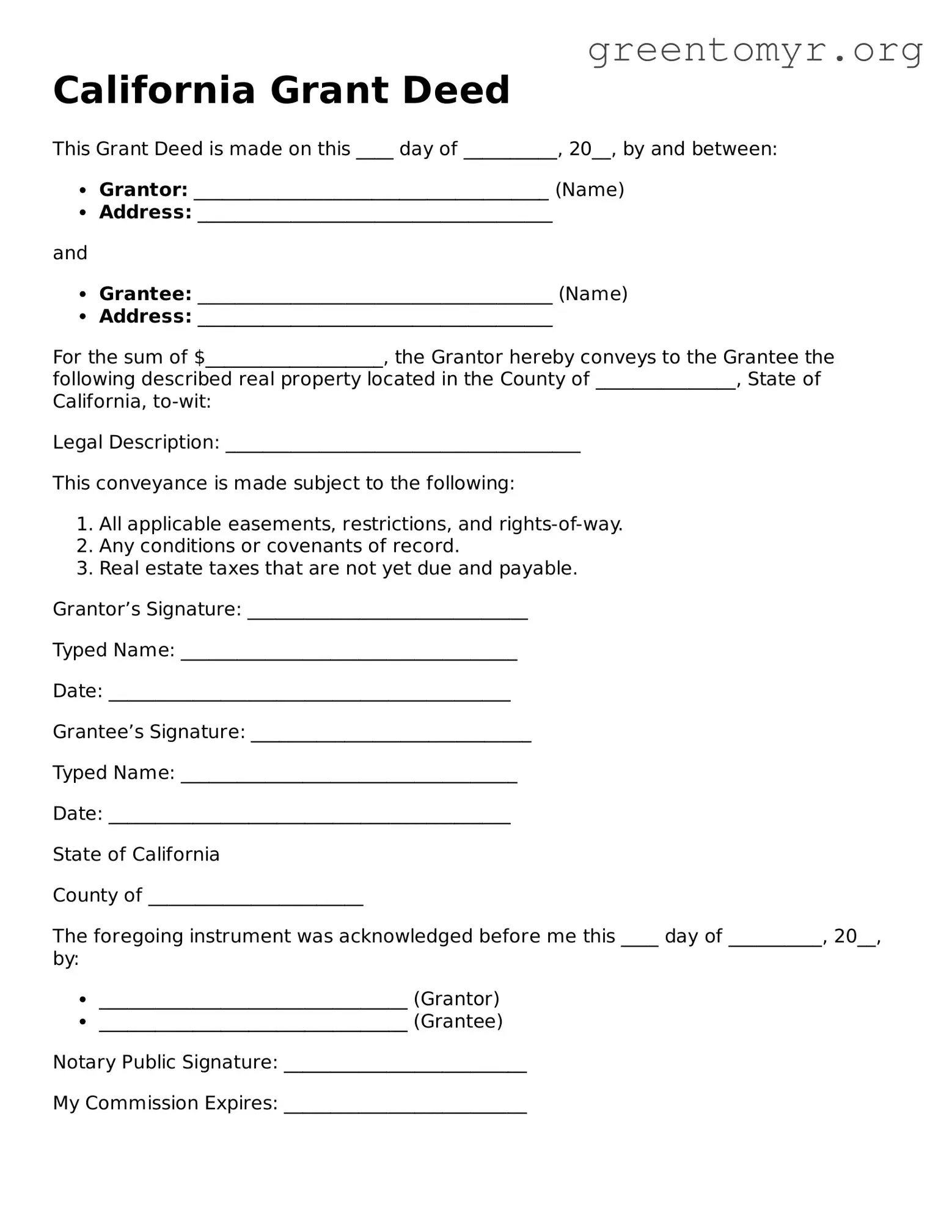

California Grant Deed

This Grant Deed is made on this ____ day of __________, 20__, by and between:

- Grantor: ______________________________________ (Name)

- Address: ______________________________________

and

- Grantee: ______________________________________ (Name)

- Address: ______________________________________

For the sum of $___________________, the Grantor hereby conveys to the Grantee the following described real property located in the County of _______________, State of California, to-wit:

Legal Description: ______________________________________

This conveyance is made subject to the following:

- All applicable easements, restrictions, and rights-of-way.

- Any conditions or covenants of record.

- Real estate taxes that are not yet due and payable.

Grantor’s Signature: ______________________________

Typed Name: ____________________________________

Date: ___________________________________________

Grantee’s Signature: ______________________________

Typed Name: ____________________________________

Date: ___________________________________________

State of California

County of _______________________

The foregoing instrument was acknowledged before me this ____ day of __________, 20__, by:

- _________________________________ (Grantor)

- _________________________________ (Grantee)

Notary Public Signature: __________________________

My Commission Expires: __________________________