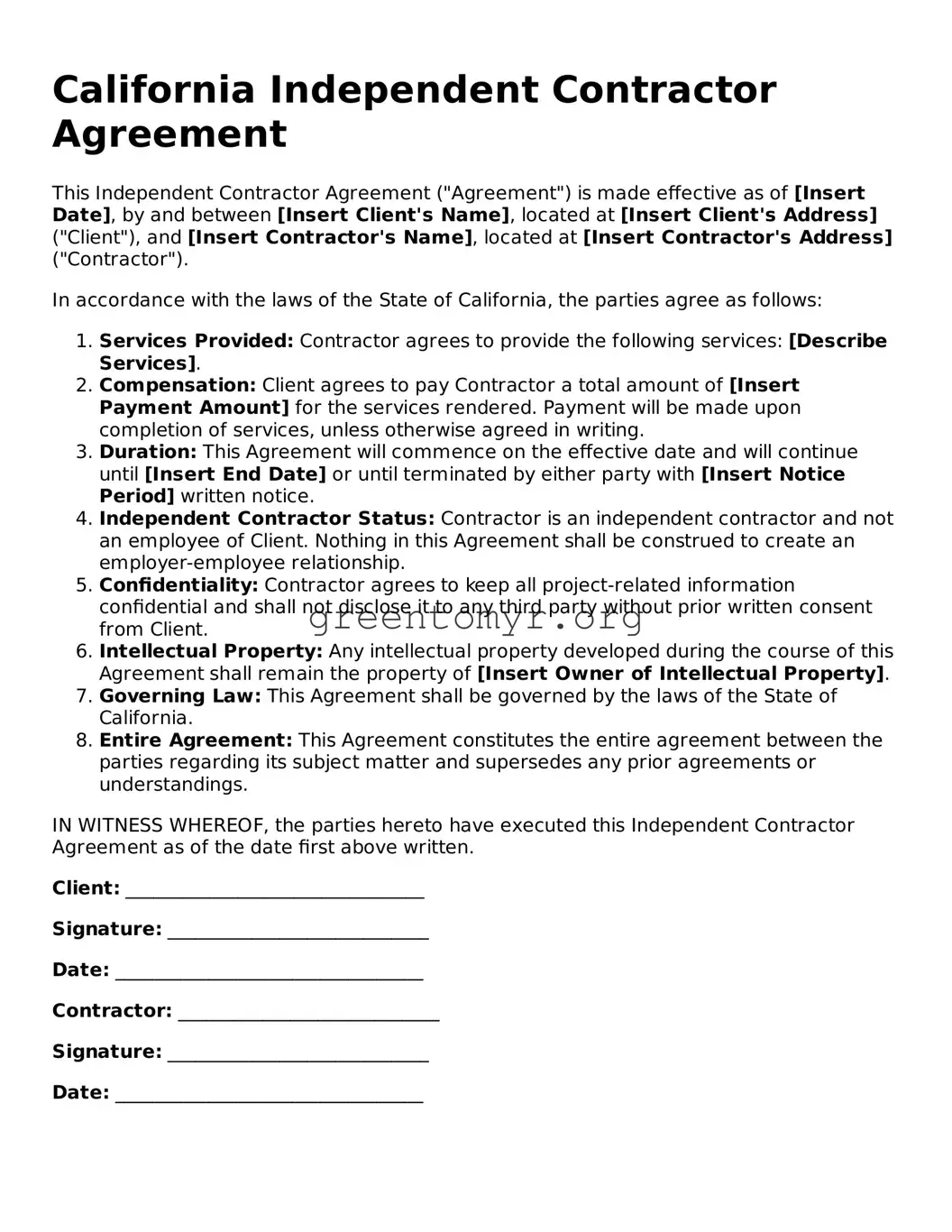

California Independent Contractor Agreement

This Independent Contractor Agreement ("Agreement") is made effective as of [Insert Date], by and between [Insert Client's Name], located at [Insert Client's Address] ("Client"), and [Insert Contractor's Name], located at [Insert Contractor's Address] ("Contractor").

In accordance with the laws of the State of California, the parties agree as follows:

- Services Provided: Contractor agrees to provide the following services: [Describe Services].

- Compensation: Client agrees to pay Contractor a total amount of [Insert Payment Amount] for the services rendered. Payment will be made upon completion of services, unless otherwise agreed in writing.

- Duration: This Agreement will commence on the effective date and will continue until [Insert End Date] or until terminated by either party with [Insert Notice Period] written notice.

- Independent Contractor Status: Contractor is an independent contractor and not an employee of Client. Nothing in this Agreement shall be construed to create an employer-employee relationship.

- Confidentiality: Contractor agrees to keep all project-related information confidential and shall not disclose it to any third party without prior written consent from Client.

- Intellectual Property: Any intellectual property developed during the course of this Agreement shall remain the property of [Insert Owner of Intellectual Property].

- Governing Law: This Agreement shall be governed by the laws of the State of California.

- Entire Agreement: This Agreement constitutes the entire agreement between the parties regarding its subject matter and supersedes any prior agreements or understandings.

IN WITNESS WHEREOF, the parties hereto have executed this Independent Contractor Agreement as of the date first above written.

Client: ________________________________

Signature: ____________________________

Date: _________________________________

Contractor: ____________________________

Signature: ____________________________

Date: _________________________________