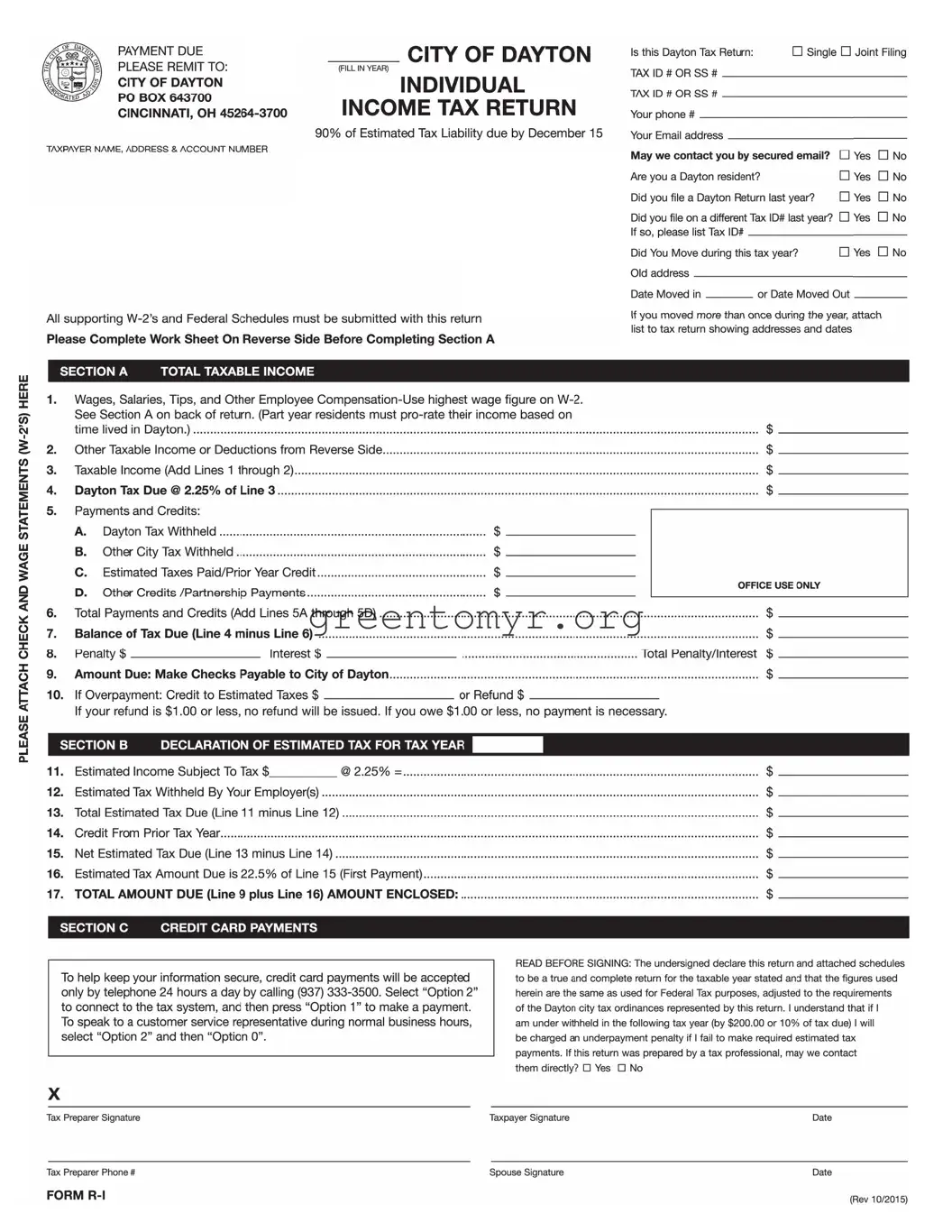

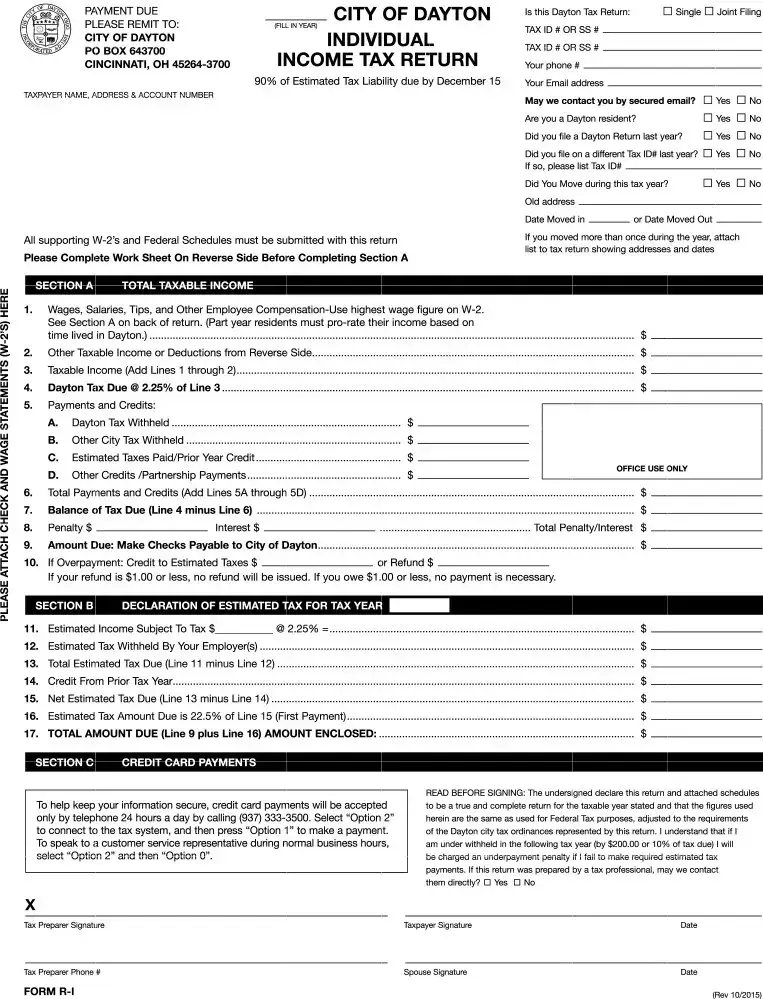

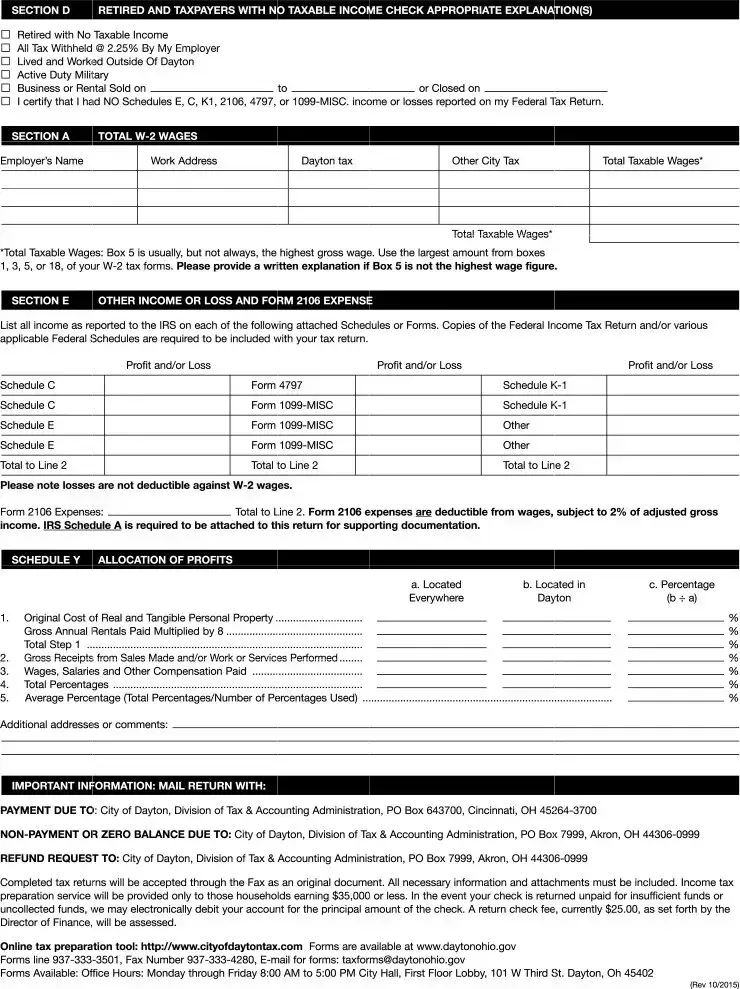

The completion of the Dayton R 1 form requires careful attention to detail. A common mistake individuals make is neglecting to provide accurate income figures. Taxpayers often use a figure from an incorrect box on their W-2 forms. It’s essential to utilize the highest wage amount, typically found in Box 5, but sometimes this can vary. Double-checking the figures ensures that the right amount is reported, which can prevent issues later on.

Another frequent error involves the omission of necessary documents. Many individuals fail to attach the required W-2 forms and additional schedules, which are critical for verifying income and deductions. Without these documents, the tax return will be incomplete, leading potentially to delays in processing or questions from the tax office.

Additionally, taxpayers sometimes incorrectly fill out residency questions. Marking oneself as a resident when they were a part-year resident can lead to inaccurate tax calculations. It's also vital to answer questions about previous tax filings accurately. Failure to disclose whether a return was filed last year or whether the Tax ID changed could complicate the current filing.

The calculation of tax due often presents challenges as well. Mistakes occur when individuals miscalculate taxable income or apply the wrong percentage. The Dayton tax rate of 2.25% needs to be applied correctly to the total taxable income, and any miscalculation impacts the amount owed.

Some filers overlook the section regarding payments and credits. Individuals may forget to account for taxes withheld by employers or prior year credits, which can significantly reduce the tax due. Accurate tallies of these amounts are crucial for determining the correct balance owed or refund due.

Moving during the tax year also yields common errors. Taxpayers might not list all addresses or dates correctly when filing their return, especially if they vacated more than once. It’s important to provide a comprehensive list of all moves, so the tax authorities have a clear understanding of residency throughout the year.

Failing to sign the form is yet another critical mistake. A return is not valid without the taxpayer's signature, and e-filing doesn't eliminate the need for this step. Additionally, if someone else prepares the return, proper authorization is necessary, which includes signing and providing the preparer's information.

Some sections, like estimated tax payments, might be inaccurately filled out. Individuals often miscalculate or forget to complete the section entirely, leading to potential penalties for underpayment. Furthermore, not understanding the intricacies of estimated tax payments can cause confusion, which should be avoided by consulting resources or experts when needed.

Lastly, individuals sometimes neglect to review the entire form before submission. Skimming through sections can result in overlooked errors. Taking the time to thoroughly examine the form ensures that all information is complete and accurate, which helps prevent future complications.