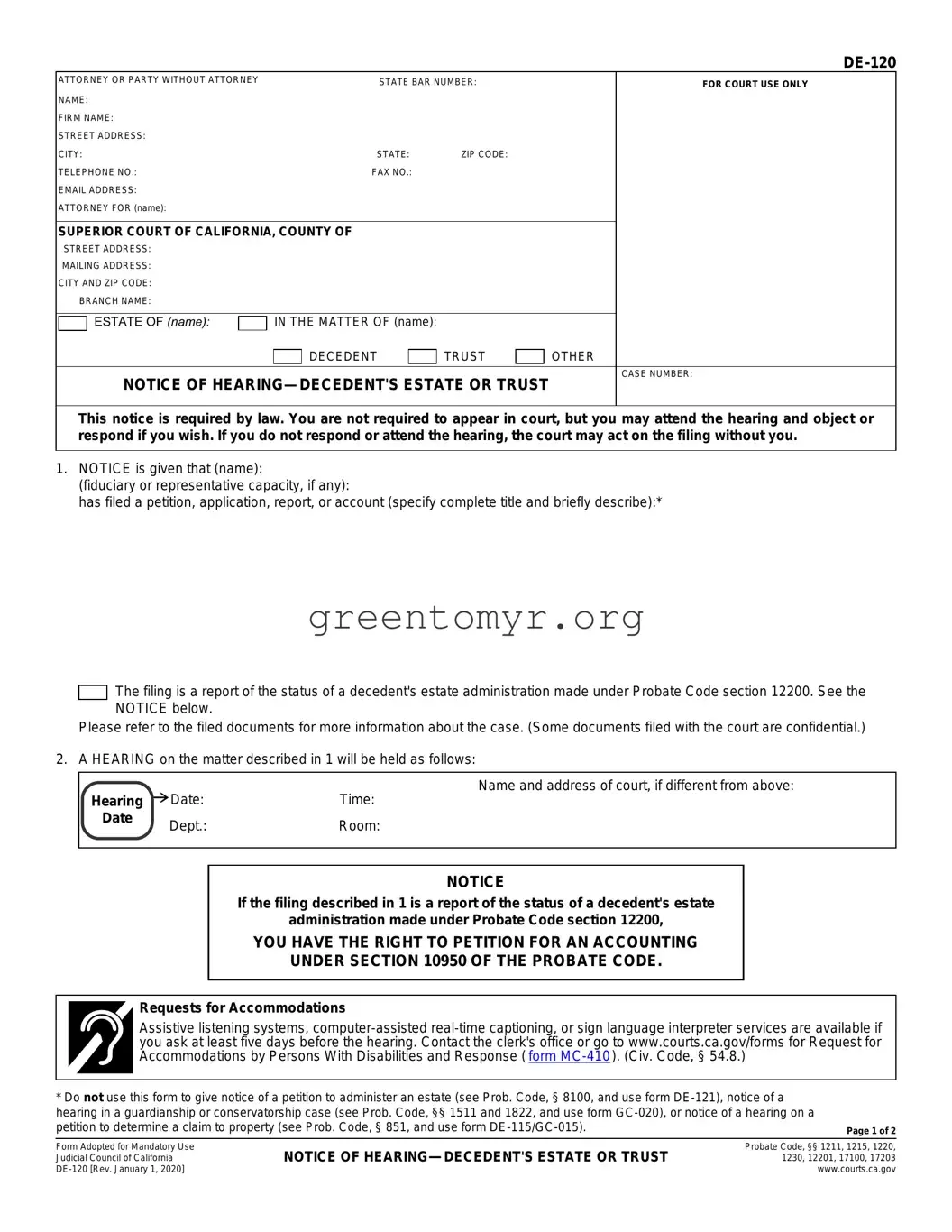

Filling out the DE-120 form can be a challenging task. It is crucial to approach it carefully. One common mistake individuals make is neglecting to include all required contact information. The form asks for specific details, including the state bar number, firm name, and an accurate mailing address. Omitting any of these can delay the process.

Another frequent error occurs when people fail to specify the full title of the document being filed in the description section. This oversight can lead to confusion or miscommunication regarding the nature of the filing. Describing the document clearly is essential for the court’s understanding and records.

In addition, many individuals overlook the section regarding the hearing date and time. If this information is incorrect or missing, it can result in missed opportunities to present one’s case or voice any concerns at the scheduled hearing. It is vital to double-check these details to ensure accuracy.

Moreover, there is a tendency to forget to sign and date the form. Without the appropriate signatures, the court may reject the filing. This simple yet critical step should not be overlooked.

People also often misunderstand the limitations of the DE-120 form. It is specifically designed for notices regarding the status of a decedent's estate administration. Using this form for other purposes can lead to complications. Understanding the specific use of the form prevents unnecessary errors.

Another common mistake involves the section for the clerk's certificate of posting. Some individuals assume that providing general information suffices, while it is essential to provide specific details about where and when the notice was posted. Accuracy in this area ensures compliance with legal requirements.

Furthermore, failing to use the correct mailing method is another frequent issue. Individuals must either deposit their notice through standard postal service methods or document their chosen process clearly. Clarity in this section avoids confusion and potential challenges later.

Many people also struggle with ensuring that the names and addresses of individuals receiving the notice are complete and accurate. An incomplete address can lead to undeliverable notice, which might affect the legal proceedings. Careful attention to detail in this section is crucial.

Lastly, individuals sometimes do not realize that the DE-120 form requires attachments or additional documentation, as mentioned in certain segments. This can lead to delays or complications in the processing of their case. It is important to read and follow all instructions closely, ensuring everything needed is included.