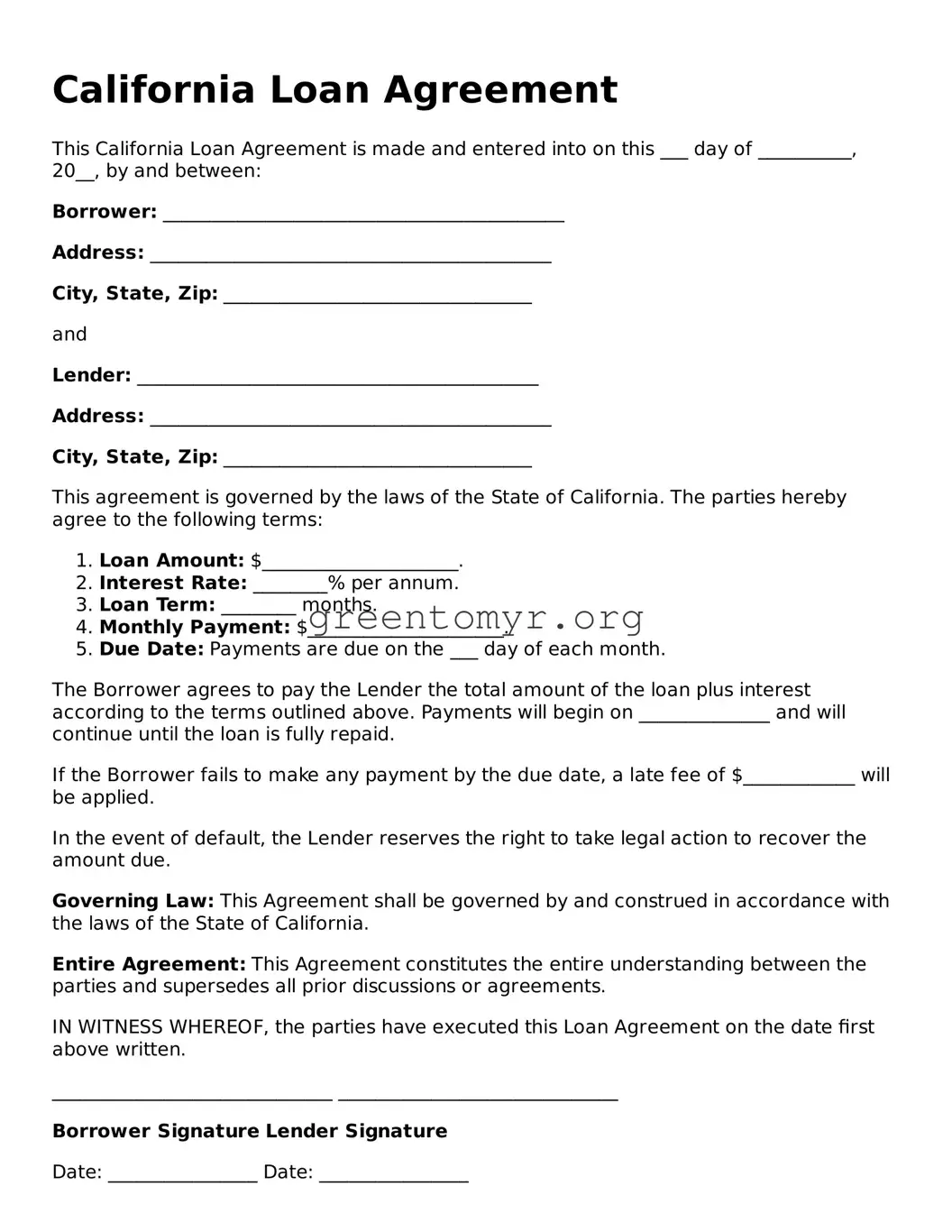

California Loan Agreement

This California Loan Agreement is made and entered into on this ___ day of __________, 20__, by and between:

Borrower: ___________________________________________

Address: ___________________________________________

City, State, Zip: _________________________________

and

Lender: ___________________________________________

Address: ___________________________________________

City, State, Zip: _________________________________

This agreement is governed by the laws of the State of California. The parties hereby agree to the following terms:

- Loan Amount: $_____________________.

- Interest Rate: ________% per annum.

- Loan Term: ________ months.

- Monthly Payment: $_____________________.

- Due Date: Payments are due on the ___ day of each month.

The Borrower agrees to pay the Lender the total amount of the loan plus interest according to the terms outlined above. Payments will begin on ______________ and will continue until the loan is fully repaid.

If the Borrower fails to make any payment by the due date, a late fee of $____________ will be applied.

In the event of default, the Lender reserves the right to take legal action to recover the amount due.

Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of California.

Entire Agreement: This Agreement constitutes the entire understanding between the parties and supersedes all prior discussions or agreements.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement on the date first above written.

______________________________ ______________________________

Borrower Signature Lender Signature

Date: ________________ Date: ________________