When filling out the DE 2063 form, people often make critical mistakes that may affect their claims for unemployment benefits. Understanding these common errors can help ensure a smoother application process.

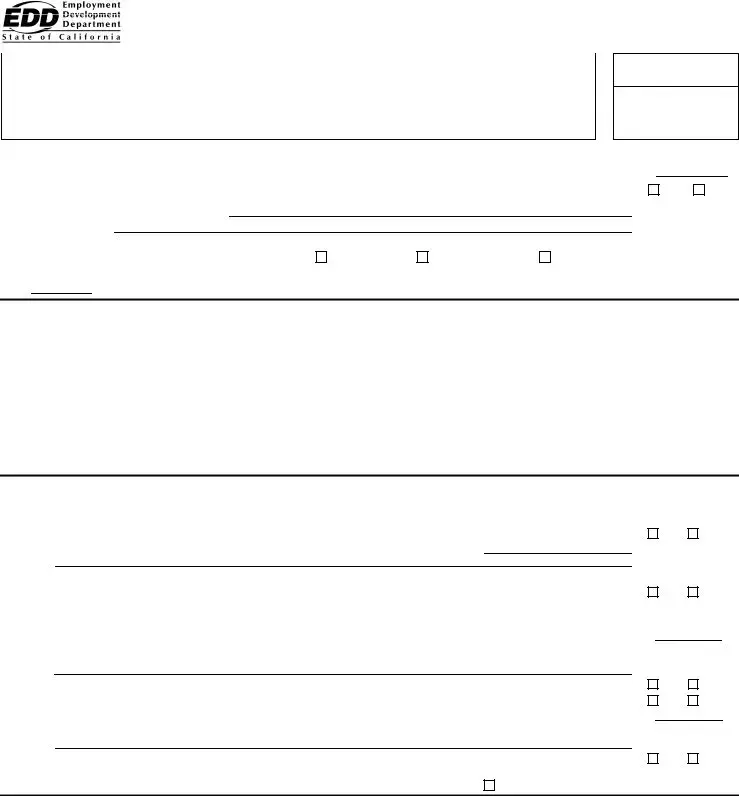

One frequent mistake is failing to report gross earnings accurately. Individuals may underestimate their income or leave the section blank, thinking it unnecessary. However, every form must reflect actual earnings before any deductions. Inaccuracies can lead to delays or denials.

Another common error occurs in the section regarding the availability of work. Some claimants respond inaccurately by marking “Yes” when the answer should have been “No.” If an employee did not report for all available work, they need to specify the dates and reasons. Failure to do this can raise red flags during the verification process.

People often overlook the importance of selecting the correct reason for not working full-time. The options include “Lay off due to lack of work,” “Discharged,” or “Voluntary Quit.” Misidentifying the reason can confuse the employer’s statement and lead to complications in determining eligibility for benefits.

The significant date of the last day worked is another detail that is frequently mishandled. Claimants must provide an exact date prior to the payroll week ending date. Omitting this information or providing an incorrect date can compromise the claim.

Claimants must also navigate the certification requirement carefully. A failure to sign the form or to provide correct contact details can invalidate the submission. This signature is crucial as it affirms that the information is complete and truthful.

