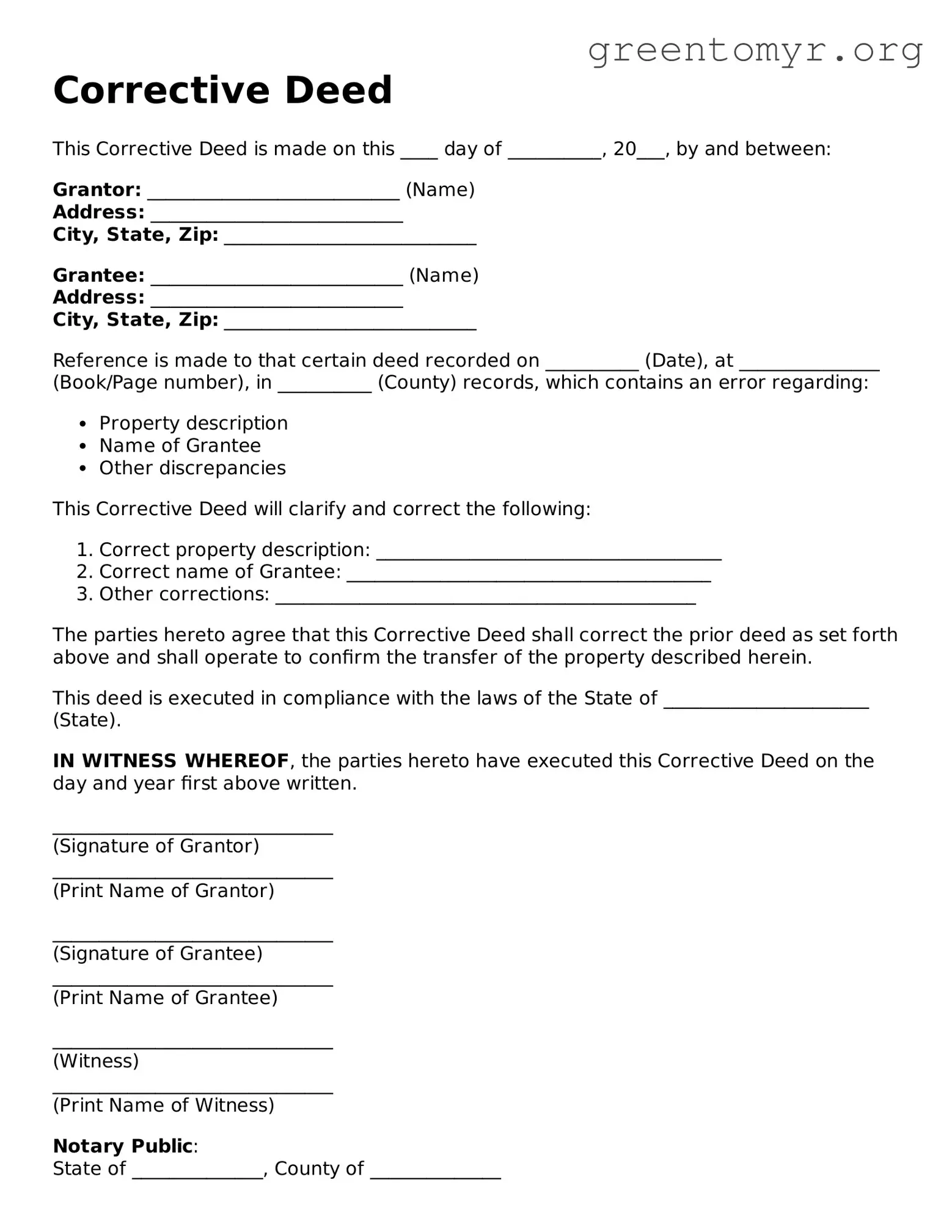

Corrective Deed

This Corrective Deed is made on this ____ day of __________, 20___, by and between:

Grantor: ___________________________ (Name)

Address: ___________________________

City, State, Zip: ___________________________

Grantee: ___________________________ (Name)

Address: ___________________________

City, State, Zip: ___________________________

Reference is made to that certain deed recorded on __________ (Date), at _______________ (Book/Page number), in __________ (County) records, which contains an error regarding:

- Property description

- Name of Grantee

- Other discrepancies

This Corrective Deed will clarify and correct the following:

- Correct property description: _____________________________________

- Correct name of Grantee: _______________________________________

- Other corrections: _____________________________________________

The parties hereto agree that this Corrective Deed shall correct the prior deed as set forth above and shall operate to confirm the transfer of the property described herein.

This deed is executed in compliance with the laws of the State of ______________________ (State).

IN WITNESS WHEREOF, the parties hereto have executed this Corrective Deed on the day and year first above written.

______________________________

(Signature of Grantor)

______________________________

(Print Name of Grantor)

______________________________

(Signature of Grantee)

______________________________

(Print Name of Grantee)

______________________________

(Witness)

______________________________

(Print Name of Witness)

Notary Public:

State of ______________, County of ______________

On this ____ day of __________, 20___, before me appeared _______________________ (Grantor's Name) and _______________________ (Grantee's Name), personally known to me or proven to me on the basis of satisfactory evidence to be the persons whose names are subscribed to the within instrument, and acknowledged to me that they executed the same in their authorized capacities, and that by their signatures on the instrument, the persons, or the entity upon behalf of which the persons acted, executed the instrument.

My Commission Expires: ______________________

______________________________

(Signature of Notary Public)