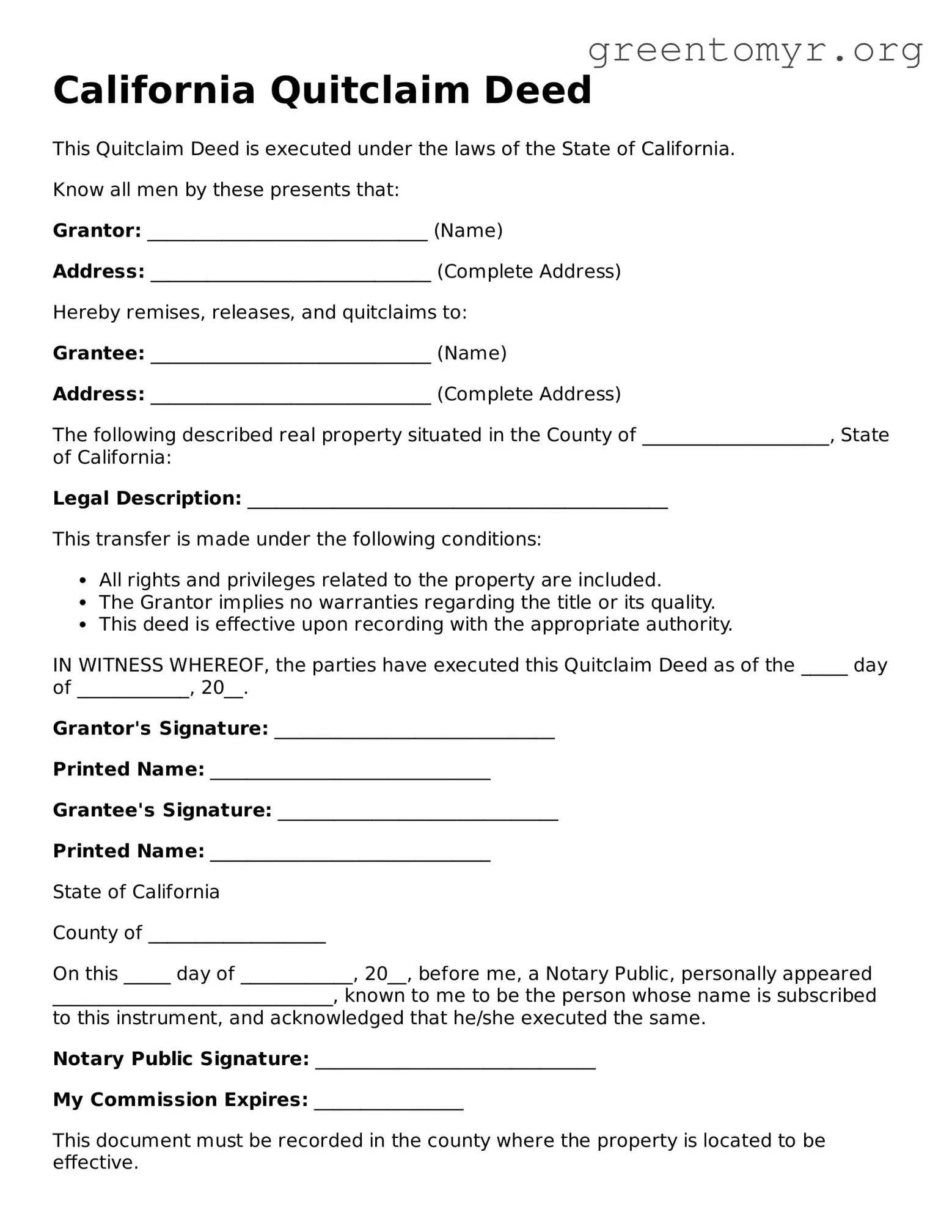

California Quitclaim Deed

This Quitclaim Deed is executed under the laws of the State of California.

Know all men by these presents that:

Grantor: ______________________________ (Name)

Address: ______________________________ (Complete Address)

Hereby remises, releases, and quitclaims to:

Grantee: ______________________________ (Name)

Address: ______________________________ (Complete Address)

The following described real property situated in the County of ____________________, State of California:

Legal Description: _____________________________________________

This transfer is made under the following conditions:

- All rights and privileges related to the property are included.

- The Grantor implies no warranties regarding the title or its quality.

- This deed is effective upon recording with the appropriate authority.

IN WITNESS WHEREOF, the parties have executed this Quitclaim Deed as of the _____ day of ____________, 20__.

Grantor's Signature: ______________________________

Printed Name: ______________________________

Grantee's Signature: ______________________________

Printed Name: ______________________________

State of California

County of ___________________

On this _____ day of ____________, 20__, before me, a Notary Public, personally appeared ______________________________, known to me to be the person whose name is subscribed to this instrument, and acknowledged that he/she executed the same.

Notary Public Signature: ______________________________

My Commission Expires: ________________

This document must be recorded in the county where the property is located to be effective.