it for their records. It's wise to keep the document until the sale is finalized and any pending details have been resolved.

What happens if I lose my Bill of Sale?

If you lose your Bill of Sale, there are steps you can take to recover from the situation. For vehicles, contact the DMV; they may have a record of the transaction if a title transfer was recorded. If possible, try to obtain a replacement copy from the other party involved in the transaction.

Can a Bill of Sale be contested?

Yes, a Bill of Sale can be contested if there are disputes regarding the transaction. Common reasons for contesting might include claims of fraud, misrepresentation, or if one party did not fully authorize the sale. Having a thorough and accurate Bill of Sale can significantly strengthen your position in such disputes.