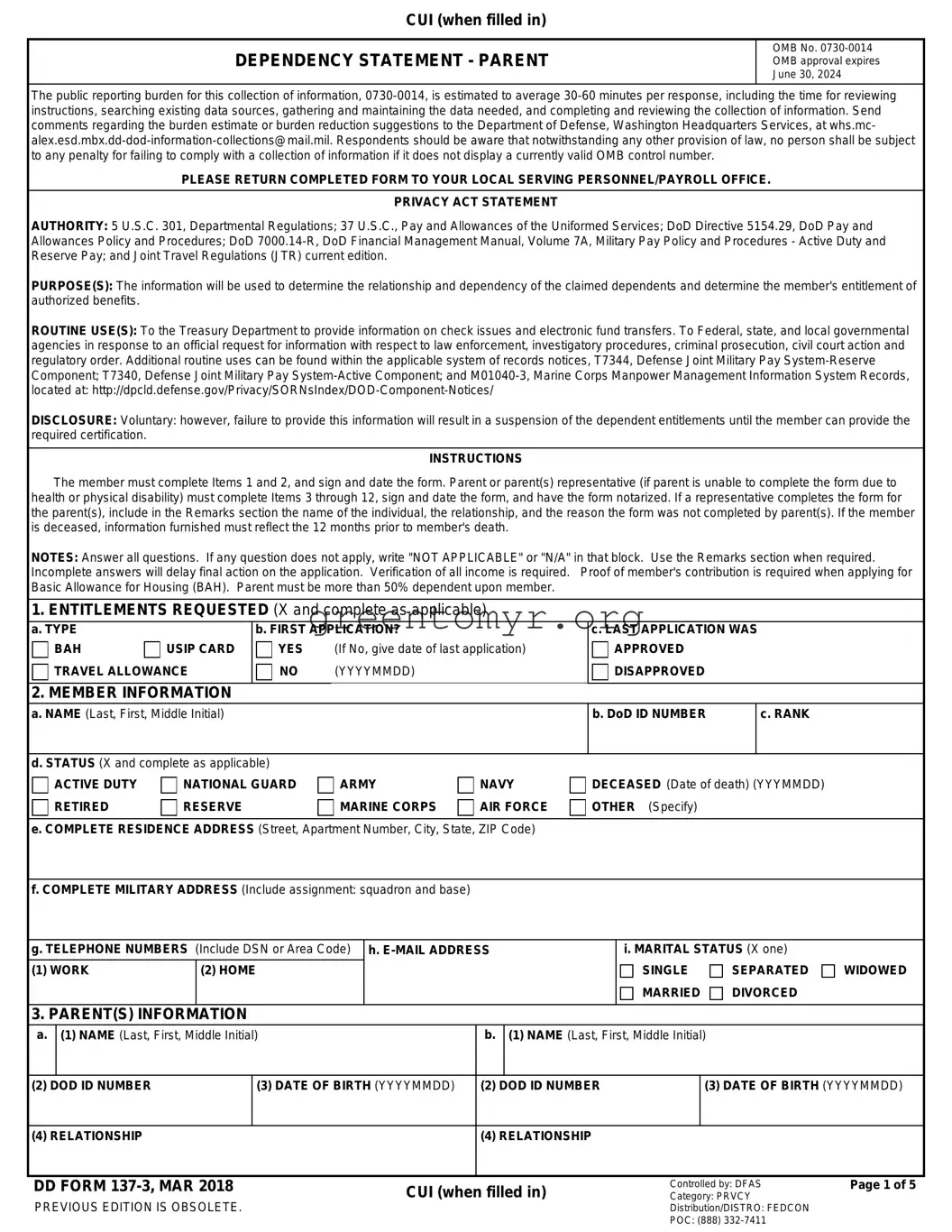

The public reporting burden for this collection of information, 0730-0014, is estimated to average 30-60 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding the burden estimate or burden reduction suggestions to the Department of Defense, Washington Headquarters Services, at whs.mc- [email protected]. Respondents should be aware that notwithstanding any other provision of law, no person shall be subject to any penalty for failing to comply with a collection of information if it does not display a currently valid OMB control number.

