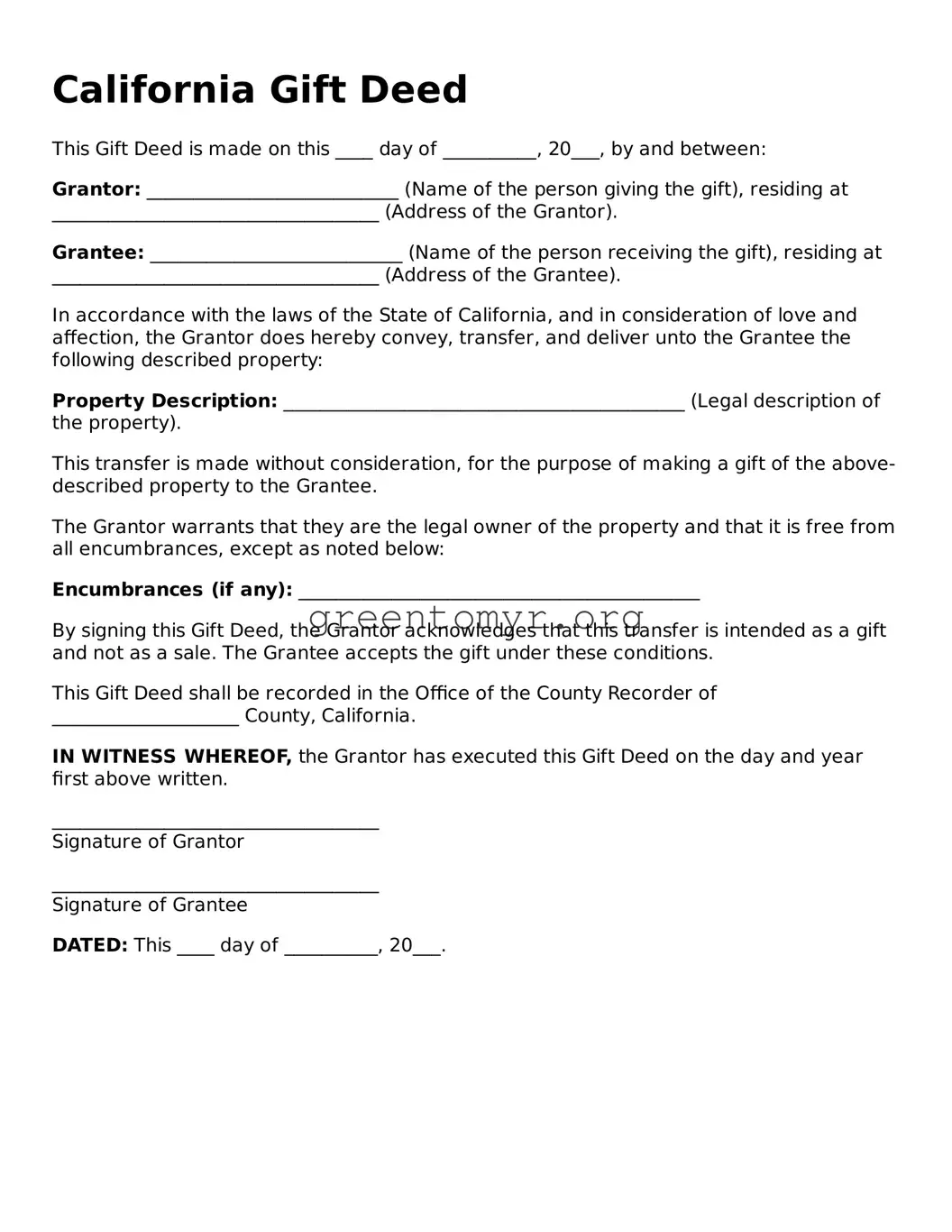

California Gift Deed

This Gift Deed is made on this ____ day of __________, 20___, by and between:

Grantor: ___________________________ (Name of the person giving the gift), residing at ___________________________________ (Address of the Grantor).

Grantee: ___________________________ (Name of the person receiving the gift), residing at ___________________________________ (Address of the Grantee).

In accordance with the laws of the State of California, and in consideration of love and affection, the Grantor does hereby convey, transfer, and deliver unto the Grantee the following described property:

Property Description: ___________________________________________ (Legal description of the property).

This transfer is made without consideration, for the purpose of making a gift of the above-described property to the Grantee.

The Grantor warrants that they are the legal owner of the property and that it is free from all encumbrances, except as noted below:

Encumbrances (if any): ___________________________________________

By signing this Gift Deed, the Grantor acknowledges that this transfer is intended as a gift and not as a sale. The Grantee accepts the gift under these conditions.

This Gift Deed shall be recorded in the Office of the County Recorder of ____________________ County, California.

IN WITNESS WHEREOF, the Grantor has executed this Gift Deed on the day and year first above written.

___________________________________

Signature of Grantor

___________________________________

Signature of Grantee

DATED: This ____ day of __________, 20___.