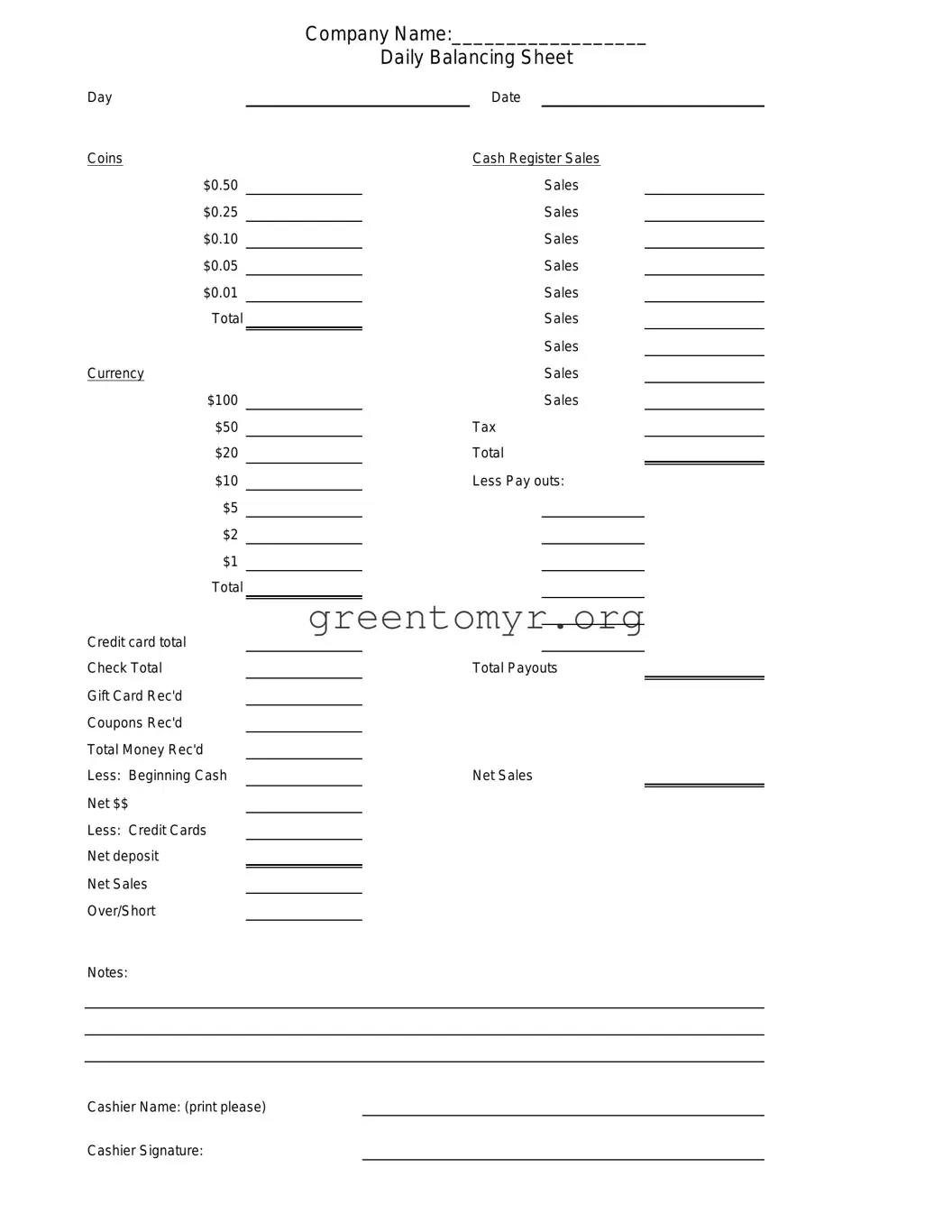

The Cash Drawer Count Sheet form plays a crucial role in managing financial transactions at various businesses, particularly in retail settings. It serves as a tool for tracking the amount of cash on hand at the beginning and end of a shift, ensuring that cashiers are accountable for their till balances. This simple yet effective form typically includes sections for recording the starting cash amount, any cash received during transactions, and the total cash expected at the end of a shift. By documenting discrepancies, the form aids in identifying potential errors or theft, fostering a culture of transparency and trust. Additionally, businesses often utilize this form to reconcile cash sales with total receipts, making it easier to maintain accurate financial records. In a world where efficiency and accountability matter, the Cash Drawer Count Sheet becomes an indispensable resource for both employees and management alike.