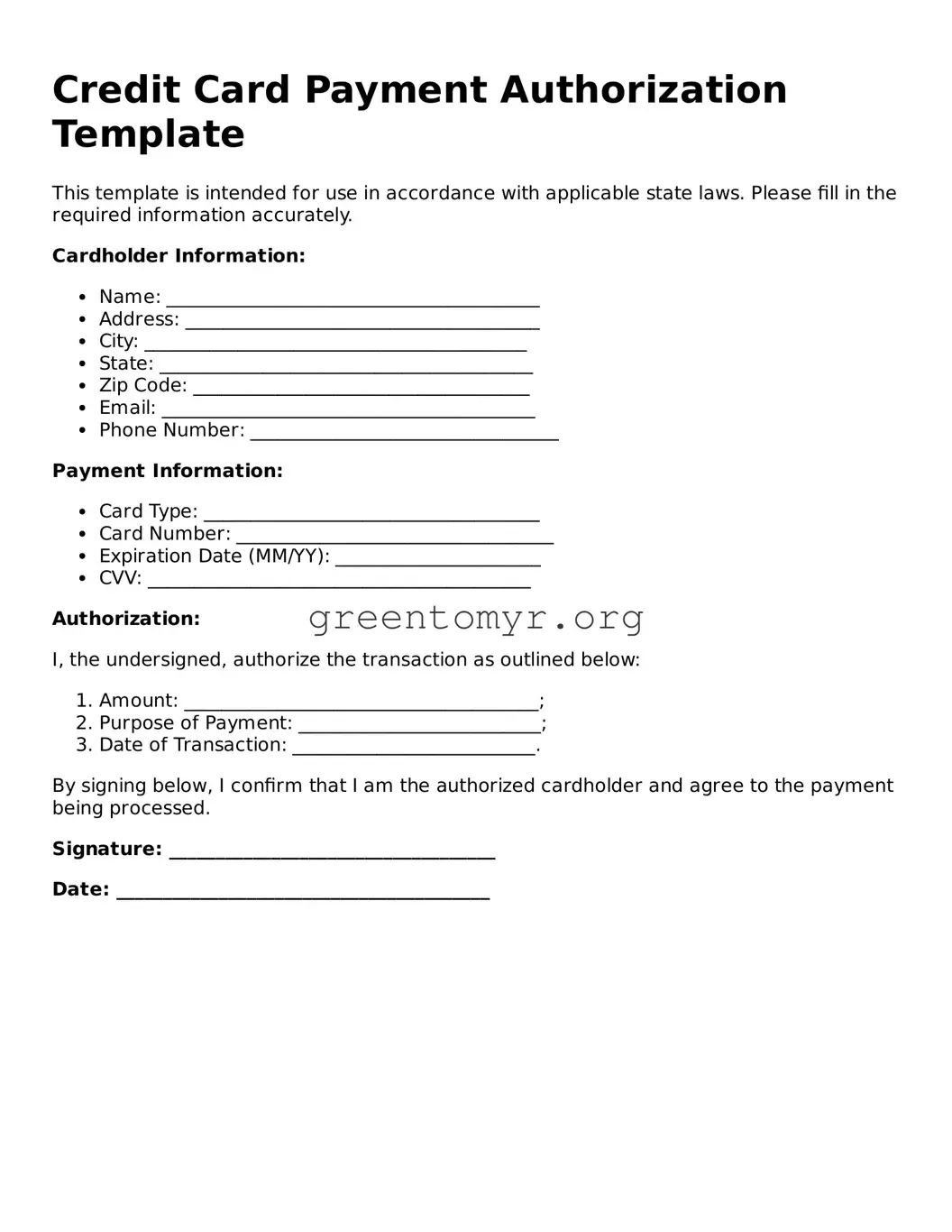

Using a Credit Card Payment Authorization form can seem straightforward, but many individuals encounter pitfalls that may lead to delays or errors in processing. One common mistake is failing to provide complete information. If a person omits their name, card number, or expiration date, the transaction may not be authorized. Each field on the form serves a specific purpose and all parts must be filled out accurately to ensure smooth processing.

Another frequent error is providing incorrect billing information. This may include details that do not match what is on file with their credit card company. The address and ZIP code should be identical to what the credit card issuer has on record. If discrepancies occur, the payment can be declined, leading to frustration.

A lack of signatures is also a mistake many make. The Credit Card Payment Authorization form typically requires the cardholder's signature to validate the transaction. Without a signature, it may be impossible for the accepting party to authenticate the authorization, ultimately hindering the payment process.

Timing can also be a crucial factor. Submitting the authorization form right before a deadline may not be wise. Some organizations process payments only during business hours, and they may need a specific amount of time to verify and complete the transaction. Waiting until the last moment can create complications.

Individuals should also be cautious about using unsecure channels to submit their forms. Sending sensitive information, like credit card details, through unsecured email or messaging apps can leave it vulnerable to theft. It is essential to ensure that any submission methods are secure and that the recipient is trustworthy.

Lastly, many people overlook reviewing the terms and conditions of the transaction. Understanding the implications of the authorization, including any recurring charges or cancellation policies, is critical. Failure to comprehend these details can lead to unexpected fees or obligations that individuals may not be prepared to manage.