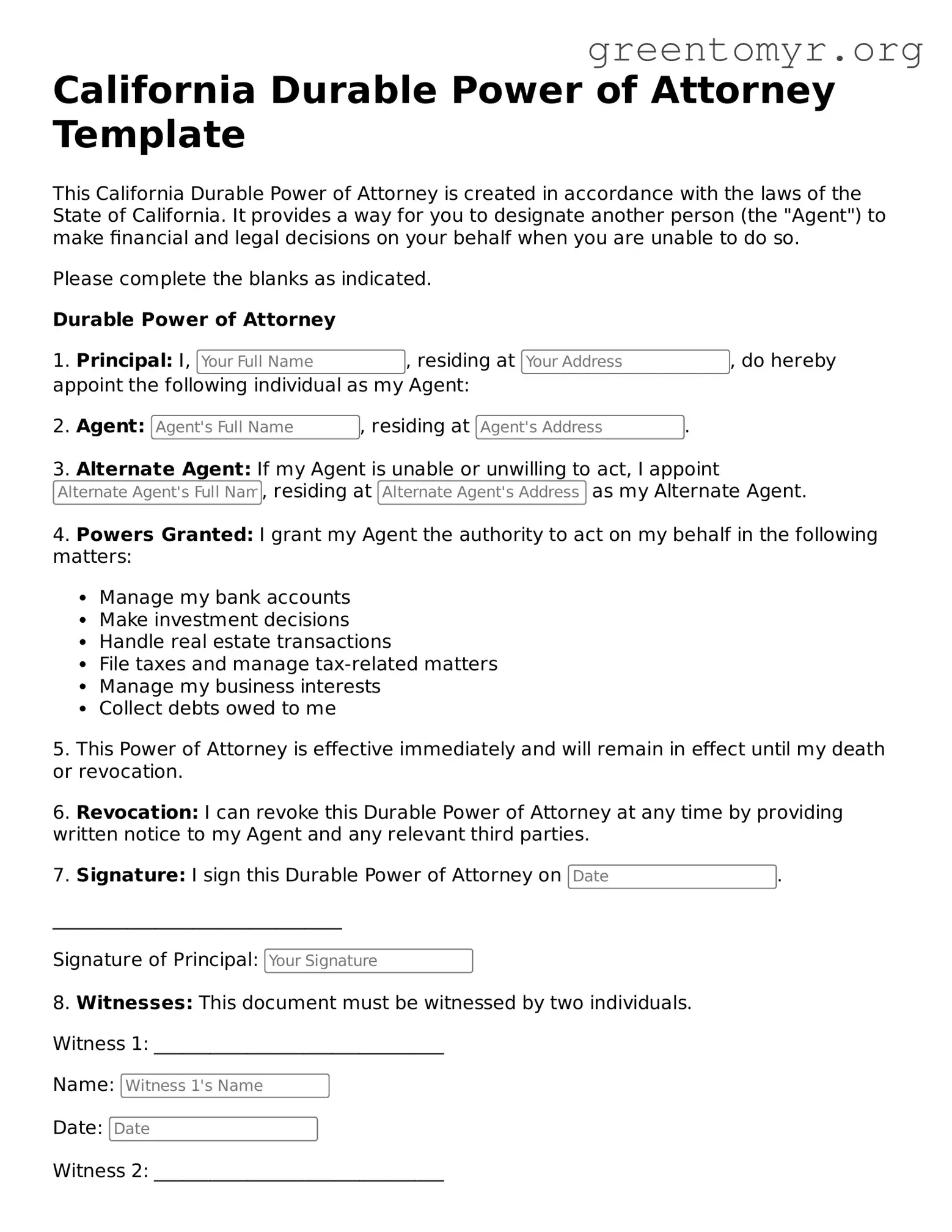

Durable Power of Attorney Form for the State of California

A California Durable Power of Attorney is a legal document that allows an individual to appoint someone to make decisions on their behalf, even if they become incapacitated. This form grants significant authority, enabling the designated agent to manage financial and legal matters. If you're ready to take control of your future, fill out the form by clicking the button below.