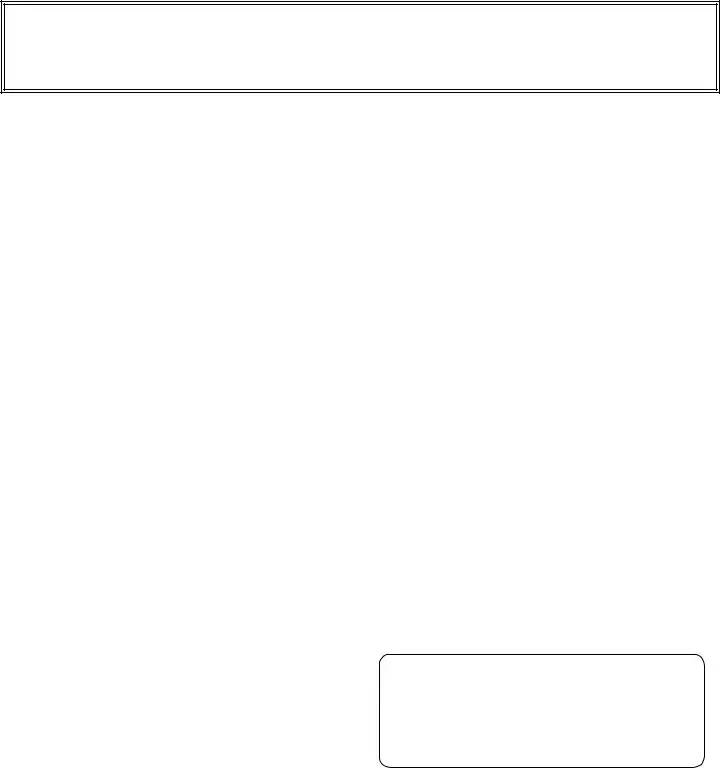

North CarolinaAnnual Report

for Business Corporations

NameofCorporation:

StateofIncorporation: |

FiscalYear Ending: |

SecretaryofStateCorp.IDNumber:

FederalEmployerIDNumber:

Check here if information has not changed since most recently filedAnnual Report, complete line 8 only.

1.Registeredagent®isteredofficemailingaddress |

Agent: |

2.Streetaddress&countyofregisteredoffice

Mailing Address:

Street Address:  County:

County:

3.Ifregisteredagentchanged,signatureofnewagent:

(signatureconstitutesconsenttoappointment)

4.Enterprincipalofficeaddresshere:

5.Enterprincipalofficetelephonenumberhere:

6.Entername,title,andbusinessaddressofprincipalofficershere:

Name: |

|

Title: |

Address: |

|

|

City: |

State: |

Zip: |

Name: |

|

Title: |

Address: |

|

|

City: |

State: |

Zip: |

Name: |

|

Title: |

Address: |

|

|

City: |

State: |

Zip: |

7.Brieflydescribethenatureofbusiness:

8.Certification of annual report, must be completed by all corporations

SIGNATURE:(Formmustbesignedbyofficerofcorporation) |

DATE: |

CheckListforNCAnnualReportforBusinessCorporations

(Instructions for the preparation of the Business Annual Report Form, CD - 479)

Thischecklistisincludedtoassistyouinpreparingtheannualreportforyourbusinesscorporation.Pleasetakeafew minutesandreadtheinformationprovided.

1.ThefollowinginformationmustbeprovidedbyeachcorporationfilinganAnnualReportwiththeNorthCarolina DepartmentofRevenue:

A.NameofCorporation

B.StateofIncorporation

C.SecretaryofStateCorp.IDNumber

D.FederalEmployerIDNumber

EffectiveJanuary1,1998andapplyingtotaxyearsendingonorafterDecember31,1997,allcorporationsauthorizedto transactbusinessinNorthCarolinaexceptforinsurancecompanies,limitedliabilitycompanies,nonprofitcorporations, andprofessionalassociationsmustfileaCorporateAnnualReportwiththeDepartmentofRevenueandremitatwenty dollar($20.00)fee.Ifthecorporationinformationrequiredtobeenteredinitem1throughitem7ofFormCD-479has notchangedsincethemostrecentlyfiledannualreport,checktheboxnearthetopoftheform.

2.Whenchangingtheregisteredagentortheregisteredofficemailingaddressinformation,indicatethechangein Item1.Theregisteredagentnamemustbetypedorprinted.TheregisteredofficemailingaddresscanbeaPost OfficeBox.

3.Ifthestreetaddressoftheregisteredofficechanged,indicatethechangeinitem2.Thestreetaddressofthe registeredofficemustbea“StreetAddress”andnota“PostOfficeBox”.

4.Iftheregisteredagenthaschanged,thenewregisteredagentmustsignconsenttotheappointmentinthespace provided.Iftheregisteredagent’snamewaschangedduetomarriage,orbyanyotherlegalmeans,the corporationmustindicatesuchchangeinthespaceprovidedandhavetheagentsignconsenttotheappointment undertheirnewname.

5.Theprincipalofficeaddressshouldrevealthecorporation’sphysicallocation.

6.EntertheprincipalofficetelephonenumberinItem5.

7.Everycorporationmusthaveatleastoneofficer.Ifonlyoneofficerislistedonthereport,itmustbethePresident. Enterthecompletename,title,andbusinessaddressoftheprincipalofficersinItem6.

8.ProvideabriefdescriptionofthenatureofyourbusinessinItem7.Eachcorporationmustprovideabrief descriptionofthenatureofbusinessbeforetheannualreportcanbefiled.

9.ChecktheAnnualReportcarefullytoensureallinformationrequiredforfilinghasbeenprovided.Completethe signature,date,andtypeand/orprintthenameandtitleinthespaceprovidedontheformtocertifythatthe informationisaccurateandcurrent.

For more information or assistance, |

|

please contact: |

NCAnnual Report for BC forms are available on the |

|

Internet at both the Secretary of State’s Web Site, and at |

Secretary of State |

the Department of Revenue’s Web Site: |

Corporations Division |

|

Post Office Box 29525 |

Secretary of State’s Office: www.state.nc.us/secstate |

Raleigh, NC 27626-0525 |

|

Phone (919)733-4201 |

Department of Revenue: www.dor.state.nc.us/DOR |

Toll Free 1-(888) 246-7636 |

|

County:

County: