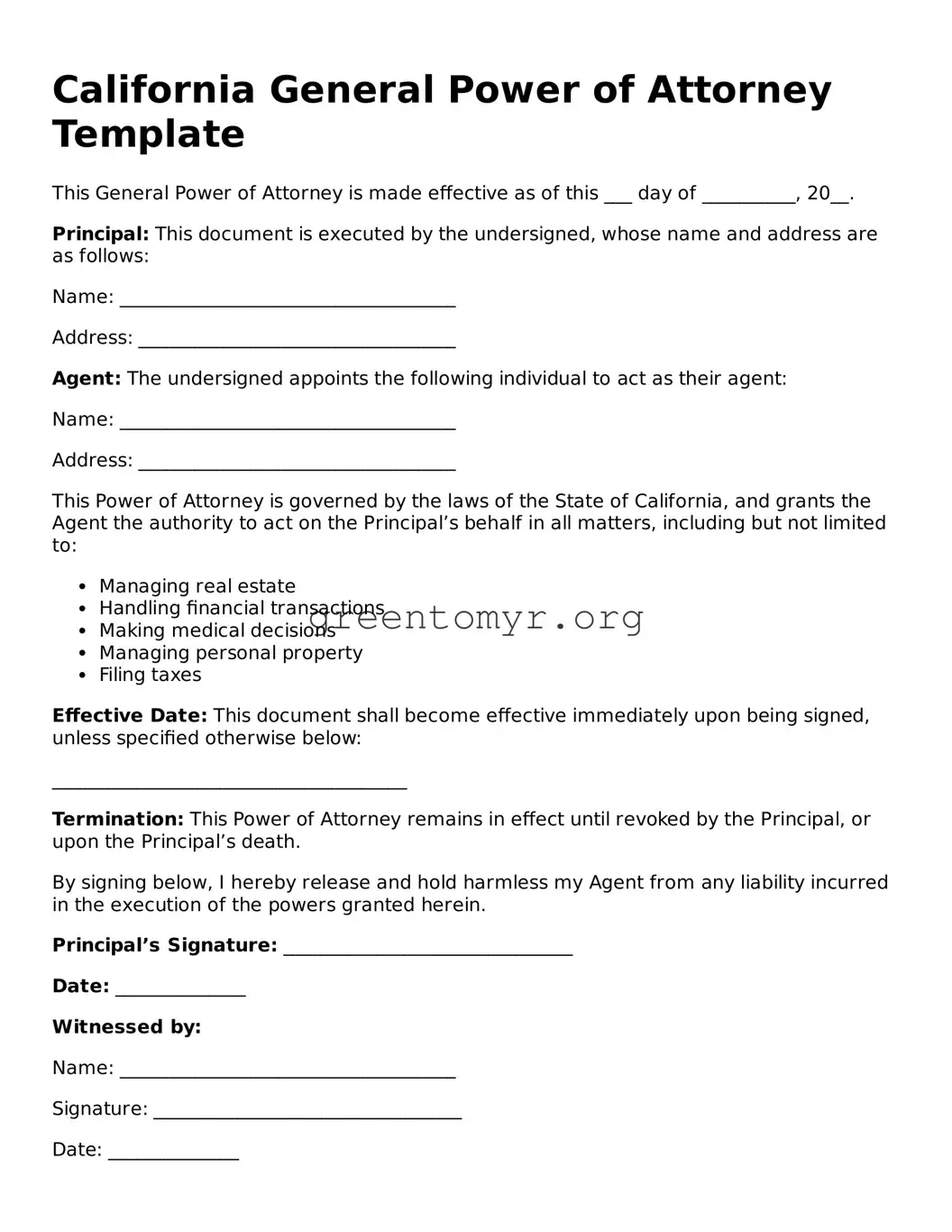

California General Power of Attorney Template

This General Power of Attorney is made effective as of this ___ day of __________, 20__.

Principal: This document is executed by the undersigned, whose name and address are as follows:

Name: ____________________________________

Address: __________________________________

Agent: The undersigned appoints the following individual to act as their agent:

Name: ____________________________________

Address: __________________________________

This Power of Attorney is governed by the laws of the State of California, and grants the Agent the authority to act on the Principal’s behalf in all matters, including but not limited to:

- Managing real estate

- Handling financial transactions

- Making medical decisions

- Managing personal property

- Filing taxes

Effective Date: This document shall become effective immediately upon being signed, unless specified otherwise below:

______________________________________

Termination: This Power of Attorney remains in effect until revoked by the Principal, or upon the Principal’s death.

By signing below, I hereby release and hold harmless my Agent from any liability incurred in the execution of the powers granted herein.

Principal’s Signature: _______________________________

Date: ______________

Witnessed by:

Name: ____________________________________

Signature: _________________________________

Date: ______________

Notarization:

State of California

County of _________________________________

On this ___ day of __________, 20__, before me, __________________________________, a Notary Public in and for said State, personally appeared ______________________________, known to me to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same.

Witness my hand and official seal.

Signature: _________________________________

My Commission Expires: ______________