Filling out the CF-1040PV form can be straightforward, but many make mistakes that can lead to delays or issues with their tax payments. Here are ten common errors to watch out for.

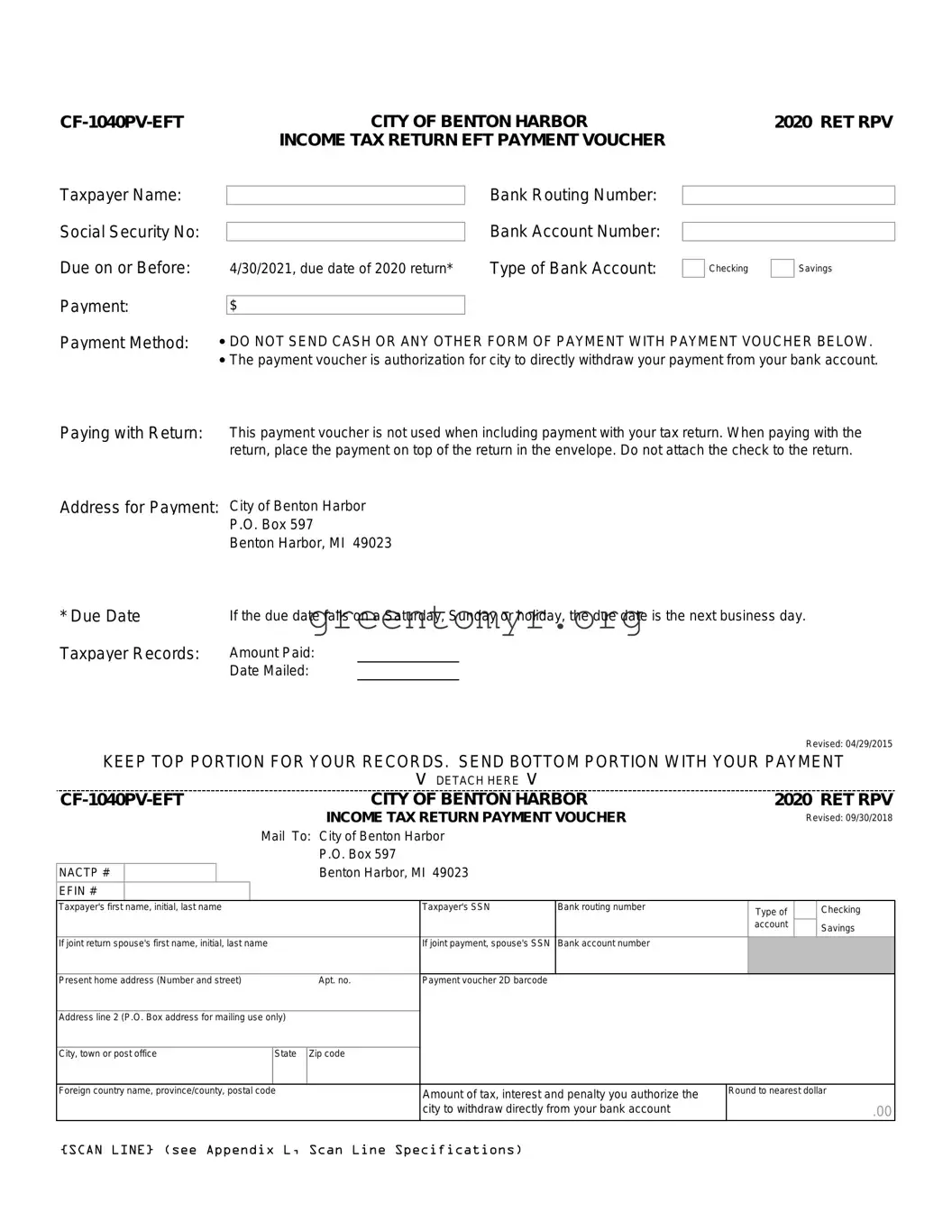

First, people often forget to provide their full name. Ensure you fill in your first name, middle initial, and last name exactly as they appear on your Social Security card. A missing name can lead to confusion and delays with your payment.

Another mistake involves the Social Security Number (SSN). Many individuals misplace or enter incorrect digits in this critical section. Double-check every number before submission, as errors can complicate your tax processing.

Inaccurate bank routing numbers are also a frequent problem. This number ensures that funds are withdrawn from the correct financial institution. A simple typo could result in payment processing errors that are hard to resolve.

Selecting the right type of bank account is crucial. Some fail to indicate whether their account is a checking or savings account. This information is necessary for the city to make a withdrawal; omitting it may cause your payment to be rejected.

Many forget to state the correct payment amount. People often miscalculate tax, interest, and penalties owed. Always round to the nearest dollar as instructed, or risk submitting the wrong figure.

It's also common to see individuals failing to assign the payment date correctly. Remember, the payment must be made by the due date, which can fall on a weekend or holiday, automatically extending it to the next business day.

An issue that can arise when a couple files jointly is forgetting to include the spouse's information. If your return is a joint filing, both names, Social Security numbers, and bank account details must be accurately filled in.

People sometimes neglect to keep a copy of the voucher for their records. Retaining this documentation will help you track your payment and provide proof if any questions arise later.

Lastly, always remember to detach the payment voucher properly before mailing. Submitting the entire document can lead to confusion about what payment has been authorized.

Being mindful of these common mistakes can ease your tax filing process and help ensure timely payment. A careful review can save you time and headaches down the line.