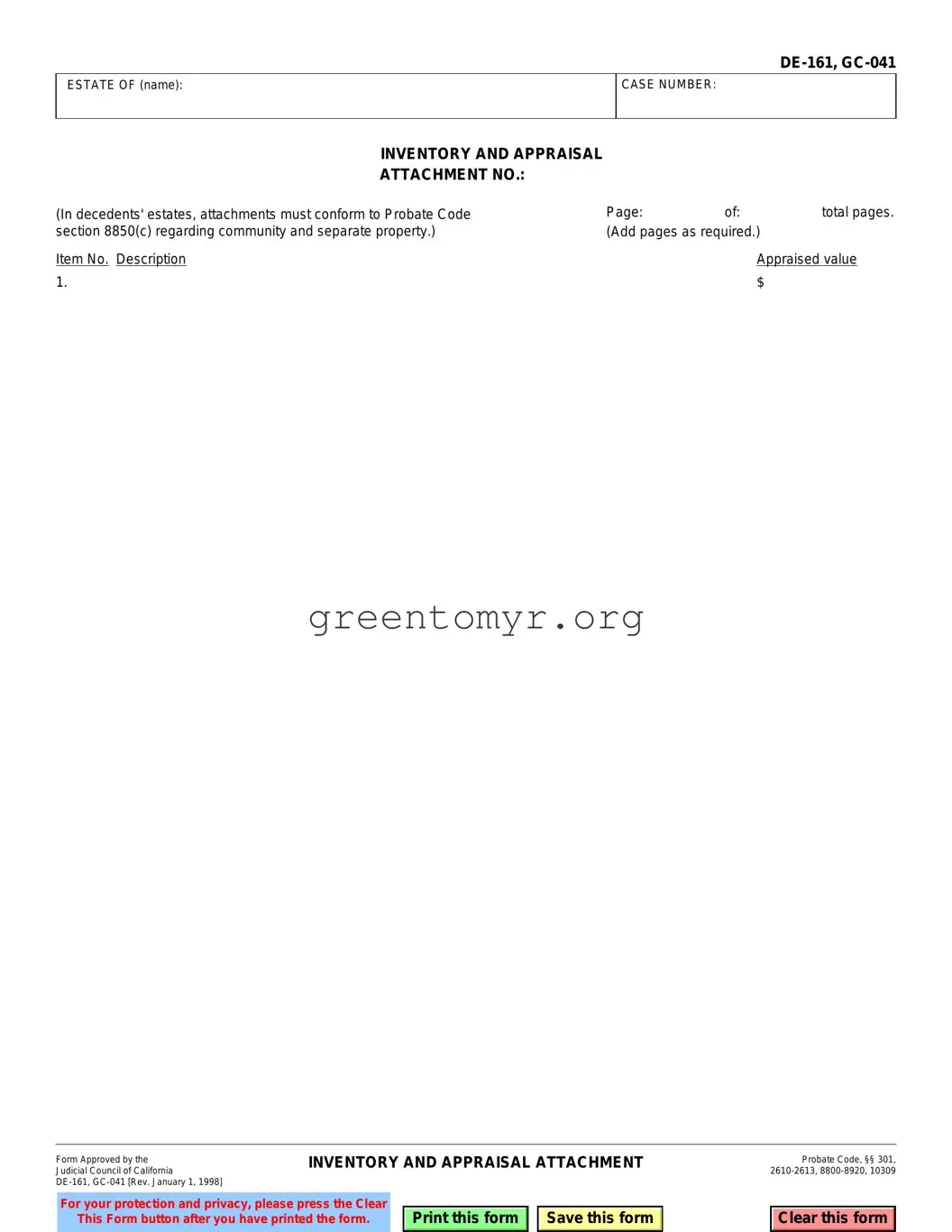

Completing the DE-161 GC-041 form is a critical step in managing an estate. However, common errors can lead to complications. One frequent mistake is failing to properly identify the estate by leaving out the name and case number. This essential information is crucial for processing and can delay the entire appraisal process.

Another common error occurs when individuals do not include all necessary attachments. The form specifies that attachments must adhere to the requirements set forth in Probate Code section 8850(c). Without these attachments, the inventory may not accurately represent the decedent's community and separate property.

Many people overlook the item description. Each item should be clearly described to avoid confusion during the appraisal. Vague or incomplete descriptions can lead to misinterpretations, resulting in potential disputes among beneficiaries.

Additionally, inaccuracies in the appraised values can cause significant issues. It is essential to ensure that all values accurately reflect the current market conditions. Providing outdated or incorrect valuation can affect tax implications and distribute equitably among heirs.

Some users incorrectly format the page numbering. The form requires a specific structure, typically indicated as "Page: of: total pages." Neglecting this can create confusion about the completeness of the submission.

A frequent oversight involves forgetting to print the form and pressing the Clear This Form button before completing the document. This simple act risks losing all entered information, necessitating a complete re-entry, which can lead to filing delays.

Individuals also often neglect to sign or date the form. An unsigned or undated document may be deemed incomplete or invalid, potentially causing the entire submission to be rejected.

Failure to review the form thoroughly before submission can be detrimental. Common mistakes may include typos or misstatements that could have been easily corrected through careful proofreading.

Lastly, ignoring instructions provided on the form can lead to significant setbacks. These instructions are designed to ensure a smooth filing process and should be followed meticulously.