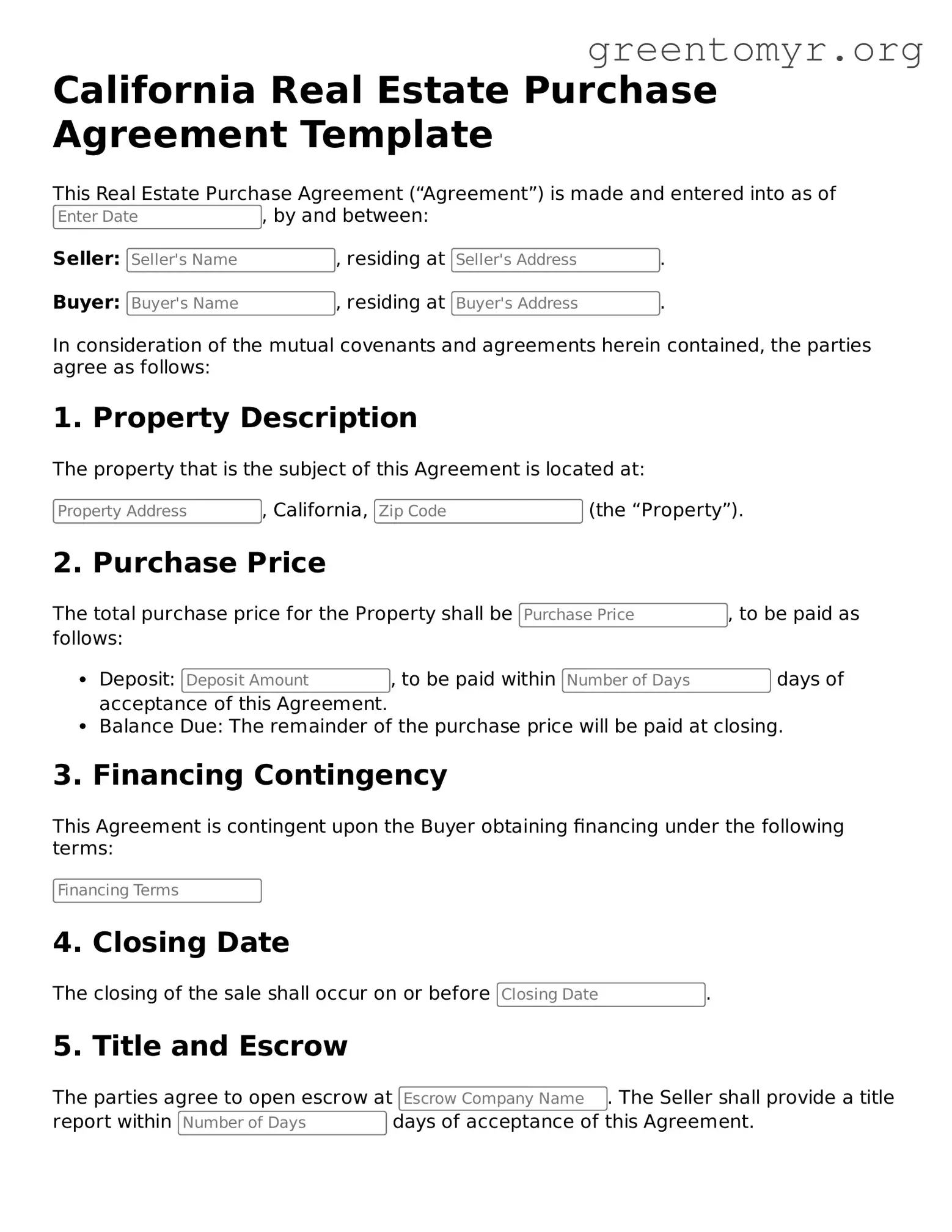

Real Estate Purchase Agreement Form for the State of California

The California Real Estate Purchase Agreement form is a legal document used to outline the terms and conditions of a real estate transaction in California. This form provides clarity to both buyers and sellers, specifying essential details such as price, financing, and responsibilities. Understanding this agreement is crucial for a smooth property transfer, so take the next step by filling out the form below.