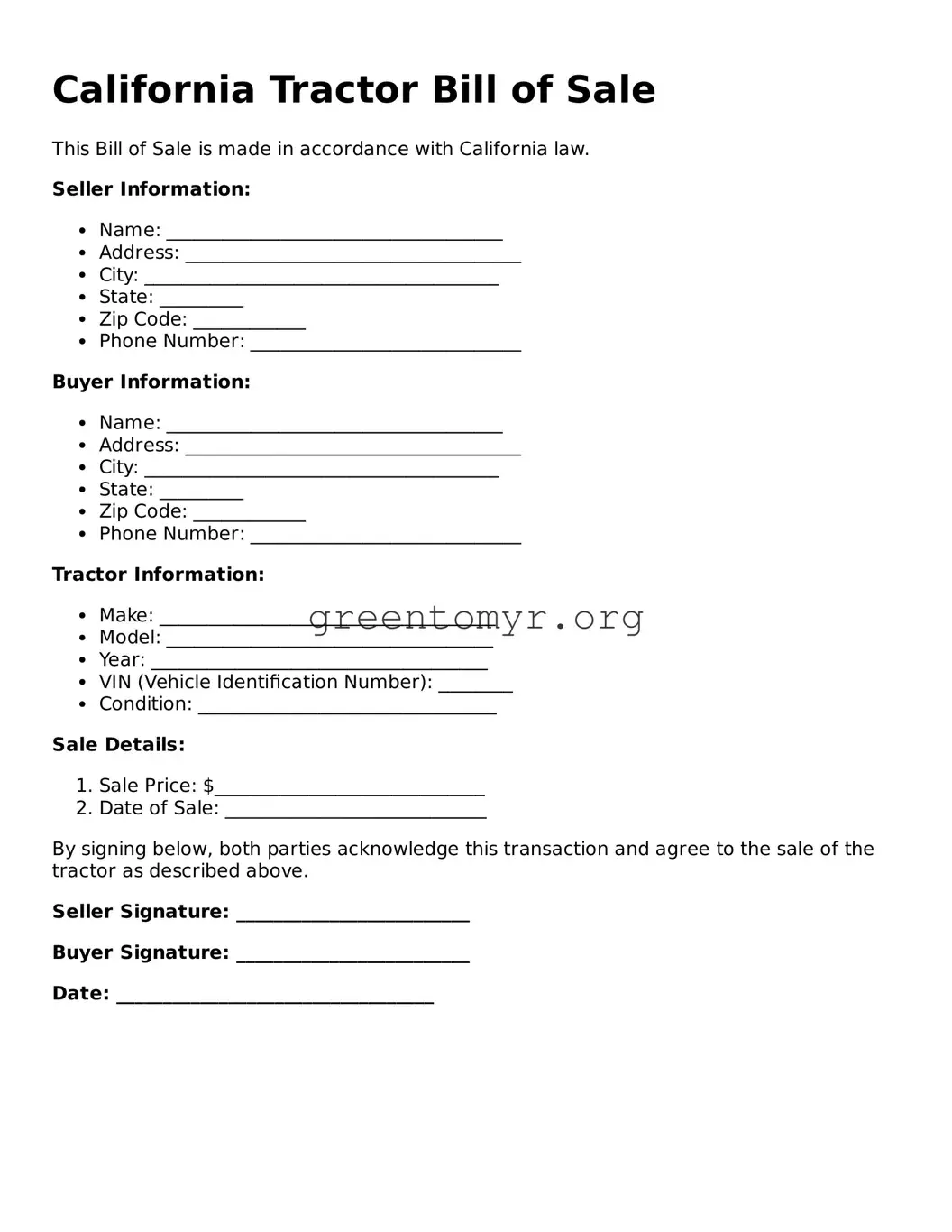

California Tractor Bill of Sale

This Bill of Sale is made in accordance with California law.

Seller Information:

- Name: ____________________________________

- Address: ____________________________________

- City: ______________________________________

- State: _________

- Zip Code: ____________

- Phone Number: _____________________________

Buyer Information:

- Name: ____________________________________

- Address: ____________________________________

- City: ______________________________________

- State: _________

- Zip Code: ____________

- Phone Number: _____________________________

Tractor Information:

- Make: ____________________________________

- Model: ___________________________________

- Year: ____________________________________

- VIN (Vehicle Identification Number): ________

- Condition: ________________________________

Sale Details:

- Sale Price: $_____________________________

- Date of Sale: ____________________________

By signing below, both parties acknowledge this transaction and agree to the sale of the tractor as described above.

Seller Signature: _________________________

Buyer Signature: _________________________

Date: __________________________________