Completing the DE 24 form correctly is crucial for maintaining accurate employer account information with the Employment Development Department (EDD). Yet, many people make common mistakes that can lead to delays or complications. Here are seven frequent errors to avoid when filling out the form.

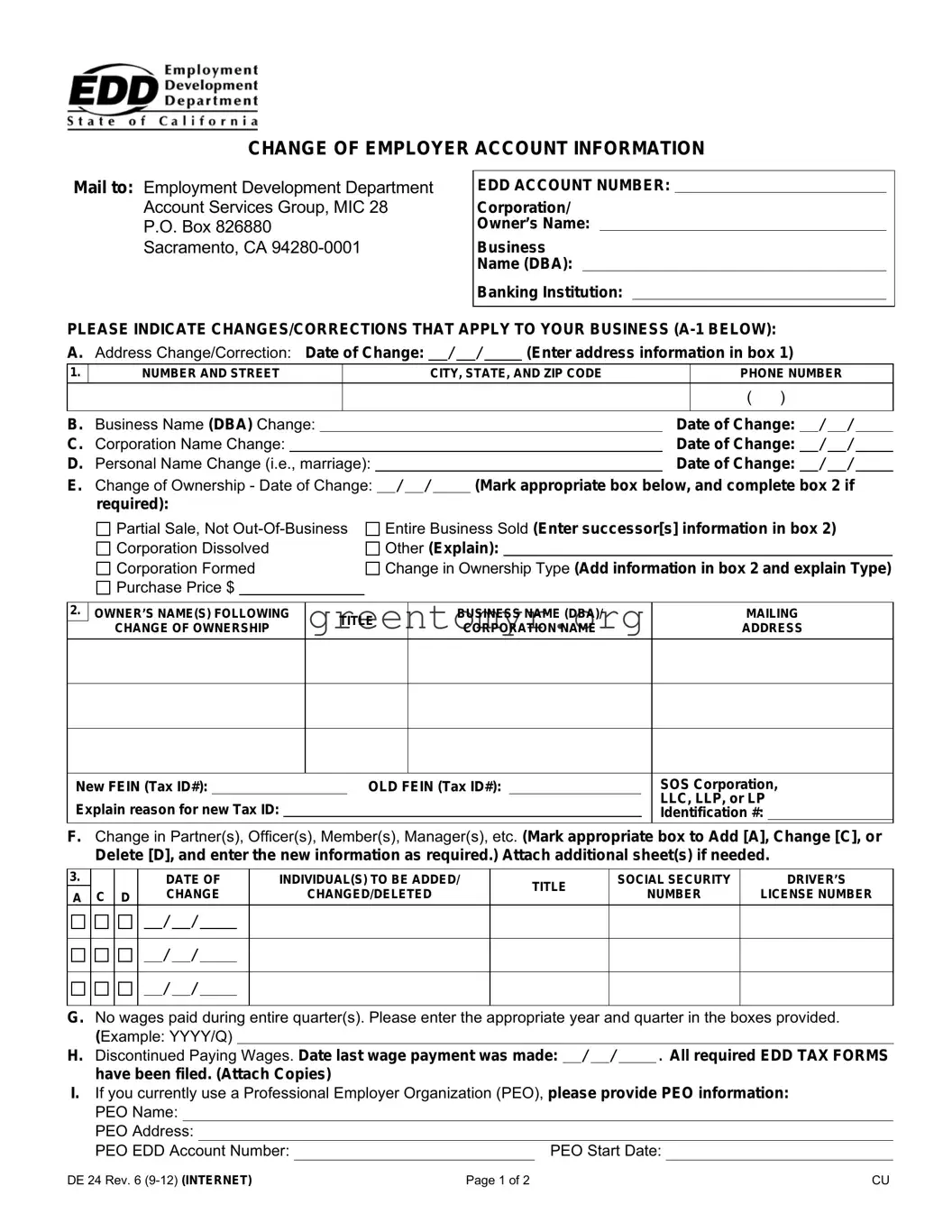

One of the most significant mistakes is failing to provide a current and correct address. This information is essential for the EDD to reach you with necessary correspondence. Double-check that the address entered in Box A-1 aligns with postal standards. An incorrect address can lead to missed communications and potential issues with your account.

Another common error is neglecting to indicate the specific date of change. Each change must have a corresponding date, as this is crucial for keeping accurate records. Ensure that the dates filled in for address changes, name changes, and ownership changes are clear and up-to-date.

People often overlook the requirement to include a signature. The form must be signed by an authorized individual, such as an officer or owner of the business. If the signature is missing, the EDD will not process the form. Before submitting, check that a valid signature has been provided, along with the printed name and title of the signer.

A frequent oversight involves entering incomplete or incorrect information in Box 2, particularly during a change of ownership. It's essential to fill out all required fields accurately. Missing or incorrect data can delay processing or halt the update altogether.

Some individuals incorrectly assume that they can submit the DE 24 form without including related EDD tax forms if applicable. All required forms must be filed and attached to the DE 24 to ensure compliance. This includes providing past wage information or indicating if wages were not paid during a specific period.

Another mistake is providing outdated or incorrect tax identification numbers for businesses. If there has been a change in the Employer Identification Number (EIN), the correct new number should be highlighted on the form. Failure to do so can cause confusion and lead to further issues with tax accounts.

Lastly, some people forget to check if they are using a Professional Employer Organization (PEO). If applicable, it's vital to provide accurate PEO details, including the name, address, and EDD account number. Omitting this information could complicate the processing of your account changes.

Avoiding these common pitfalls can streamline the process of updating your employment account information. Take your time, review each section, and ensure accuracy to prevent unnecessary delays.

Partial Sale, Not

Partial Sale, Not

Corporation Dissolved

Corporation Dissolved

Corporation Formed

Corporation Formed

Purchase Price $

Purchase Price $