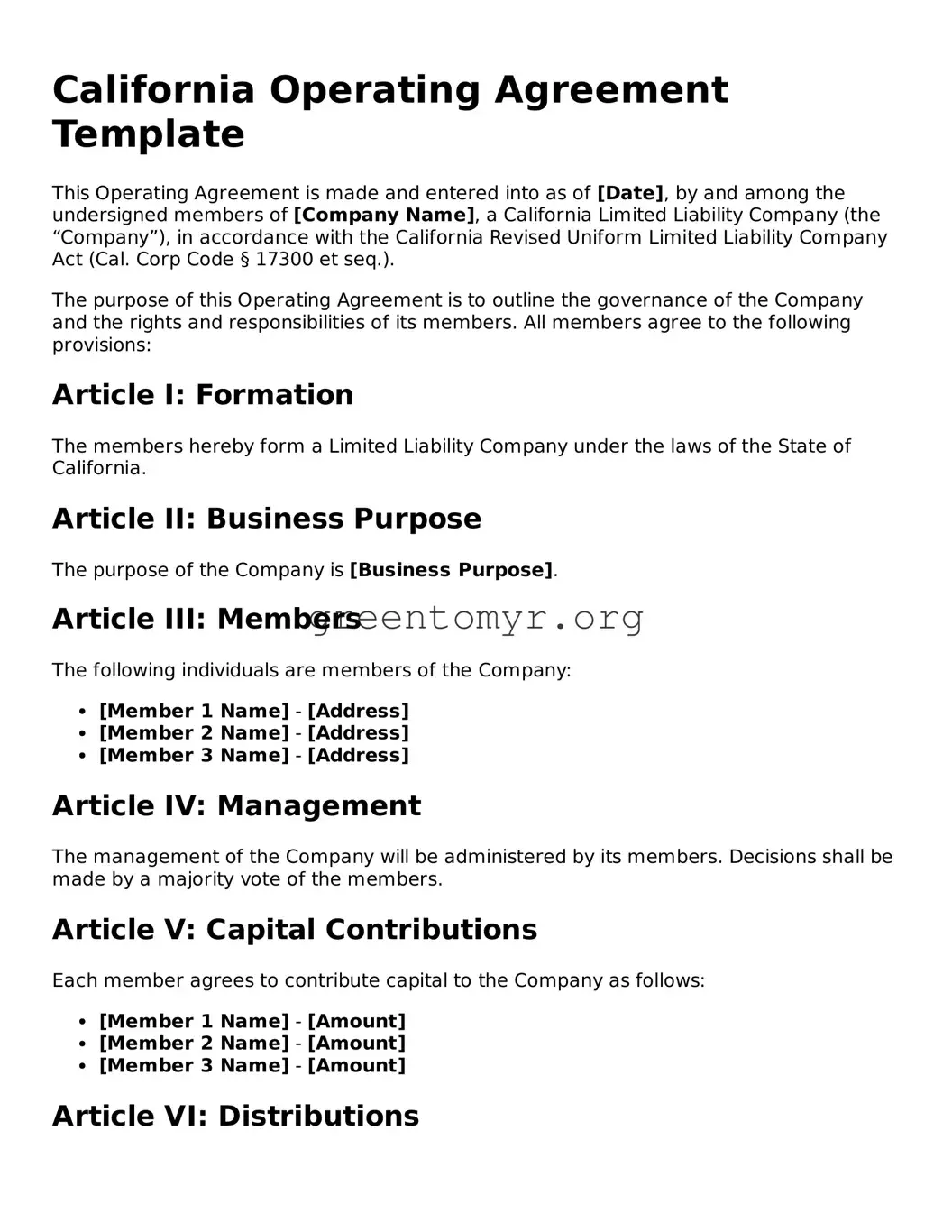

California Operating Agreement Template

This Operating Agreement is made and entered into as of [Date], by and among the undersigned members of [Company Name], a California Limited Liability Company (the “Company”), in accordance with the California Revised Uniform Limited Liability Company Act (Cal. Corp Code § 17300 et seq.).

The purpose of this Operating Agreement is to outline the governance of the Company and the rights and responsibilities of its members. All members agree to the following provisions:

Article I: Formation

The members hereby form a Limited Liability Company under the laws of the State of California.

Article II: Business Purpose

The purpose of the Company is [Business Purpose].

Article III: Members

The following individuals are members of the Company:

- [Member 1 Name] - [Address]

- [Member 2 Name] - [Address]

- [Member 3 Name] - [Address]

Article IV: Management

The management of the Company will be administered by its members. Decisions shall be made by a majority vote of the members.

Article V: Capital Contributions

Each member agrees to contribute capital to the Company as follows:

- [Member 1 Name] - [Amount]

- [Member 2 Name] - [Amount]

- [Member 3 Name] - [Amount]

Article VI: Distributions

Distributions will be made to the members as determined by the laws of the State of California, in accordance with the members' respective percentage interests in the Company.

Article VII: Withdrawal or Addition of Members

No member may withdraw from the Company without the prior written consent of all remaining members. New members may be admitted with the consent of all existing members.

Article VIII: Indemnification

The Company shall indemnify any member or manager against any loss or liability incurred in connection with the Company, except in instances of fraud or willful misconduct.

Article IX: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of California.

IN WITNESS WHEREOF

The undersigned members have executed this Operating Agreement as of the date first above written.

- [Member 1 Signature]

- [Member 2 Signature]

- [Member 3 Signature]

Each member acknowledges having received a copy of the Operating Agreement.