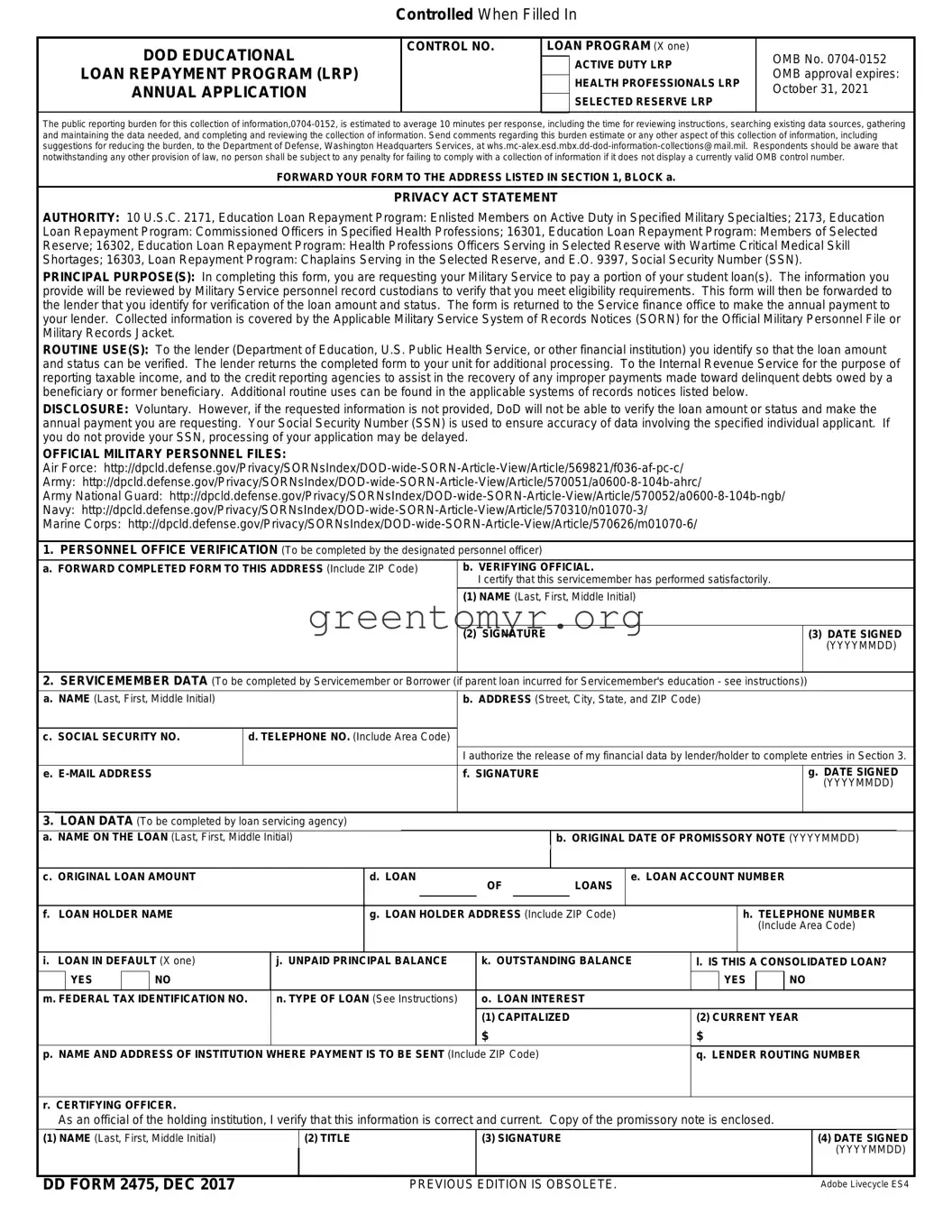

The public reporting burden for this collection of information,0704-0152, is estimated to average 10 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing the burden, to the Department of Defense, Washington Headquarters Services, at [email protected]. Respondents should be aware that notwithstanding any other provision of law, no person shall be subject to any penalty for failing to comply with a collection of information if it does not display a currently valid OMB control number.

FORWARD YOUR FORM TO THE ADDRESS LISTED IN SECTION 1, BLOCK a.

PRIVACY ACT STATEMENT

AUTHORITY: 10 U.S.C. 2171, Education Loan Repayment Program: Enlisted Members on Active Duty in Specified Military Specialties; 2173, Education

Loan Repayment Program: Commissioned Officers in Specified Health Professions; 16301, Education Loan Repayment Program: Members of Selected

Reserve; 16302, Education Loan Repayment Program: Health Professions Officers Serving in Selected Reserve with Wartime Critical Medical Skill

Shortages; 16303, Loan Repayment Program: Chaplains Serving in the Selected Reserve, and E.O. 9397, Social Security Number (SSN).