PLEASE RETURN COMPLETED FORM TO YOUR LOCAL SERVING PERSONNEL/PAYROLL OFFICE.

PRIVACY ACT STATEMENT

AUTHORITY: 5 U.S.C. 301, Departmental Regulations; 37 U.S.C., Pay and Allowances of the Uniformed Services; DoD Directive 5154.29, DoD Pay and Allowances Policy and Procedures; DoD 7000.14-R, DoD Financial Management Manual, Volume 7A, Military Pay Policy and Procedures - Active Duty and Reserve Pay; and Joint Travel Regulations (JTR) current edition.

PURPOSE(S): The information will be used to determine the relationship and dependency of the claimed dependents and determine the member's entitlement of authorized benefits.

ROUTINE USE(S): To the Treasury Department to provide information on check issues and electronic fund transfers. To Federal, state, and local governmental agencies in response to an official request for information with respect to law enforcement, investigatory procedures, criminal prosecution, civil court action and regulatory order. Additional routine uses can be found within the applicable system of records notices, T7344, Defense Joint Military Pay System-Reserve Component; T7340, Defense Joint Military Pay System-Active Component; and M01040-3, Marine Corps Manpower Management Information System Records, located at: http://dpcld.defense.gov/Privacy/SORNsIndex/DOD-Component-Notices/

DISCLOSURE: Voluntary: however, failure to provide this information will result in a suspension of the dependent entitlements until the member can provide the required certification.

