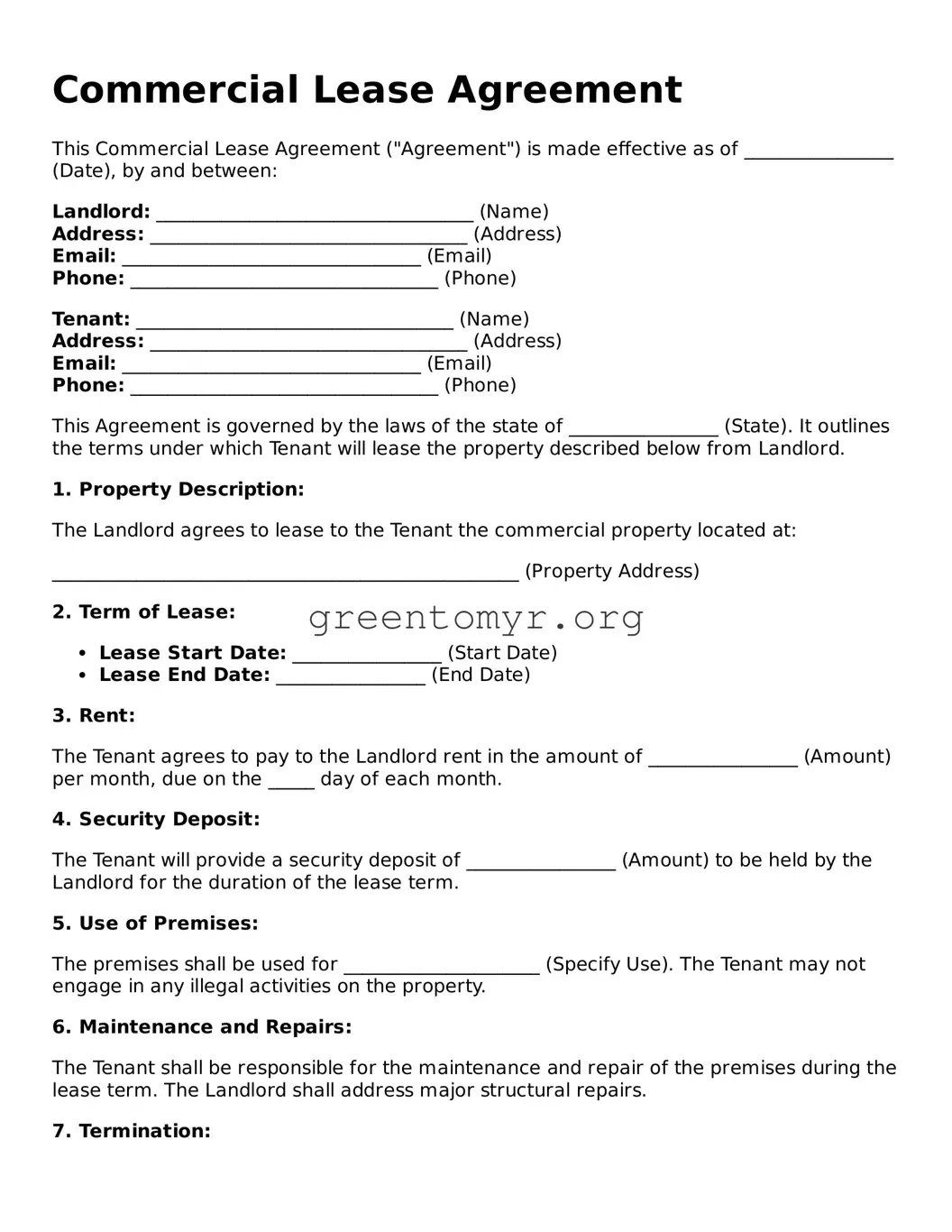

Commercial Lease Agreement

This Commercial Lease Agreement ("Agreement") is made effective as of ________________ (Date), by and between:

Landlord: __________________________________ (Name)

Address: __________________________________ (Address)

Email: ________________________________ (Email)

Phone: _________________________________ (Phone)

Tenant: __________________________________ (Name)

Address: __________________________________ (Address)

Email: ________________________________ (Email)

Phone: _________________________________ (Phone)

This Agreement is governed by the laws of the state of ________________ (State). It outlines the terms under which Tenant will lease the property described below from Landlord.

1. Property Description:

The Landlord agrees to lease to the Tenant the commercial property located at:

__________________________________________________ (Property Address)

2. Term of Lease:

- Lease Start Date: ________________ (Start Date)

- Lease End Date: ________________ (End Date)

3. Rent:

The Tenant agrees to pay to the Landlord rent in the amount of ________________ (Amount) per month, due on the _____ day of each month.

4. Security Deposit:

The Tenant will provide a security deposit of ________________ (Amount) to be held by the Landlord for the duration of the lease term.

5. Use of Premises:

The premises shall be used for _____________________ (Specify Use). The Tenant may not engage in any illegal activities on the property.

6. Maintenance and Repairs:

The Tenant shall be responsible for the maintenance and repair of the premises during the lease term. The Landlord shall address major structural repairs.

7. Termination:

This Agreement may be terminated prior to the Lease End Date under the following conditions:

- Mutual Agreement of both parties.

- Violation of Lease terms by Tenant after written notice.

8. Governing Law:

This Agreement shall be governed by the laws of the state of ________________ (State).

IN WITNESS WHEREOF, the parties hereto have executed this Commercial Lease Agreement as of the day and year first above written.

_____________________________

Landlord Signature

_____________________________

Tenant Signature