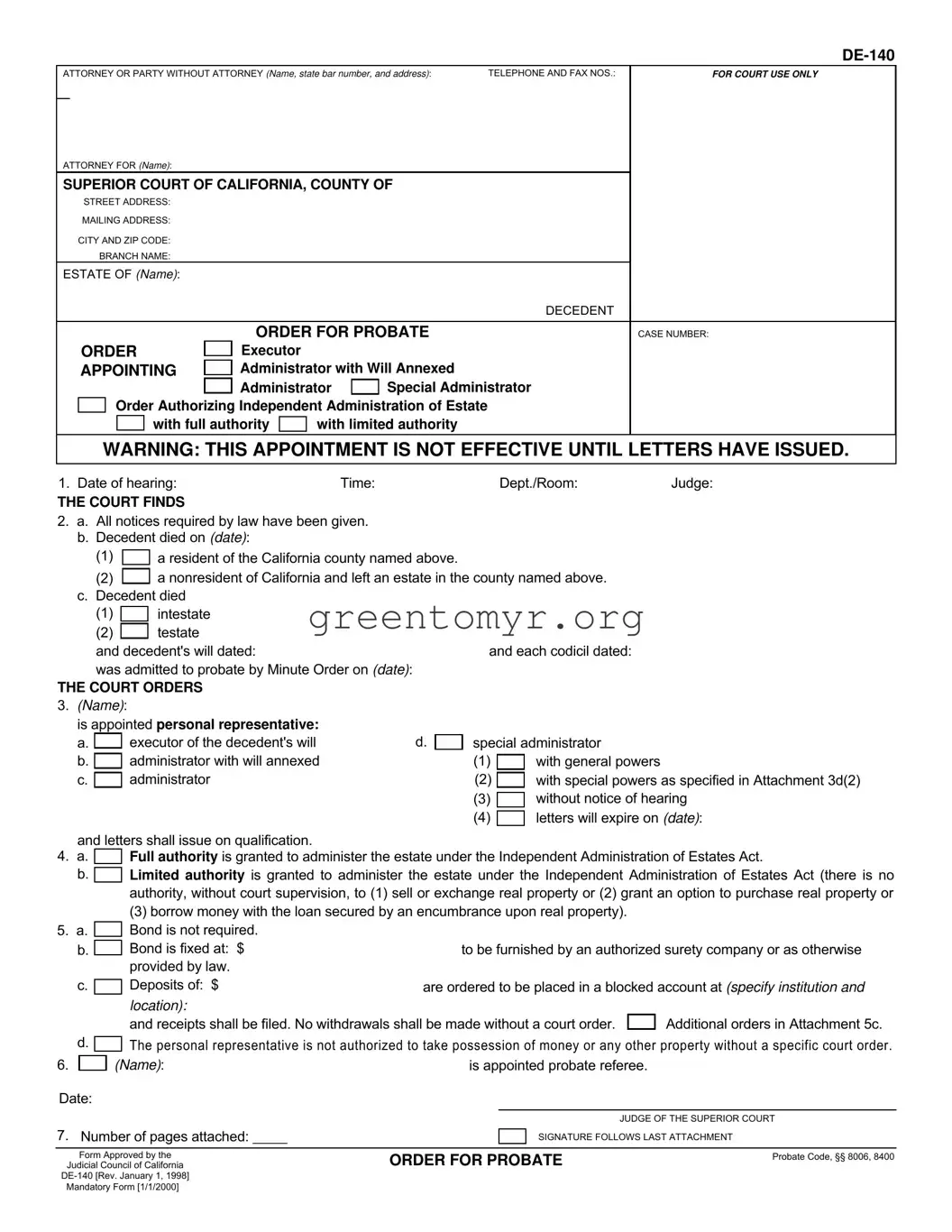

Completing the DE-140 form can be straightforward, but certain common mistakes can lead to delays or complications in probate proceedings. One significant error is failing to provide all required information. It is crucial for individuals to fill in their name, contact information, and relevant details about the decedent accurately. Omitting even one piece of information can create challenges in processing the form.

Additionally, incorrect designation of the representative can occur. The form requires specific titles, such as executor or administrator, to be chosen correctly. Selecting the wrong title can lead to misunderstandings about the authority granted and may necessitate further legal proceedings.

Another common mistake is providing an incomplete description of the decedent's estate. People often do not specify whether the decedent died intestate or testate, or fail to mention the date of the will. Such omissions can confuse the court about the applicability of certain laws governing the estate.

Inaccurate dates are also problematic. The form requires precise dates for various events, such as the date of death and the hearing. Errors in these dates can disrupt the timeline of the probate process, causing unnecessary complications.

Moreover, failing to sign and date the form can render it invalid. Proper completion includes the applicant's signature at the bottom, as well as the date when the form is signed. Skipping this step can lead to immediate rejection of the submission.

People frequently misinterpret the authority granted under the Independent Administration of Estates Act. Mistakes in indicating whether full or limited authority is requested can complicate administration rights. Individuals should thoughtfully consider the implications of their selections.

Neglecting the section on bond requirements can also create issues. If the court mandates a bond but no amount is specified on the form, processing could be significantly delayed. It is essential to address this aspect if applicable.

Allocating a specific probate referee is another important detail that must not be overlooked. Many individuals do not fill this section out or mistakenly name someone not qualified, which can result in further delays as the court may need to appoint a new referee.

Lastly, incomplete or unclear attachments to the DE-140 form can lead to misunderstandings. When additional pages are needed, they should be clearly numbered and referenced within the form to assist the court in reviewing the information.

The personal representative is not authorized to take possession of money or any other property without a specific court order.

The personal representative is not authorized to take possession of money or any other property without a specific court order.