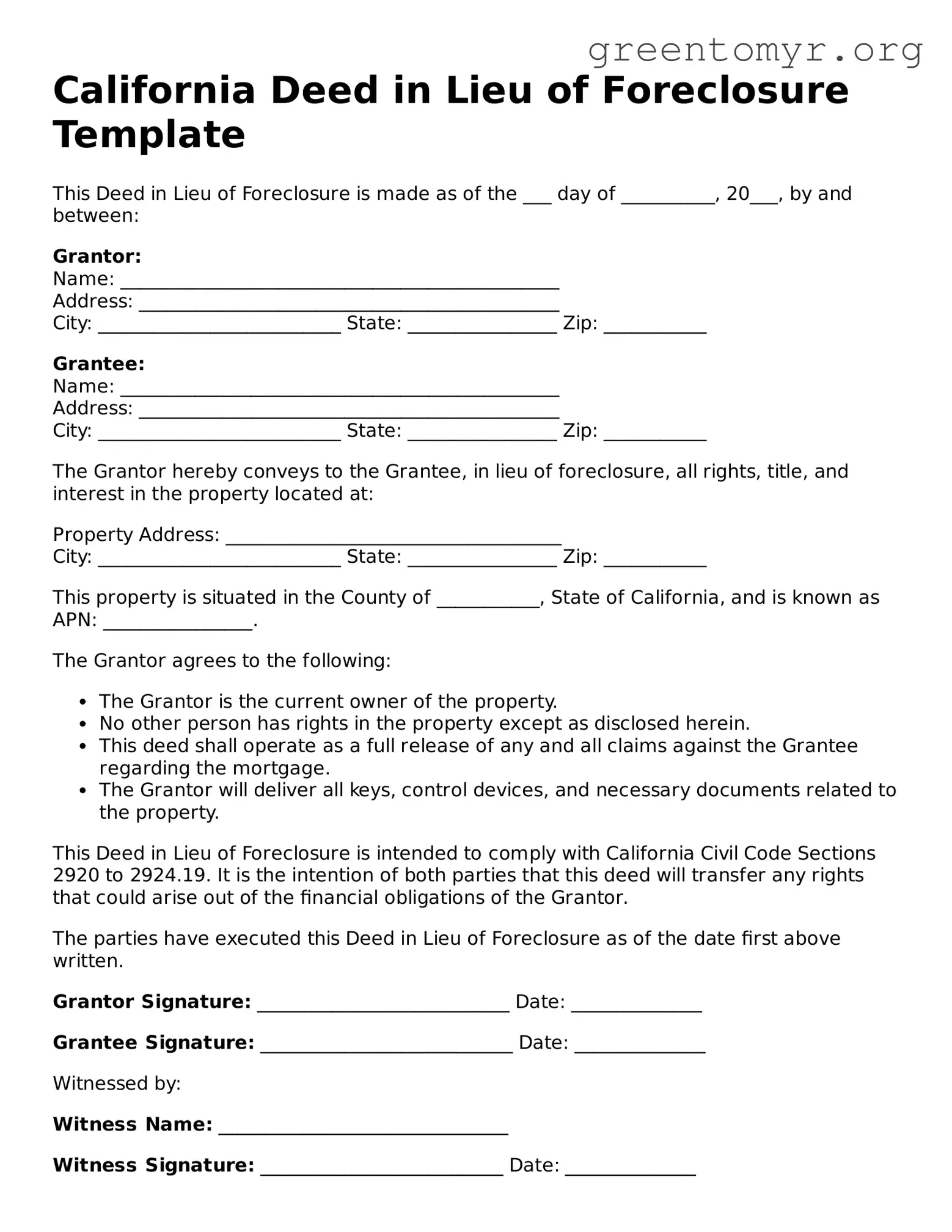

California Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made as of the ___ day of __________, 20___, by and between:

Grantor:

Name: _______________________________________________

Address: _____________________________________________

City: __________________________ State: ________________ Zip: ___________

Grantee:

Name: _______________________________________________

Address: _____________________________________________

City: __________________________ State: ________________ Zip: ___________

The Grantor hereby conveys to the Grantee, in lieu of foreclosure, all rights, title, and interest in the property located at:

Property Address: ____________________________________

City: __________________________ State: ________________ Zip: ___________

This property is situated in the County of ___________, State of California, and is known as APN: ________________.

The Grantor agrees to the following:

- The Grantor is the current owner of the property.

- No other person has rights in the property except as disclosed herein.

- This deed shall operate as a full release of any and all claims against the Grantee regarding the mortgage.

- The Grantor will deliver all keys, control devices, and necessary documents related to the property.

This Deed in Lieu of Foreclosure is intended to comply with California Civil Code Sections 2920 to 2924.19. It is the intention of both parties that this deed will transfer any rights that could arise out of the financial obligations of the Grantor.

The parties have executed this Deed in Lieu of Foreclosure as of the date first above written.

Grantor Signature: ___________________________ Date: ______________

Grantee Signature: ___________________________ Date: ______________

Witnessed by:

Witness Name: _______________________________

Witness Signature: __________________________ Date: ______________

Notarized by:

State of California

County of ____________

On this ___ day of ___________, 20___, before me, __________________________, Notary Public, personally appeared __________________________________, proved to me on the basis of satisfactory evidence to be the person(s) who executed the preceding instrument.

My Commission Expires: ________________