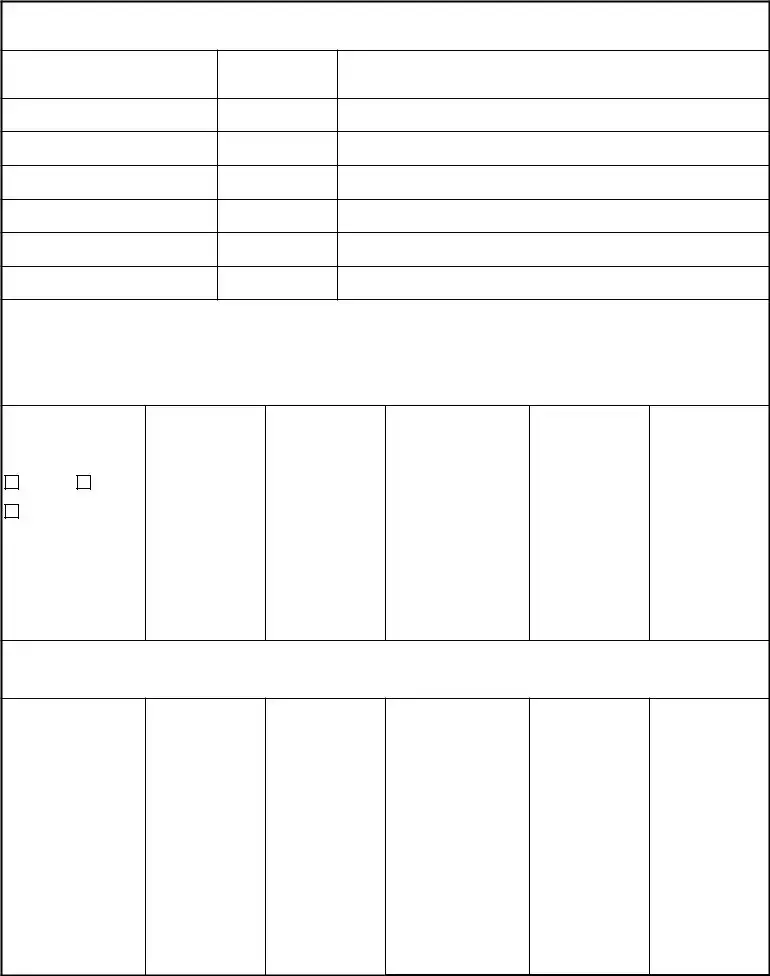

INSTRUCTIONS

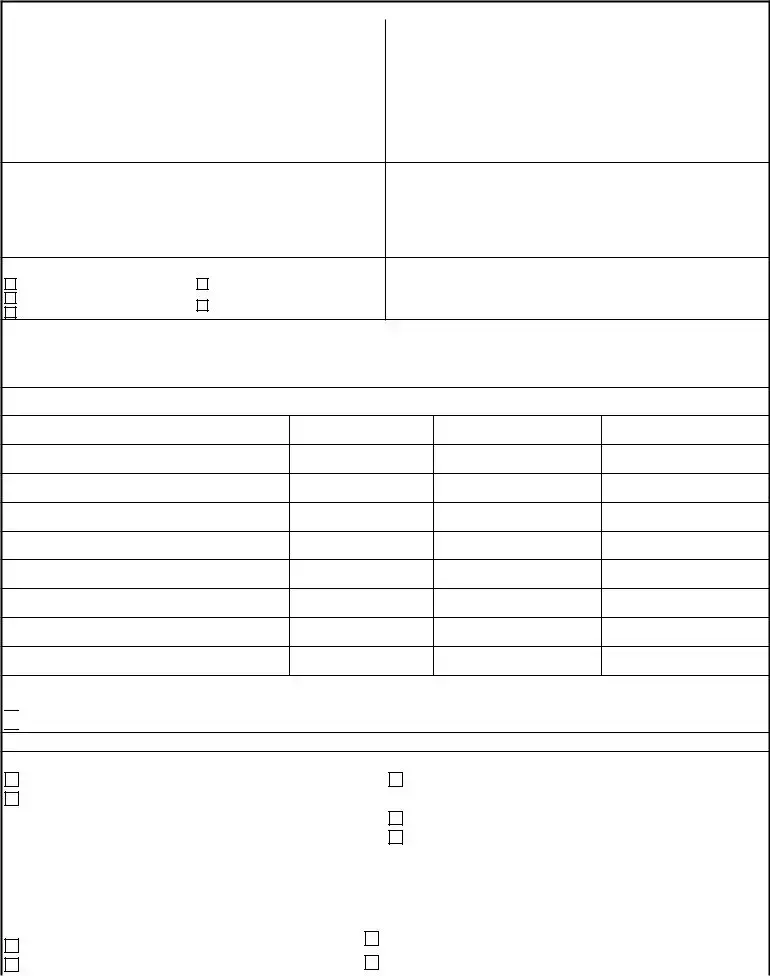

The member must complete Items 1 and 2, and sign and date the form. Parent or parent(s) representative (if parent is unable to complete the form due to health or physical disability) must complete Items 3 through 12, sign and date the form, and have the form notarized. If a representative completes the form for the parent(s), include in the Remarks section the name of the individual, the relationship, and the reason the form was not completed by parent(s). If the member is deceased, information furnished must reflect the 12 months prior to member's death.

NOTES: Answer all questions. If any question does not apply, write "NOT APPLICABLE" or "N/A" in that block. Use the Remarks section when required. Incomplete answers will delay final action on the application. Verification of all income is required. Proof of member's contribution is required when applying for Basic Allowance for Housing (BAH). Parent must be more than 50% dependent upon member.

1.ENTITLEMENTS REQUESTED (X and complete as applicable)

TRAVEL ALLOWANCE

TRAVEL ALLOWANCE

APPROVED

APPROVED

DISAPPROVED

DISAPPROVED

SEPARATED

SEPARATED DIVORCED

DIVORCED

YES

YES

NO

NO