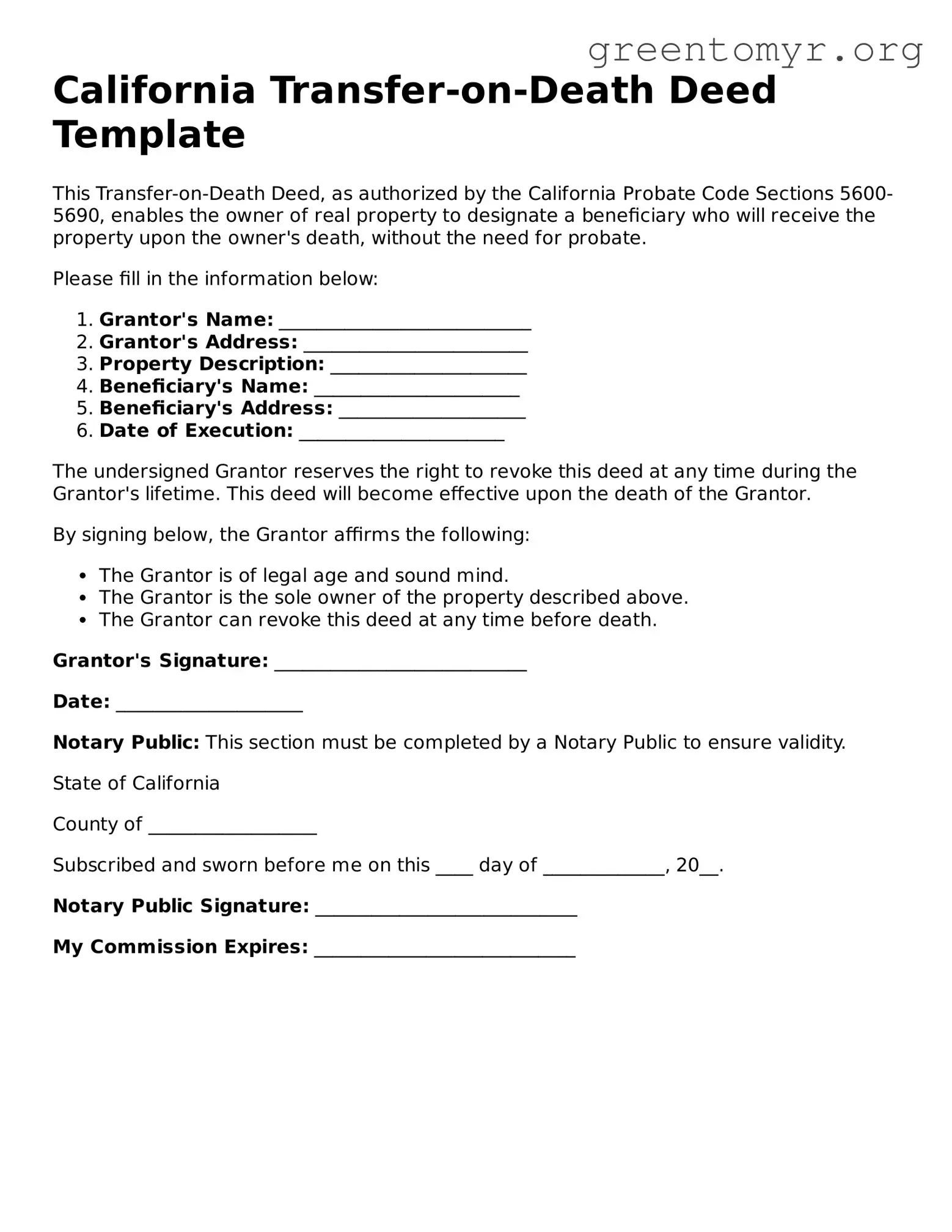

California Transfer-on-Death Deed Template

This Transfer-on-Death Deed, as authorized by the California Probate Code Sections 5600-5690, enables the owner of real property to designate a beneficiary who will receive the property upon the owner's death, without the need for probate.

Please fill in the information below:

- Grantor's Name: ___________________________

- Grantor's Address: ________________________

- Property Description: _____________________

- Beneficiary's Name: ______________________

- Beneficiary's Address: ____________________

- Date of Execution: ______________________

The undersigned Grantor reserves the right to revoke this deed at any time during the Grantor's lifetime. This deed will become effective upon the death of the Grantor.

By signing below, the Grantor affirms the following:

- The Grantor is of legal age and sound mind.

- The Grantor is the sole owner of the property described above.

- The Grantor can revoke this deed at any time before death.

Grantor's Signature: ___________________________

Date: ____________________

Notary Public: This section must be completed by a Notary Public to ensure validity.

State of California

County of __________________

Subscribed and sworn before me on this ____ day of _____________, 20__.

Notary Public Signature: ____________________________

My Commission Expires: ____________________________