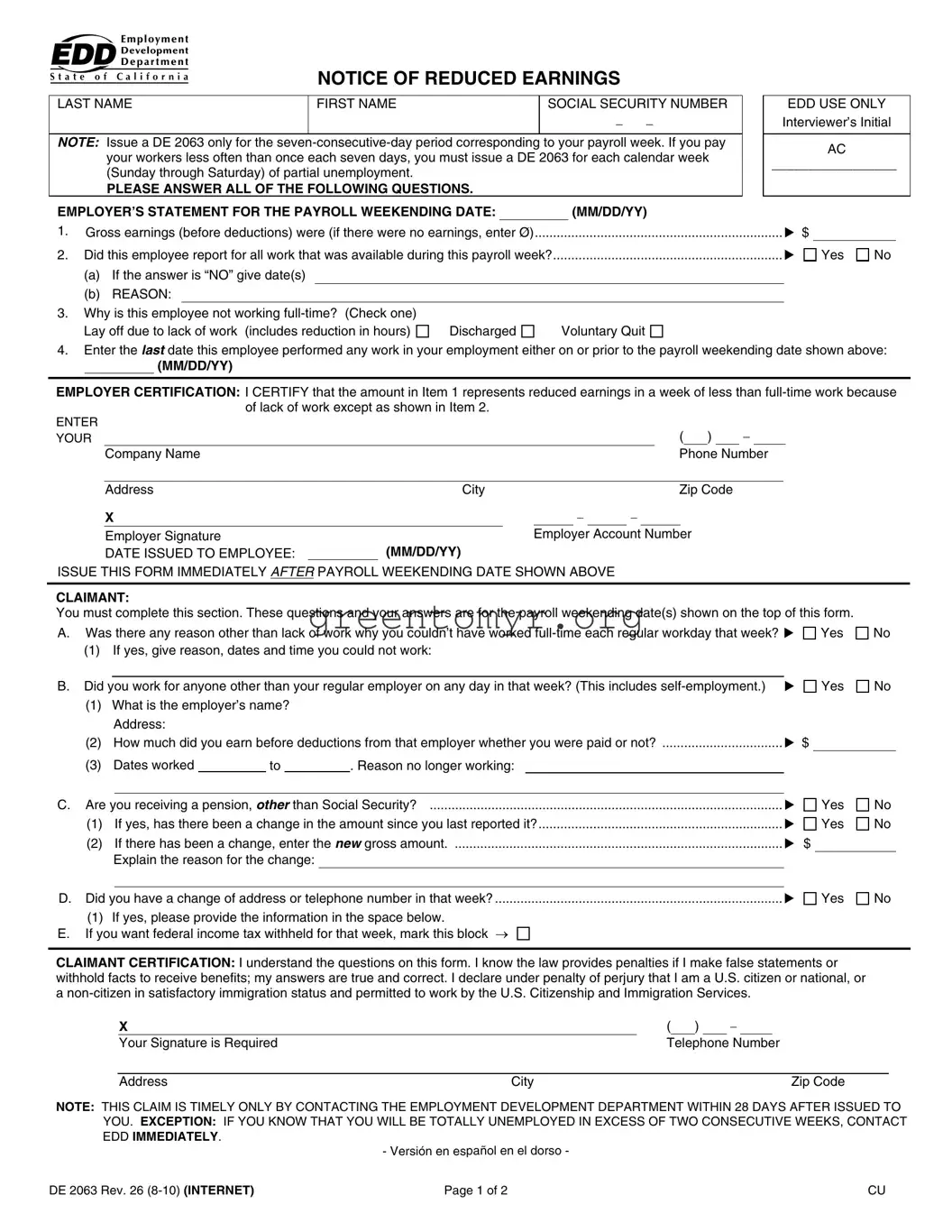

On the claimant’s side, neglecting to mention additional employment during the week can jeopardize their benefits. Responding “No” when there was indeed work performed for another employer, including self-employment, may be considered fraudulent and can result in legal consequences.

Additionally, some individuals forget to disclose changes to their pension status. omitting this information may lead the Employment Development Department to question the accuracy of the claim, potentially leading to a suspension of benefits.

Changes in personal contact information are often not reported. When claimants fail to provide updates regarding their address or telephone number, it can hinder communication and create issues when the EDD tries to follow up on claims.

Another common oversight involves neglecting to indicate whether federal income tax should be withheld. This section requires attention, especially for those who prefer to have taxes deducted from their benefits.

Lastly, missing the deadline to submit the form can disqualify individuals from receiving benefits. The warning to contact the EDD within 28 days is crucial; failure to heed this advice may result in a complete loss of benefits.

By paying close attention to these potential pitfalls, individuals can enhance their chances of a successful submission of the DE 2063 form and avoid unnecessary complications with their claims.

Yes

Yes

No

No