A Credit Check Authorization form is a document that allows a lender, landlord, or employer to obtain a person's credit report. This report helps them assess the individual's creditworthiness and financial history. The form ensures that individuals give their consent before a credit check is conducted.

Filling out this form is essential because it protects your rights. By signing, you agree to have your credit checked, which is often a requirement during loan applications, rental agreements, or job offers. This consent helps institutions make informed decisions regarding your financial reliability.

Typically, lenders, landlords, and employers request this form. Any organization needing to evaluate your credit history may require this authorization. Always ensure that the request is legitimate and that the organization complies with the Fair Credit Reporting Act (FCRA).

How does a Credit Check affect my credit score?

A credit check can impact your credit score in two ways, depending on the type of check

-

Hard inquiries:

These occur when you apply for new credit. They can slightly lower your score for a brief period.

-

Soft inquiries:

These happen when you check your own credit or when organizations check your credit for pre-approval purposes. Soft inquiries do not affect your score.

Yes, your personal information should be kept safe. Reputable companies have privacy policies and procedures in place to protect your data. Before submitting your information, you can ask about their data protection measures.

Yes, you can revoke your authorization at any time. It’s best to do this in writing. Keep in mind that once you have revoked consent, the organization will no longer be able to check your credit. However, if they have already conducted a check, that report cannot be rescinded.

How long is a Credit Check Authorization valid?

The authorization typically remains valid until the purpose for the credit check is fulfilled or until you revoke it in writing. Some organizations may list an expiration date on the form, so always read the terms carefully before signing.

What should I do if I believe there’s an error on my credit report?

If you discover an error, it’s vital to take action promptly. You can dispute inaccuracies by contacting the credit reporting agency directly. Provide any supporting documents, and they will investigate your claim. If the agency finds that the information is incorrect, they will correct it or remove it from your report.

Are there any costs associated with credit checks?

Typically, you should not incur any fees when an employer or landlord conducts a credit check as part of their application process. However, you can access your own credit report for a fee, unless you are obtaining it for a free, annual review. Always check with the involved parties for any specific fees that may apply.

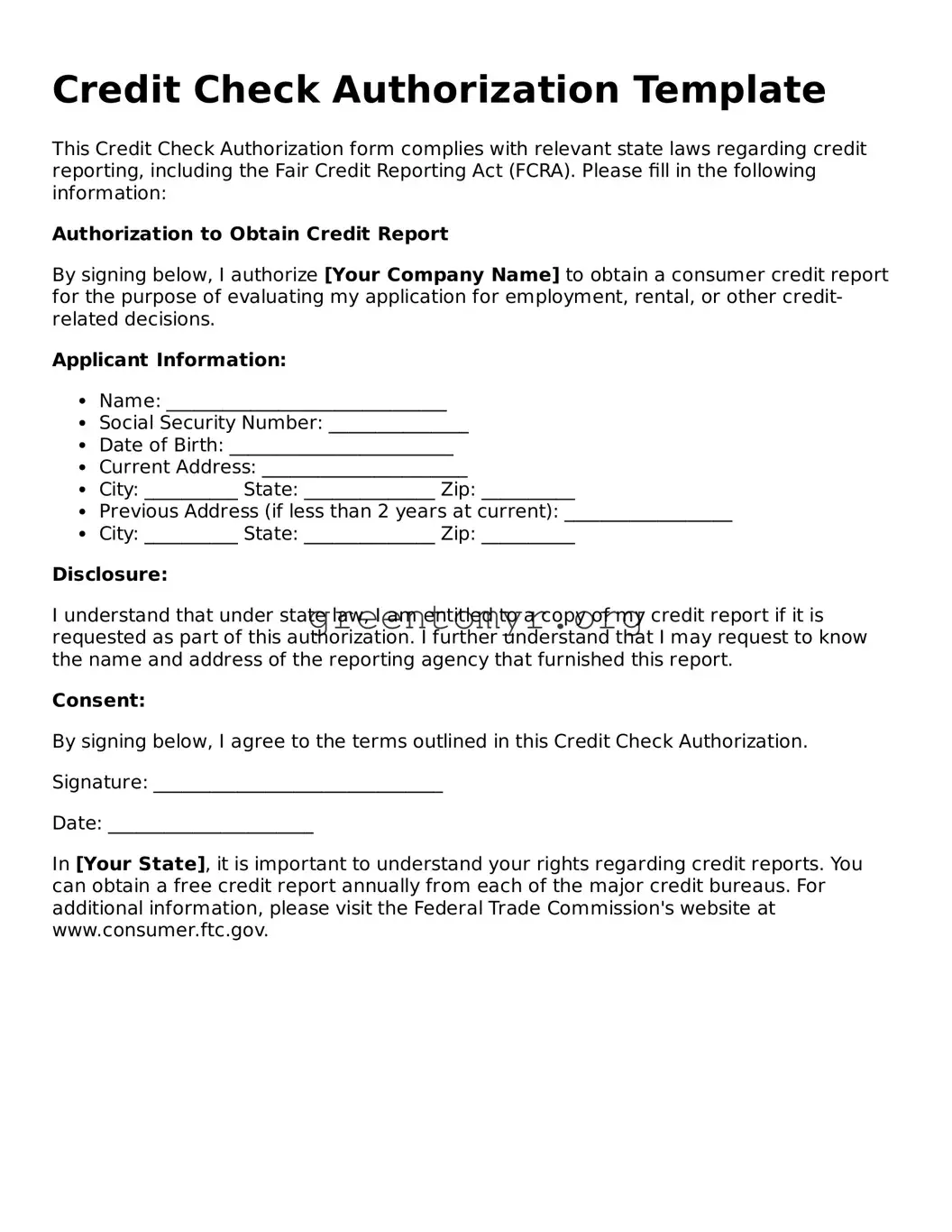

Generally, you will need to provide personal information such as:

-

Your full name

-

Social Security number

-

Date of birth

-

Current address

Some forms may ask for additional information, depending on the required checks, so ensure you read the form carefully.