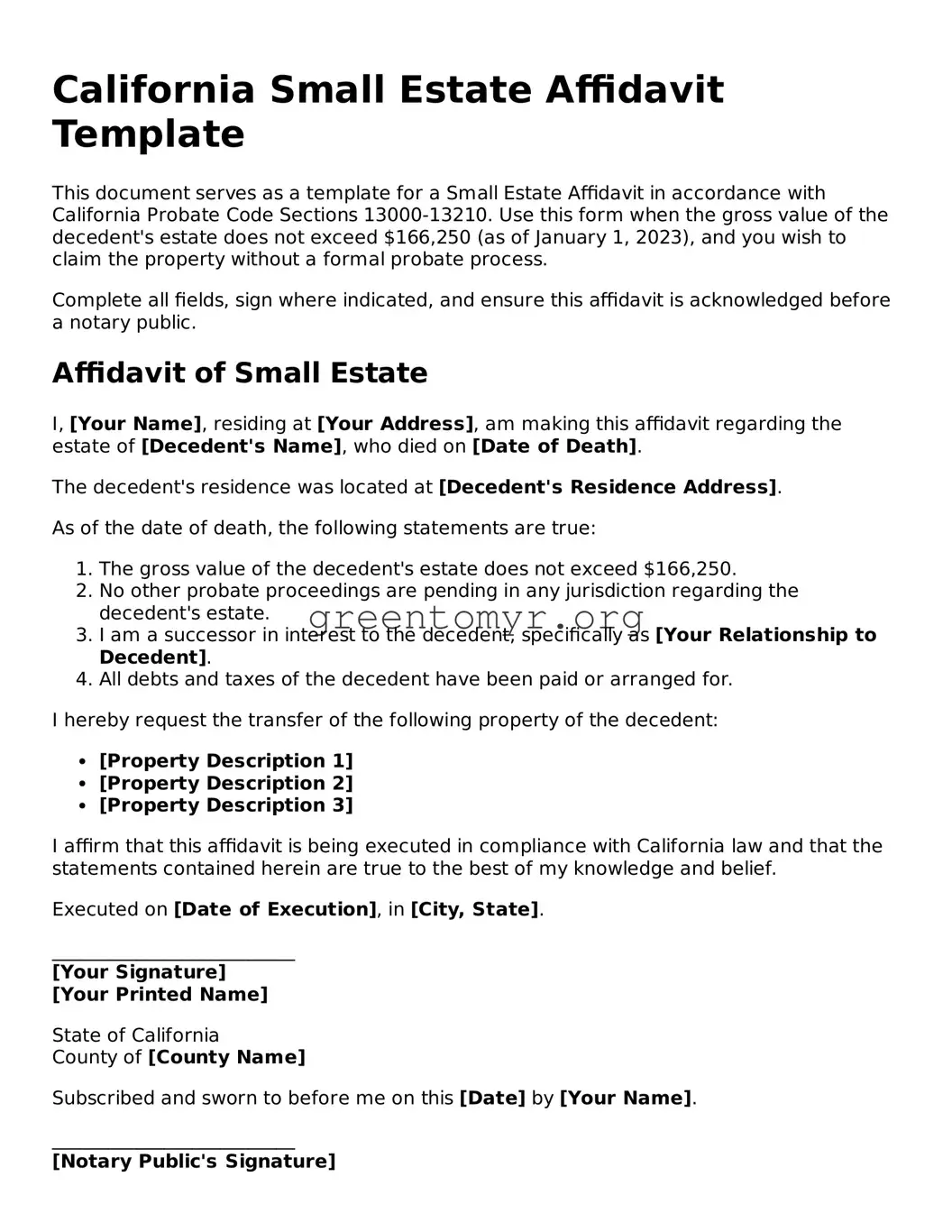

California Small Estate Affidavit Template

This document serves as a template for a Small Estate Affidavit in accordance with California Probate Code Sections 13000-13210. Use this form when the gross value of the decedent's estate does not exceed $166,250 (as of January 1, 2023), and you wish to claim the property without a formal probate process.

Complete all fields, sign where indicated, and ensure this affidavit is acknowledged before a notary public.

Affidavit of Small Estate

I, [Your Name], residing at [Your Address], am making this affidavit regarding the estate of [Decedent's Name], who died on [Date of Death].

The decedent's residence was located at [Decedent's Residence Address].

As of the date of death, the following statements are true:

- The gross value of the decedent's estate does not exceed $166,250.

- No other probate proceedings are pending in any jurisdiction regarding the decedent's estate.

- I am a successor in interest to the decedent, specifically as [Your Relationship to Decedent].

- All debts and taxes of the decedent have been paid or arranged for.

I hereby request the transfer of the following property of the decedent:

- [Property Description 1]

- [Property Description 2]

- [Property Description 3]

I affirm that this affidavit is being executed in compliance with California law and that the statements contained herein are true to the best of my knowledge and belief.

Executed on [Date of Execution], in [City, State].

__________________________

[Your Signature]

[Your Printed Name]

State of California

County of [County Name]

Subscribed and sworn to before me on this [Date] by [Your Name].

__________________________

[Notary Public's Signature]

Notary Public in and for said State.