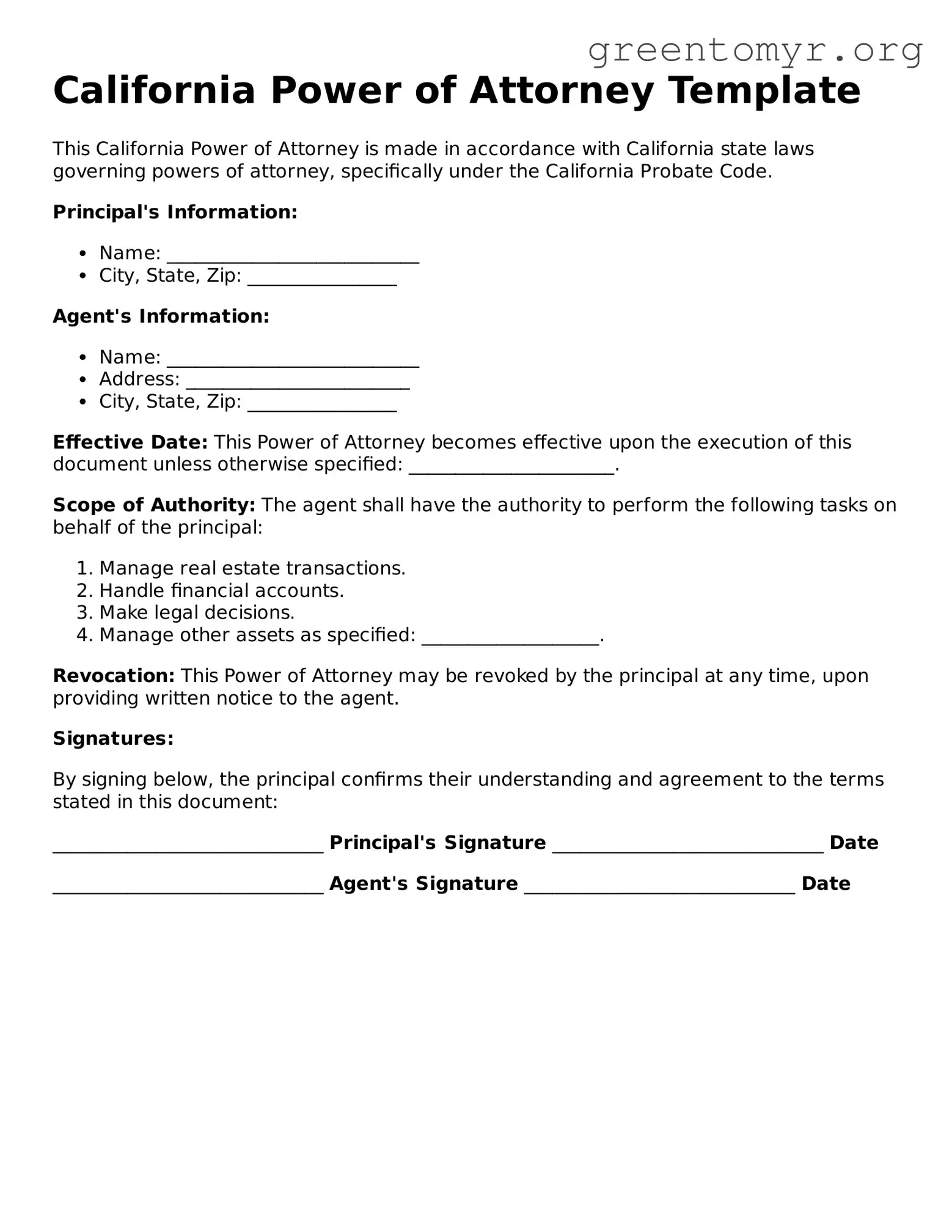

California Power of Attorney Template

This California Power of Attorney is made in accordance with California state laws governing powers of attorney, specifically under the California Probate Code.

Principal's Information:

- Name: ___________________________

- City, State, Zip: ________________

Agent's Information:

- Name: ___________________________

- Address: ________________________

- City, State, Zip: ________________

Effective Date: This Power of Attorney becomes effective upon the execution of this document unless otherwise specified: ______________________.

Scope of Authority: The agent shall have the authority to perform the following tasks on behalf of the principal:

- Manage real estate transactions.

- Handle financial accounts.

- Make legal decisions.

- Manage other assets as specified: ___________________.

Revocation: This Power of Attorney may be revoked by the principal at any time, upon providing written notice to the agent.

Signatures:

By signing below, the principal confirms their understanding and agreement to the terms stated in this document:

_____________________________ Principal's Signature _____________________________ Date

_____________________________ Agent's Signature _____________________________ Date