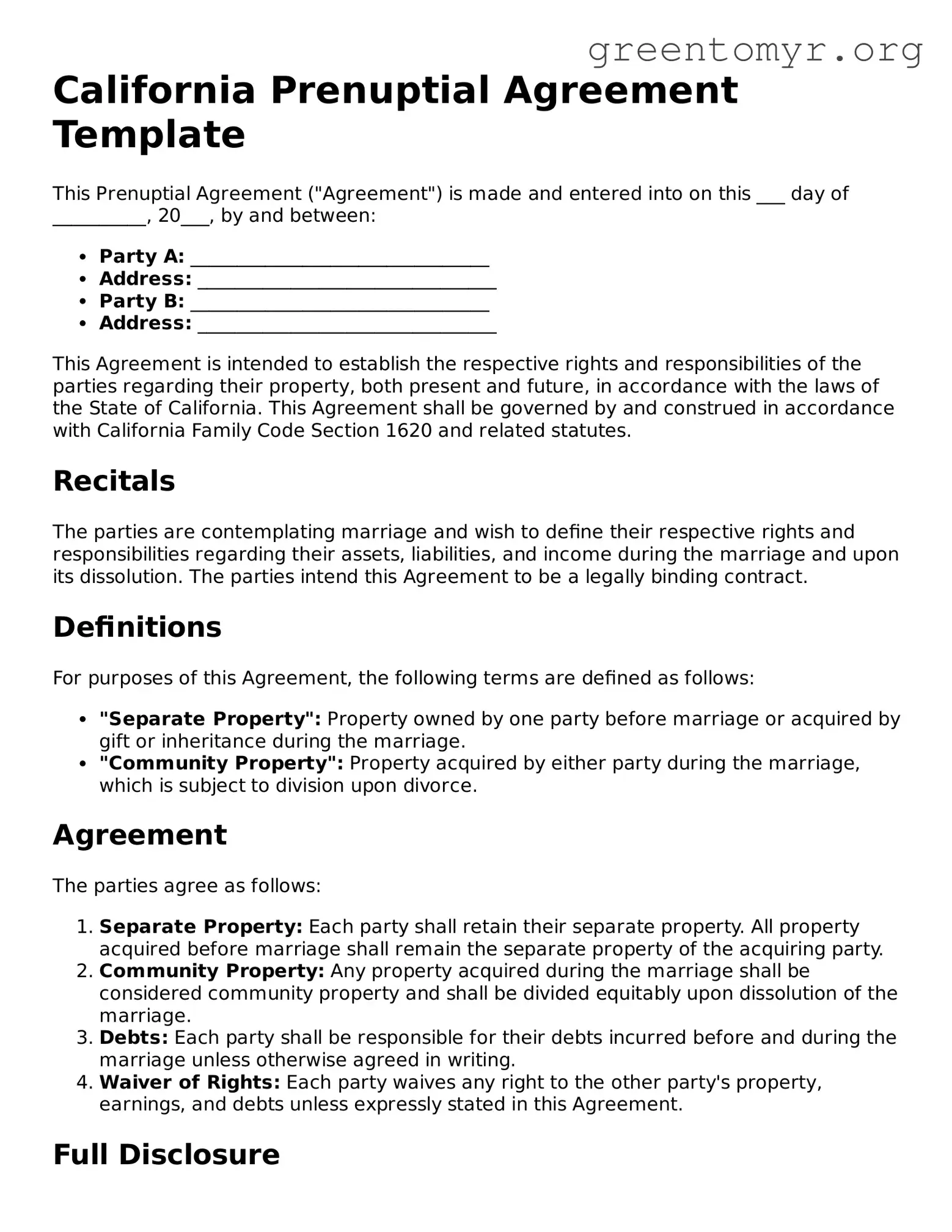

California Prenuptial Agreement Template

This Prenuptial Agreement ("Agreement") is made and entered into on this ___ day of __________, 20___, by and between:

- Party A: ________________________________

- Address: ________________________________

- Party B: ________________________________

- Address: ________________________________

This Agreement is intended to establish the respective rights and responsibilities of the parties regarding their property, both present and future, in accordance with the laws of the State of California. This Agreement shall be governed by and construed in accordance with California Family Code Section 1620 and related statutes.

Recitals

The parties are contemplating marriage and wish to define their respective rights and responsibilities regarding their assets, liabilities, and income during the marriage and upon its dissolution. The parties intend this Agreement to be a legally binding contract.

Definitions

For purposes of this Agreement, the following terms are defined as follows:

- "Separate Property": Property owned by one party before marriage or acquired by gift or inheritance during the marriage.

- "Community Property": Property acquired by either party during the marriage, which is subject to division upon divorce.

Agreement

The parties agree as follows:

- Separate Property: Each party shall retain their separate property. All property acquired before marriage shall remain the separate property of the acquiring party.

- Community Property: Any property acquired during the marriage shall be considered community property and shall be divided equitably upon dissolution of the marriage.

- Debts: Each party shall be responsible for their debts incurred before and during the marriage unless otherwise agreed in writing.

- Waiver of Rights: Each party waives any right to the other party's property, earnings, and debts unless expressly stated in this Agreement.

Full Disclosure

Each party acknowledges that they have provided full disclosure of their assets, liabilities, and financial circumstances as of the date of this Agreement.

Governing Law

This Agreement shall be governed by the laws of the State of California.

Severability

If any provision of this Agreement is held to be invalid or unenforceable, the remaining provisions shall continue to be valid and enforceable.

Entire Agreement

This Agreement constitutes the entire understanding between the parties and supersedes all prior agreements, understandings, and negotiations, whether written or oral.

Signatures

IN WITNESS WHEREOF, the parties hereby execute this Agreement as of the day and year first above written.

Party A Signature: ________________________________ Date: ________________

Party B Signature: ________________________________ Date: ________________

Witness Signature: ________________________________ Date: ________________