PRINCIPAL PURPOSE(S): In completing this form, you are requesting your Military Service to pay a portion of your student loan(s). The information you provide will be reviewed by Military Service personnel record custodians to verify that you meet eligibility requirements. This form will then be forwarded to the lender that you identify for verification of the loan amount and status. The form is returned to the Service finance office to make the annual payment to your lender. Collected information is covered by the Applicable Military Service System of Records Notices (SORN) for the Official Military Personnel File or Military Records Jacket.

ROUTINE USE(S): To the lender (Department of Education, U.S. Public Health Service, or other financial institution) you identify so that the loan amount and status can be verified. The lender returns the completed form to your unit for additional processing. To the Internal Revenue Service for the purpose of reporting taxable income, and to the credit reporting agencies to assist in the recovery of any improper payments made toward delinquent debts owed by a beneficiary or former beneficiary. Additional routine uses can be found in the applicable systems of records notices listed below.

DISCLOSURE: Voluntary. However, if the requested information is not provided, DoD will not be able to verify the loan amount or status and make the annual payment you are requesting. Your Social Security Number (SSN) is used to ensure accuracy of data involving the specified individual applicant. If you do not provide your SSN, processing of your application may be delayed.

OFFICIAL MILITARY PERSONNEL FILES:

Air Force: http://dpcld.defense.gov/Privacy/SORNsIndex/DOD-wide-SORN-Article-View/Article/569821/f036-af-pc-c/

Army: http://dpcld.defense.gov/Privacy/SORNsIndex/DOD-wide-SORN-Article-View/Article/570051/a0600-8-104b-ahrc/

Army National Guard: http://dpcld.defense.gov/Privacy/SORNsIndex/DOD-wide-SORN-Article-View/Article/570052/a0600-8-104b-ngb/

Navy: http://dpcld.defense.gov/Privacy/SORNsIndex/DOD-wide-SORN-Article-View/Article/570310/n01070-3/

Marine Corps: http://dpcld.defense.gov/Privacy/SORNsIndex/DOD-wide-SORN-Article-View/Article/570626/m01070-6/

1.PERSONNEL OFFICE VERIFICATION (To be completed by the designated personnel officer)

a. FORWARD COMPLETED FORM TO THIS ADDRESS (Include ZIP Code) |

b. VERIFYING OFFICIAL. |

|

|

I certify that this servicemember has performed satisfactorily. |

|

|

(1) NAME (Last, First, Middle Initial) |

|

|

|

|

|

(2) SIGNATURE |

(3) DATE SIGNED |

|

|

(YYYYMMDD) |

2.SERVICEMEMBER DATA (To be completed by Servicemember or Borrower (if parent loan incurred for Servicemember's education - see instructions))

a. NAME (Last, First, Middle Initial) |

|

b. ADDRESS (Street, City, State, and ZIP Code) |

|

|

|

|

|

|

|

|

|

c. SOCIAL SECURITY NO. |

d. TELEPHONE NO. (Include Area Code) |

|

|

|

|

|

|

I authorize the release of my financial data by lender/holder to complete entries in Section 3. |

|

|

|

|

e. E-MAIL ADDRESS |

|

f. SIGNATURE |

g. DATE SIGNED |

|

|

|

(YYYYMMDD) |

|

|

|

3.LOAN DATA (To be completed by loan servicing agency)

a. |

NAME ON THE LOAN (Last, First, Middle Initial) |

|

|

|

b. ORIGINAL DATE OF PROMISSORY NOTE (YYYYMMDD) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. ORIGINAL LOAN AMOUNT |

|

d. LOAN |

OF |

|

LOANS |

e. LOAN ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f. LOAN HOLDER NAME |

|

g. LOAN HOLDER ADDRESS (Include ZIP Code) |

|

|

|

h. TELEPHONE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Include Area Code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i. LOAN IN DEFAULT (X one) |

j. UNPAID PRINCIPAL BALANCE |

k. OUTSTANDING BALANCE |

l. IS THIS A CONSOLIDATED LOAN? |

|

|

|

YES |

|

NO |

|

|

|

|

|

|

|

|

|

YES |

|

NO |

|

m. FEDERAL TAX IDENTIFICATION NO. |

n. TYPE OF LOAN (See Instructions) |

o. LOAN INTEREST |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) CAPITALIZED |

|

(2) CURRENT YEAR |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

p. NAME AND ADDRESS OF INSTITUTION WHERE PAYMENT IS TO BE SENT (Include ZIP Code) |

|

|

|

q. LENDER ROUTING NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

r. CERTIFYING OFFICER.

As an official of the holding institution, I verify that this information is correct and current. Copy of the promissory note is enclosed.