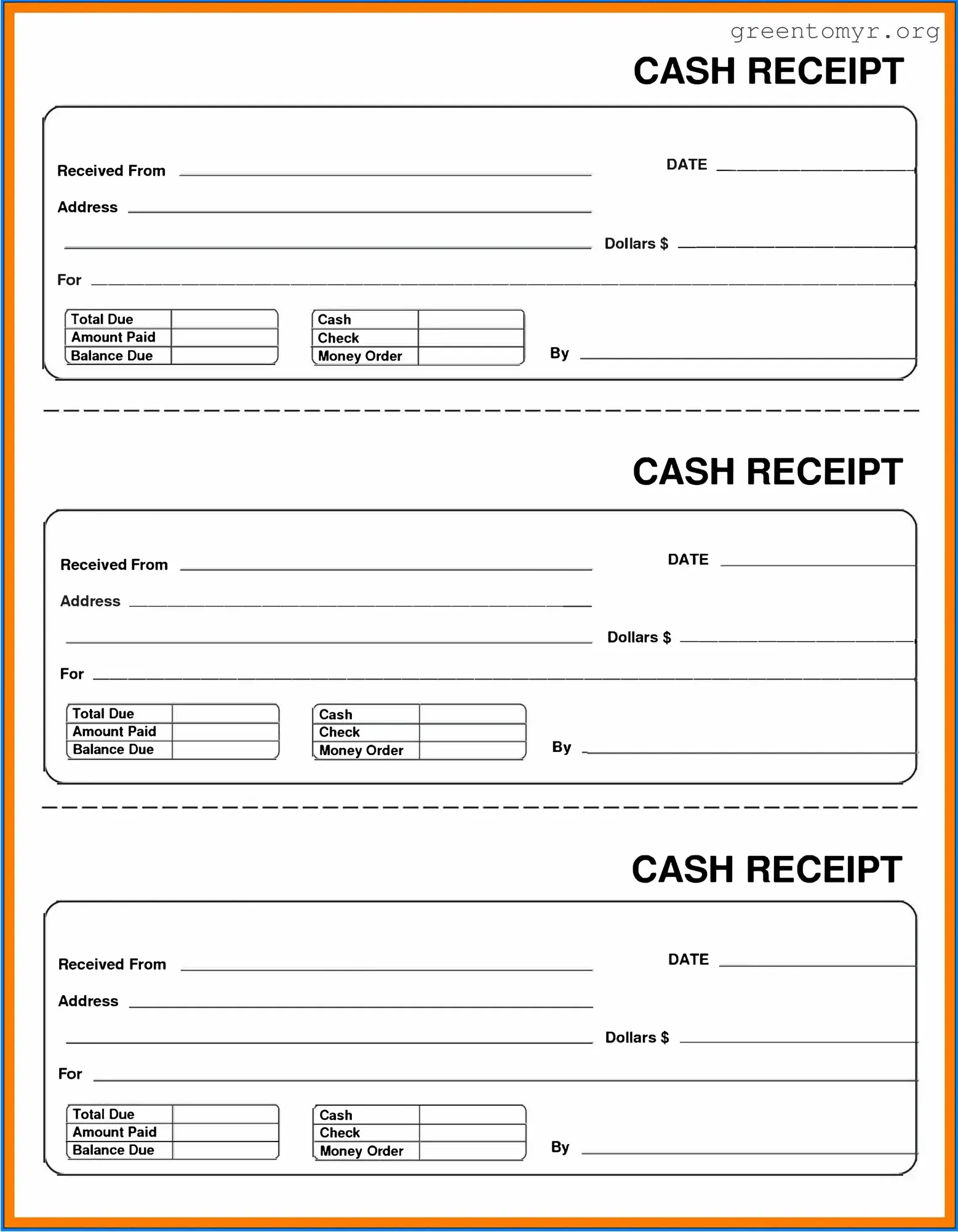

A Cash Receipt form is a document used to officially record cash transactions, such as payments received for services rendered or products sold. This form serves as proof of payment and is crucial for both the payer and the recipient. It ensures transparency and accountability in the handling of cash. Typically, it includes details like the date, amount received, payer's name, and the purpose of the payment.

You should use a Cash Receipt form anytime you receive cash. This includes instances like:

-

Payments from clients for services or products.

-

Cash donations or contributions to organizations.

-

Refunds for returned items that are paid in cash.

Utilizing the form helps ensure that every cash transaction is properly documented.

Several key details should be included on a Cash Receipt form to make it valid and useful. Commonly required information includes:

-

Date of the transaction

-

Name of the person or entity making the payment

-

Amount received

-

Description of what the payment is for

-

Method of payment (if applicable, to indicate whether it was cash, check, etc.)

-

Signature of the person issuing the receipt

By compiling this information, you create a clear record of the transaction.

Ensuring accuracy in your Cash Receipt form involves a few careful steps. First, double-check all figures to confirm they add up correctly. Next, ensure that the spelling of names and descriptions is correct. If you are dealing with multiple transactions, maintain a consistent format for clarity. Lastly, consider having a second person review the form for any overlooked errors.

Yes, you can absolutely use a handwritten Cash Receipt form as long as it contains all the necessary information. However, consider using printed forms for consistency and professionalism. Handwritten forms should be neat and legible to avoid misunderstandings, especially if they are to be referenced later.

Proper storage of Cash Receipt forms is important for both accountability and future reference. Here’s how to do it effectively:

-

Organize forms by date or transaction type.

-

Use folders or binders to keep them protected and easily accessible.

-

Consider digitizing receipts for backup and easier access.

Establishing a systematic storage method will help streamline your record-keeping process.